Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Share buybacks — one of the defining features of the US stock market over the past decade — hit a wall last year as higher borrowing costs and concerns about a potential recession prompted executives to preserve cash.

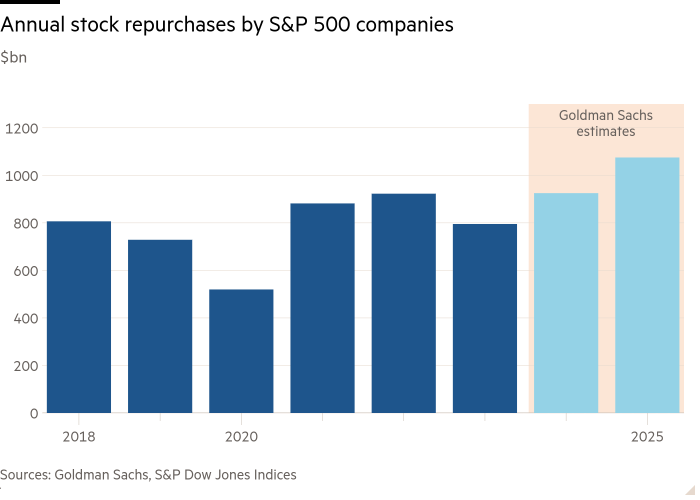

S&P 500 companies bought back $795bn of their own stock in 2023, according to S&P Dow Jones Indices. That is 14 per cent less than 2022, when buyback mania reached a new peak of $922bn. It also marked the second-largest annual decline since the global financial crisis.

Buybacks are making a comeback. S&P companies spent $472bn repurchasing their own shares in the first six months of 2024, up 21 per cent from the year-ago period. The Federal Reserve’s jumbo half-point interest rate cut last week will relight a fire under the trend. Goldman Sachs expects the total to reach $925bn this year before crossing the trillion dollar mark in 2025.

Typically, when the Fed cuts interest rates, buybacks increase. Holding cash becomes less attractive. This time there is also the spectre of an increase in the buyback tax rate from 1 to 4 per cent. Companies will probably try to ramp up purchases ahead of 2025.

At first glance, this should be cause for celebration for shareholders. Buybacks have been an important driver of stock performance because retiring stock increases earnings for each remaining share. But if that money could have been put to better use maintaining or growing the underlying business, the gains can be fleeting.

Just look at Boeing. The aerospace giant spent about $44bn on share repurchases between 2013 and 2019, according to data from S&P Global Market Intelligence. That makes it the 15th-largest buyer of its own stocks during that period. Yet the stock is down nearly 65 per cent from its March 2019 peak and the company may soon need to do a mega equity sale amid an endless string of safety scandals, productions delays and a worker strike. Critics say prioritising buybacks rather than investing in quality and resilience is what got Boeing into trouble.

Buybacks are better news when they are accompanied by investments in a company’s future. Big tech companies are among the largest buyers of their own stock. The Magnificent 7 accounted for 26 per cent of S&P 500 repurchases in 2023. But they are also spending big in other areas such as artificial intelligence.

Ultimately, buybacks should not be the only way a company grows its earnings per share. As corporate America regains its appetite for buyback binges, investors will need to take a closer look at whether increases in EPS are being driven by lower share counts or growth in underlying profits. No one wants to end up paying more for a poorer-quality company.