Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

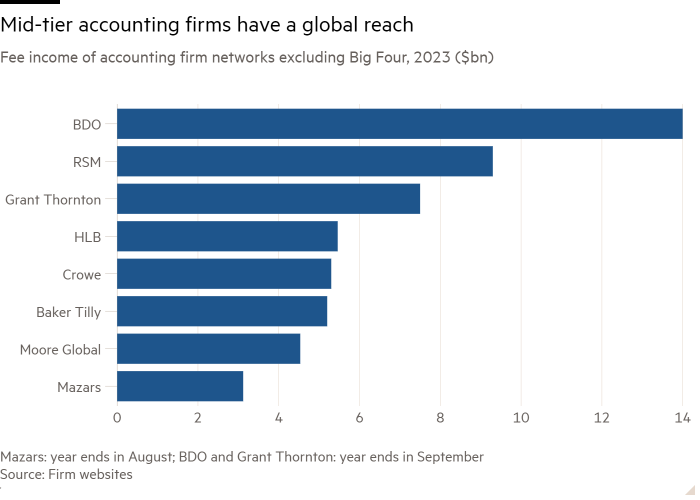

Spurned by job seekers, the accountancy profession has an image problem. But it has never been so fashionable with investors. Private equity is tipped to own as many as 10 of the 30 largest US accounting firms and might soon be funding their international expansion. Grant Thornton’s private equity-backed US business is one of the potential bidders for its UK and Irish affiliates.

It is not hard to see the logic. Accounting firms provide a flow of resilient, stable audit revenues, along with scope to consolidate a fragmented market. If private equity can find cross-border deals, it could accelerate growth by making it easier to serve high-paying international clients.

Firms have traditionally relied on a club of international networks for global reach, a structure that makes it easier to distance themselves from any member firm that runs into trouble.

But advocates of cross-border mergers emphasise the advantages of simplified decision-making, less bureaucracy and fewer arguments over how to allocate profits on international projects. Deloitte began merging its European businesses in 2016.

Reaching agreement can be tricky. A 2006 push by KPMG to merge its national partnerships in Europe failed, though its UK and Swiss firms recently agreed to merge again. Internal disagreements forced EY to abandon its ambitious attempt to break up its auditing and consulting businesses in 2023.

Another worry, noted by regulators, is that private equity ownership could damage audit quality. Maria Nykyforovych, an assistant professor at George Mason University, says the short-term investment objectives of private equity investors could create damaging incentives. Even though regulators require audit businesses to be controlled by auditors, there might be scope for private equity investors to influence the audit practice through interlocked boards or management service fees.

There is also uncertainty over investors’ end game given the difficulties of initial public offerings and trade sales. Private equity, which mostly began investing in 2021, has barely tested the exit routes. Ownership could end up with pension funds, family offices or even return to the partners.

For now, the most likely outcome seems to be a sale to other private equity firms. London-based Hg passed on half its stake in Azets to PAI Partners in June 2023. But the scale and complexity of international roll-ups could ultimately limit the pool of potential buyers.

There is potential for private equity to be a force for good in the accountancy profession. It can fund investment in artificial intelligence and other technologies or help revamp incentive structures to enhance the appeal of an accountancy career.

But there will also be unintended consequences. The speed and scale of investment in the sector risks amplifying the impact of any mis-steps.