Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

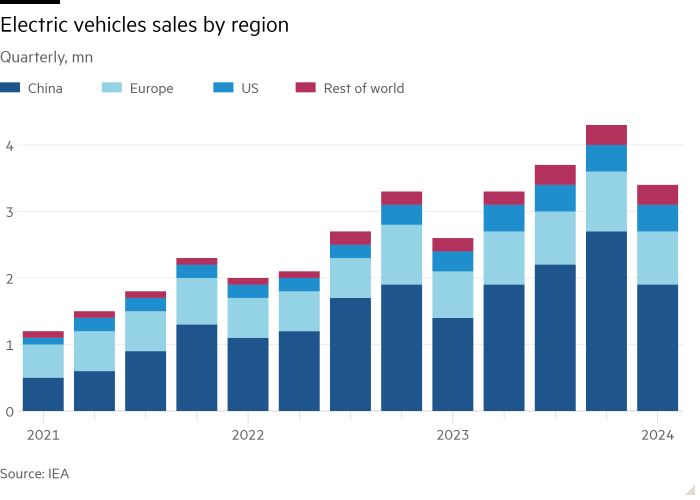

Europe is in danger of losing a key “green” manufacturing industry to Asia. Sound familiar? This time it is Europe’s nascent battery industry that is facing a shaky future. Slowing electric car sales are adding to existing problems, such as cheap battery imports from an oversupplied China.

As European automakers scale back their electric vehicle plans, Benchmark Mineral Intelligence is forecasting nearly 14 per cent lower demand in Europe for cells in 2030 than it was a year ago.

Battery makers have responded by delaying or cancelling their own projects. Northvolt of Sweden, Europe’s leading domestic battery hope, said this week it would cut jobs and trim other activities to focus on its first gigafactory in northern Sweden. Volkswagen’s battery business PowerCo is among others that have moderated ambitions.

The worry is that current conditions scupper domestic European companies’ chances of challenging the dominance of Chinese and South Korean battery makers. This feels like a “make-or-break” moment for the homegrown industry.

True, the hype a few years ago around fleets of new gigafactories in Europe was always destined to deflate. Building and scaling up gigafactories is complex and highly capital-intensive. Many start-ups did not have sound business models — or even the technology or supply chain sourcing plans, says Sam Adham at CRU.

The approach of failed UK company Britishvolt of “build and they will come” — pressing ahead with a factory before securing sufficient orders — was always dubious, for instance.

Most western battery groups have concentrated on longer-range battery chemistries. Yet automakers are increasingly open to using shorter-range but cheaper LFP (lithium iron phosphate) batteries from Chinese companies.

There are, of course, different interpretations of “domestic”. Many of the biggest Asian battery manufacturers, such as China’s CATL and South Korea’s LG Energy Solution, have manufacturing facilities in Europe. In 2023, 64 per cent of the batteries sourced for European-built EVs were from facilities in Europe, according to CRU.

But Europe has reached similar critical moments before in other green technologies and consistently lost. Solar panel manufacturing shifted to China from the 2000s onwards. Such inflection points often spur calls for greater subsidies or trade tariffs.

Higher levies have already been imposed on EV imports from China. But there are existing tools to help domestic battery makers, argues Julia Poliscanova of Transport & Environment. They just need to be implemented or distributed faster: for instance, a €3bn battery fund announced last year, or carbon footprint requirements that would reward local manufacturing.

EV sales growth will return. Domestic European battery start-ups are unlikely to overtake their powerhouse Asian rivals. The question is which can manage to survive this sticky period to carve a place in the global market.