This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to receive the newsletter every weekday. Explore all of our newsletters here

Today’s agenda: US warns Israel; UniCredit-Commerzbank update; German data dysfunction; surging Chinese steel exports; Trumponomics

Good morning, and welcome back to the working week. We start the day with an exclusive story: 14 of the world’s biggest banks and financial institutions are set to pledge today to increase their support for nuclear energy.

At an event in New York with White House climate policy adviser John Podesta, institutions including Bank of America, Barclays, BNP Paribas, Citi, Morgan Stanley and Goldman Sachs will say they support a goal first set out at the COP28 climate negotiations last year to triple the world’s nuclear energy capacity by 2050.

What exactly have they promised? This was not spelt out, but banks could support new plants by increasing direct lending and project finance to nuclear companies, arranging bond sales or introducing companies to private equity or credit funds.

Why it matters: Today’s public show of support is a long-awaited recognition of the critical role banks play in the transition to low-carbon energy. The difficulty and high cost of financing nuclear projects has been an obstacle to new plants and has contributed to a dramatic slowdown in western countries since a wave of reactors was built in the 1970s and 1980s. In the words of one industry expert, the event will be “a game-changer”. Read the full story.

-

Uranium supply chain: The price of nuclear reactor fuel has surged much faster than that of raw uranium since the start of 2022, in a sign of supply chain bottlenecks since Russia’s invasion of Ukraine.

For more analysis of the nuclear industry, sign up for our Energy Source newsletter if you’re a premium subscriber, or upgrade your subscription here. And here’s what else I’m keeping tabs on today:

-

Economic data: Manufacturing and services purchasing managers’ indices are expected for the EU, France, Germany, the UK and the US.

-

UK Labour: Chancellor Rachel Reeves will rule out a “return to austerity” at her party’s conference, where two trade unions will also vote on the government’s cuts to the winter fuel allowance for pensioners.

-

Companies: Hiscox moves up to the FTSE 100 index from the FTSE 250, while Burberry Group makes the opposite move as changes from a review take effect at the start of trading today. Raspberry Pi Holdings also joins the FTSE 250.

Five more top stories

1. The US warned Israel against opening a full-blown war with Hizbollah yesterday as the Lebanese militant group and Israeli forces engaged in some of their fiercest exchanges of fire since October 7. Here are the latest updates.

2. Exclusive: A potential multibillion-euro merger with UniCredit could threaten Mittelstand businesses, Commerzbank has warned the German government. Bank executives said a tie-up with its Italian rival could hobble lending to the small and medium-sized companies that form Germany’s economic backbone.

-

Andrea Orcel: Seventeen years after he advised on an ill-fated cross-border banking deal, can UniCredit’s CEO redeem himself with a new takeover?

3. Businesses are braced for a strike at three dozen US ports that could upend supply chains and raise prices just weeks before election day. Nearly 25,000 dockworkers could walk off the job if a new deal fails to materialise before September 30, affecting ports that together receive 41 per cent of the country’s port volume.

4. Exclusive: Germany’s statistical office has suspended some of its most important indicators after botching a data update. Since May, Destatis has not updated time-series data for retail and wholesale sales, as well as revenue from the services sector, hospitality, car dealers and garages. Here’s more on the glitches that have left economists “flying blind”.

-

German politics: The Social Democrats have clinched a narrow win over the far-right Alternative for Germany in Brandenburg elections, according to preliminary results.

5. Anura Kumara Dissanayake, a neo-Marxist outsider candidate, has won the Sri Lankan presidency, beating the incumbent Ranil Wickremesinghe and the main opposition leader Sajith Premadasa, the son of a former president. Read more about the nation’s biggest political upset since independence.

The Big Read

Donald Trump has developed a populist economic policy agenda designed to present him as a defender of workers’ interests. “Maganomics” would include more aggressive tariffs on imports, especially from China, and a draconian crackdown on immigration. Critics warn that the policies would not help the US compete with its rival and instead cause huge damage to the economy.

We’re also reading . . .

-

War in Ukraine: The Kursk incursion has failed to divert Russia’s forces, which have instead pushed into the eastern front and now threaten to capture two key logistics hubs.

-

US Steel deal: Nippon Steel’s bid is not just a simple matter of politics versus economics, but a proxy for many difficult questions with no easy answers, writes Rana Foroohar.

-

China’s wealthy: Contrary to Deng Xiaoping’s slogan, it is no longer “glorious” to get rich in Xi Jinping’s China, writes Ruchir Sharma, it is dangerous.

-

Bank of England: Tony Yates, a senior adviser to the central bank, has several suggestions for the UK chancellor on reforming the rules that govern the BoE.

Chart of the day

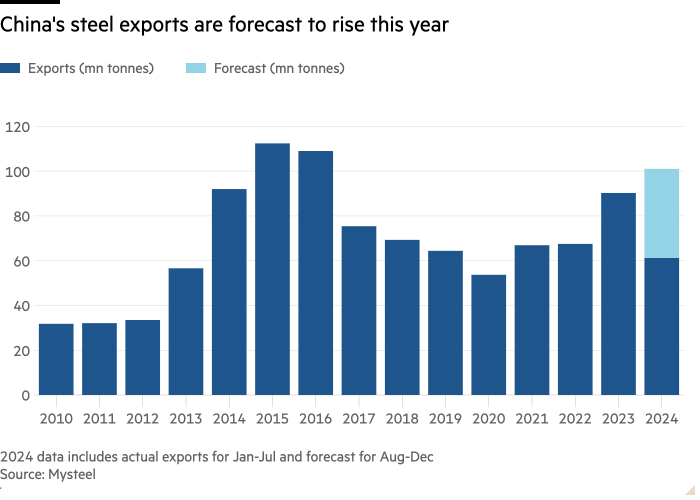

European steelmakers have appealed to trade officials to tackle a surge in Chinese steel exports that has driven European prices below the cost of production. Producers and Europe’s main trade body have called for a new, comprehensive system of tariffs.

Take a break from the news

SoftBank founder Masayoshi Son has won and lost fortunes with his bets on technology. Is the investor a visionary or a gambler who got lucky? Former Financial Times editor Lionel Barber untangles the mystery of the world’s greatest disrupter.

Additional contributions from Gordon Smith and Benjamin Wilhelm