This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to receive the newsletter every weekday. Explore all of our newsletters here

Good morning. In today’s newsletter:

-

Hizbollah walkie-talkies explode in a second day of blasts

-

An inside look at China’s ‘Shein village’

-

The secrecy surrounding Sheikh Hasina’s whereabouts

But first, the Federal Reserve cut interest rates by half a percentage point yesterday and signalled that more reductions would follow, launching its first easing cycle since the onset of the pandemic.

The US central bank’s first cut in more than four years leaves the federal funds rate at a range of 4.75 per cent to 5 per cent. The bumper cut suggests the Fed is seeking to pre-empt any weakening of the US economy and labour market after more than a year of holding rates at their highest level since 2001.

However, Fed chair Jay Powell said rates were not on a “preset” path, noting that if inflation proved sticky, the Fed could “dial back policy restraint more slowly”. Equally, the central bank was “prepared to respond” if the labour market weakened unexpectedly, he added.

Yesterday’s decision is a milestone moment for the central bank after more than two years battling inflation — and an important moment in this year’s presidential election. Here’s more on the significance of the cut.

Here’s what else I’m keeping tabs on today:

-

Economic data: Hong Kong and Australia report August labour market data while Malaysia publishes external trade figures for the month. Second-quarter GDP is due from New Zealand.

-

EU-China trade talks: China’s commerce minister Wang Wentao will meet the EU trade commissioner Valdis Dombrovskis in Brussels. The meeting comes amid trade war fears after the EU proposed sharply higher tariffs on China-made electric vehicles.

-

Monetary policy: Taiwan’s central bank is expected to hold interest rates steady, according to economists in a Reuters poll. The Bank of England also makes its rate decision.

For more insight into what rate-setters are thinking, sign up for our Central Banks newsletter by Chris Giles if you’re a premium subscriber, or upgrade your subscription here.

Five more top stories

1. Handheld walkie-talkies and other wireless communication devices used by Hizbollah were detonated across Lebanon yesterday, killing at least 20 people and injuring at least 450, a day after thousands of pagers exploded in the country. Hizbollah blamed Tuesday’s initial blasts on Israel, which has not commented directly on the attacks. Here’s the latest from Lebanon.

2. India has overtaken China’s weighting in one of the world’s biggest stock market benchmarks, as share sales and rising liquidity in Indian companies make the country more open to investors. India’s share of the free-float, “investable”, version of the MSCI All-Country World index rose to 2.33 per cent this month, eclipsing China’s 2.06 per cent.

3. Bangladesh has approached the UK for help probing the overseas wealth of allies of former prime minister Sheikh Hasina. Ahsan Mansur, Bangladesh’s new central bank governor, said the new administration is investigating whether Hasina’s regime diverted at least £13bn overseas from the banking system.

-

Where is Sheikh Hasina?: Bangladesh’s authoritarian leader fled to India after being overthrown, where a cloak of discretion is likely to surround her — and by New Delhi’s design.

4. The US government has extended its national security review of Nippon Steel’s proposed $15bn acquisition of US Steel. The move is a surprise given that the deal has been opposed by President Joe Biden and vice-president Kamala Harris. Here’s what the decision means.

5. JPMorgan Chase has tasked one of its bankers with overseeing the company’s junior banker programme, a response to renewed concerns about working conditions for young employees on Wall Street. The gruelling workload of investment banking is under renewed scrutiny following the death in May of a junior banker at Bank of America.

News in-depth

Eleanor Olcott and Tina Hu go inside China’s “Shein village”, the garment-making district at the heart of the fast fashion giant’s retail empire. Thousands of workshops in Panyu, Guangzhou have helped build a retailer that relies on speed and thin margins. But Shein’s business model is coming under pressure as rivals including Temu imitate its methods and even poach suppliers.

We’re also reading . . .

-

Solar panel boom: Here’s why businesses in Pakistan are racing to cover their factory rooftops with ultra-cheap Chinese solar panels.

-

Frequent flyers: Airline loyalty programmes have been testing customer patience, and now face US government probes, writes Brooke Masters.

-

Sudan war: Senior intelligence officers from the African state say that Russian and Ukrainian fighters have both been helping to train the same side in Sudan’s civil conflict.

Chart of the day

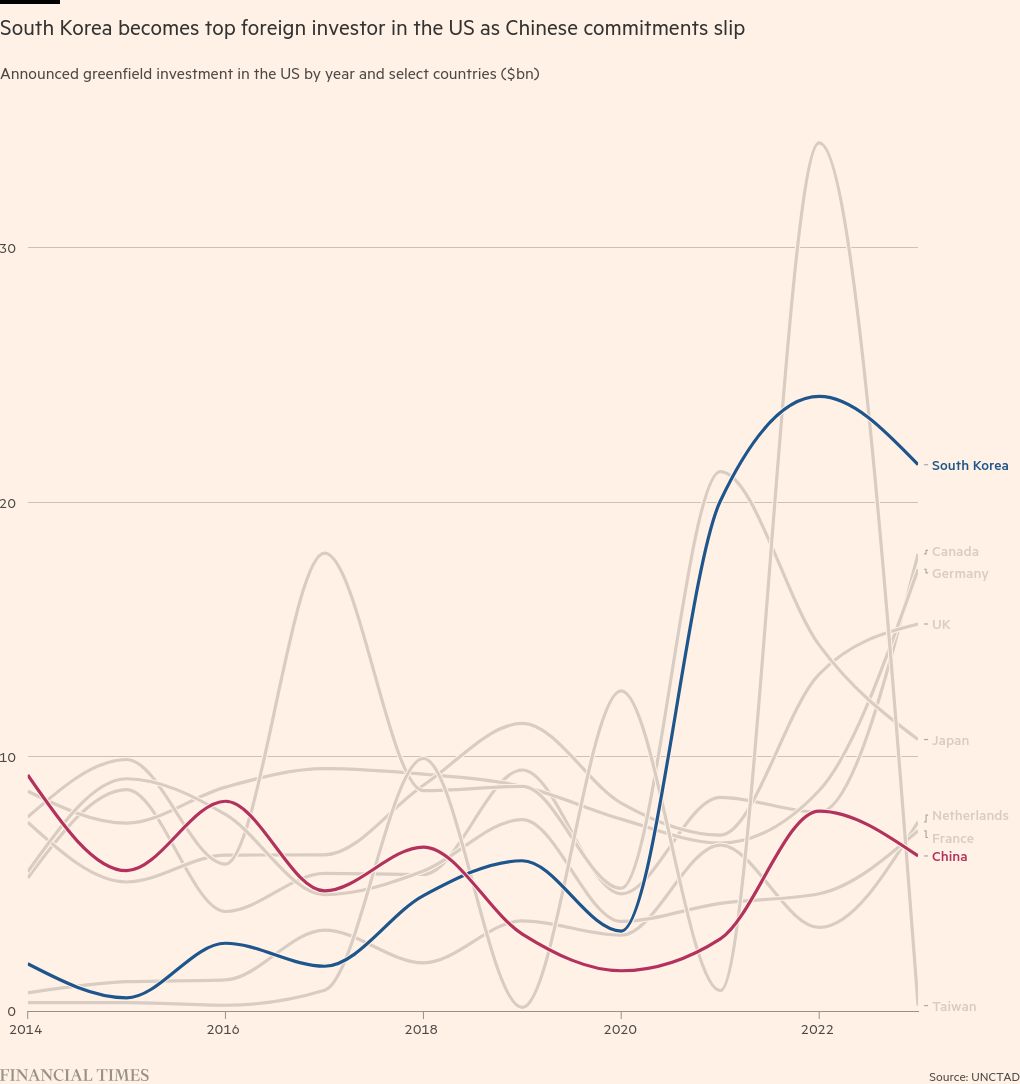

South Korean companies last year invested record amounts of capital into the US economy, as the Biden administration’s efforts to carve out China from its supply chain and lucrative subsidies for advanced technology manufacturers spark a surge in project commitments from Seoul.

Take a break from the news

Don’t miss the FT foreign correspondents’ guide to business dining around the world, which includes some of Hong Kong’s top spots for work lunches and sealing deals.

Additional contributions from Gordon Smith and Tee Zhuo