Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

HSBC’s exposure to defaulted commercial property loans in Hong Kong surged almost sixfold to more than $3bn in the first half of this year, underscoring the risks the UK bank faces from a slump in the Chinese territory’s real estate market.

Hong Kong is HSBC’s largest market for commercial real estate lending, accounting for 45 per cent of its exposure, in comparison with 18 per cent for the UK.

The London-headquartered bank had $3.2bn in “credit impaired” commercial real estate loans to Hong Kong clients as of June 30, up from just $576mn six months earlier, according to its financial report for the first half of this year.

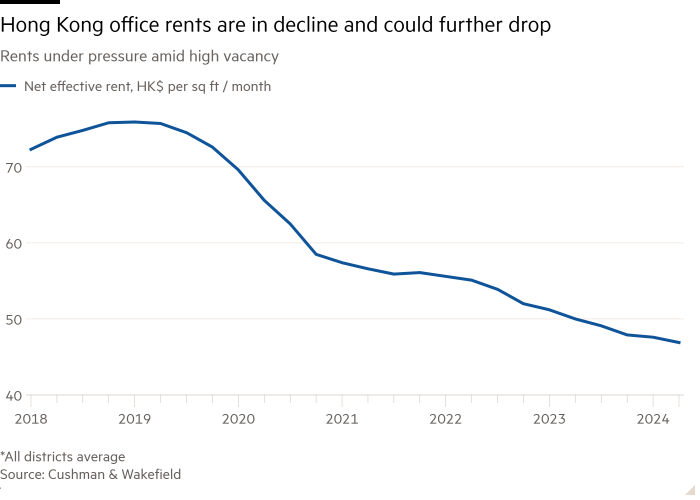

The leap in defaults is a sign of how the commercial property downturn in Hong Kong, a financial hub that has for years been one of the world’s most expensive real estate markets, has started to hit banks. Prime office rents have fallen more than 35 per cent since 2020, according to commercial property adviser Cushman & Wakefield.

While banks have been under pressure for several years over their exposure to mainland China’s property market, the focus is now shifting to Hong Kong, said David Wong, head of North Asia bank ratings at Fitch.

“We’re a lot more comfortable saying a line has been drawn under [banks’ exposure to] China commercial real estate, versus Hong Kong,” Wong said. “I don’t think we’ve seen the bottom yet.”

HSBC’s total global commercial real estate lending was $79bn as of June. The $3.2bn in “credit impaired” loans made up 9 per cent of HSBC’s total Hong Kong commercial real estate lending.

Under the bank’s definition, those borrowers have breached the terms of their loan. That can include missing payments but it can also include “non-financial” measures such as the loan-to-value ratio missing an agreed target figure.

Georges Elhedery, who became HSBC’s chief executive in September, said on a call with analysts in early August when he was chief financial officer that the loans were “all performing” even though “a large number” were classed as credit impaired.

However, the bank said “certain borrowers have sought payment deferrals to accommodate debt serviceability challenges” in its financial report for the first half of this year, published on July 31.

HSBC told the Financial Times this week that “a lot” of the borrowers are still paying interest. A spokesperson for the bank declined to provide figures on how many borrowers were paying interest or to offer more detail on Elhedery’s comment.

Standard Chartered, which as with HSBC has more exposure to commercial property lending in Hong Kong than any other region, reported a rise in the proportion of lower-rated borrowers in its most recent earnings, though it did not mark any of the loans as credit impaired.

The lender has cut its unsecured exposure to Hong Kong commercial real estate borrowers by 19 per cent since the end of 2022, it said in filings in July. Standard Chartered declined to comment.

Higher interest rates have put Hong Kong borrowers under pressure at a time when demand for office and retail space has fallen, with China’s economic slowdown and Beijing’s national security crackdown hitting international investor confidence. Tough zero-Covid measures also prompted an exodus of foreign workers during the pandemic.

The HSBC figures show that Hong Kong groups accounted for 45 per cent of the bank’s total credit-impaired commercial real estate lending as of June, up from 13 per cent six months earlier.

Elhedery said on the earnings call that the bank had taken a “probably prudent approach” in reclassifying the loans and was “comfortable and confident in the medium-to-long-term outlook” for Hong Kong’s commercial real estate sector, which would benefit from any rate cuts.

The bank said in its filing that its collateral coverage was strong and “broadly stable” even as valuations fell, and it was making “relatively low” provisions for credit losses on the loans because of high collateralisation.

“I think for those of us living in Hong Kong you can see vacancy rates are higher at this point,” said Ming Lau, the bank’s Asia chief financial officer, on the analyst call. But he said that the loans were structured so that the bank had recourse to “other assets and cash” of the borrowers.

Eleven of Hong Kong’s biggest property developers have written down the value of their investment property portfolios by about $23bn since 2020, according to data compiled by UBS for the Financial Times.

Mark Leung, a property analyst at UBS, said there could be more writedowns for Hong Kong’s developers in the near future. “For offices, rent probably will continue to come down due to the inflated supply issue, and vacancies could edge up,” he said.

Many of the territory’s property companies are controlled by tycoons and their families. Sun Hung Kai Properties is controlled by the Kwok family, Henderson Land Development by the Lee family, CK Asset by the Li family and New World Development by the Cheng family.

Gary Ng, a senior economist at Natixis, said that while the developers are expected to remain under pressure, most retained “sound financial positions” and could tap “old money” held by the tycoons and their families.