This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to receive the newsletter every weekday. Explore all of our newsletters here

Good morning. We have updates below on the Middle East crisis and how markets reacted after the Federal Reserve’s bumper rate cut, while today’s featured read looks at Amazon’s hardline stance on in-person work.

But first, we turn to the UK, where consumer confidence has fallen sharply as households anticipate what Sir Keir Starmer has warned will be a “painful” Budget.

The GfK consumer confidence index — a measure of how people view their personal finances and broader economic prospects — fell seven points to minus 20, taking it back to January’s level. The month-on-month fall was also the largest since October last year and comes despite the availability of cheaper home loans, rising real wages and the retreat of inflation.

A significant drop in consumer morale will reinforce concerns that the prime minister and his chancellor, Rachel Reeves, have been too downbeat about the economy, with one analyst saying: “If they persist in this pessimistic tone, there’s a danger it becomes a self-fulfilling prophecy.”

And here’s what I’m keeping tabs on today and over the weekend:

-

Economic data: The UK has August public sector finances and retail sales figures today, while the US publishes labour data for the same month.

-

UK politics: Nigel Farage will speak at the Reform UK conference in Birmingham after he told the Financial Times he would give up his ownership of the party. The Labour party’s conference starts in Liverpool on Sunday.

-

Quad summit: US President Joe Biden hosts the leaders of India, Japan and Australia tomorrow in his home state of Delaware.

Five more top stories

1. The S&P 500 closed at a record high yesterday as investors bet the Federal Reserve’s jumbo half-point interest rate cut would help deliver a soft landing for the US economy. The US gains capped a global rally that also featured strong gains in European and Asian markets. Read the full markets update.

2. Israeli forces struck targets along Lebanon’s southern border yesterday as Hizbollah’s leader said Israel had crossed “all red lines” with this week’s mass detonations of communication devices. Hassan Nasrallah called the attacks, which killed 32 people and injured thousands, a “major security and military blow”.

3. Robert Jenrick has accused the UK Treasury of “gaslighting” the British public over the benefits of migration. In an interview with the FT, the frontrunner in the Tory leadership contest said the “economic consensus” of the past quarter century about mass migration was “fundamentally broken”.

4. Nike chief executive John Donahoe will step down next month in an abrupt leadership change at the world’s largest sportswear maker. The move punctuates a period of dour financial performance, including a dramatic stock sell-off after the company lowered its guidance in June. Here’s who will replace him.

5. John Paulson has brushed aside Wall Street worries that Donald Trump’s plans to raise tariffs will harm the economy, while calling for the US to “decouple” from China. In a shift from his earlier criticism of the former president’s trade policy, the billionaire hedge fund manager told the FT that tariffs could help “level” the playing field, saying: “We’re not in the period of free trade.”

How well did you keep up with the news this week? Take our quiz.

News in-depth

This week, Amazon told more than 300,000 of its corporate employees that they must return to the office five days a week from the start of 2025. By doing so, chief executive Andy Jassy joins leaders including Jamie Dimon of JPMorgan Chase and Elon Musk at Tesla in pushing for a full return to the office. It also puts Amazon at odds with the softer approach taken by most of its tech rivals.

We’re also reading . . .

-

Lord Waheed Alli: The tycoon has had a knack for backing winners, but his recent donations to Labour leaders have tarnished the government’s image.

-

Degrowth: Recent reviews say the field, which calls for radical economic change to save the planet, offers few tenable policy solutions, writes Soumaya Keynes.

-

Post Office: The company with one of the UK’s worst reputations needs to cut costs and offer better rewards to become a decent business, writes John Gapper.

-

Cricket: The Indian Premier League is transforming the sport, inspiring a flurry of fast-paced competitions aimed at untapped audiences. Can they all survive?

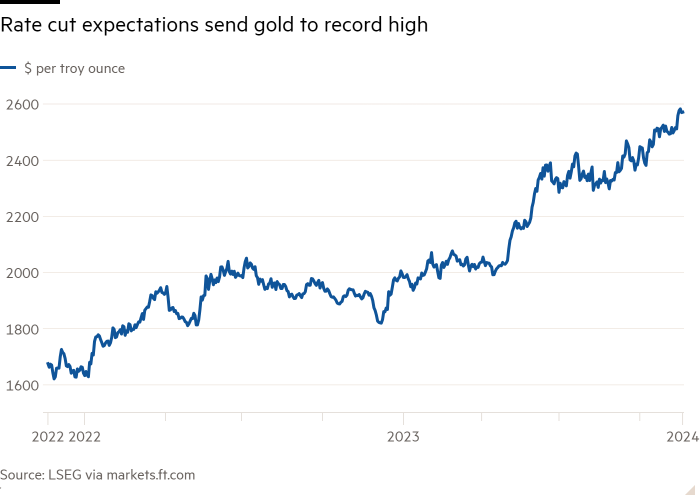

Chart of the day

Expectations of rapid interest rate cuts by the Federal Reserve have been the main driver of gold’s huge rally this year, according to analysts. Lower borrowing costs increase the attraction of assets with no yield, such as bullion, and are also likely to weigh on the dollar, in which gold is denominated. But strong demand from jewellers and central banks have also helped buoy prices.

Take a break from the news

Thanks to a wave of nostalgia, demand for classic football kits is soaring — and so are the prices. HTSI’s Alexander Tyndall looks at the rise of the football shirt, and why a Holland ’88 kit might cost you £900.

Additional contributions from Gordon Smith and Benjamin Wilhelm