Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Chinese hot pot meals are social events with diners sharing a steaming pot of soup. These restaurants were understandably hit hard during the pandemic due to social-distancing requirements. Now they face a new type of challenge as locals spend increasingly less.

China’s household savings have been rising this year, hitting a record high of about $20tn at the end of June. That is a reflection of Chinese consumers spending less on everything from clothes and travel to dining out — including hot pot dinners.

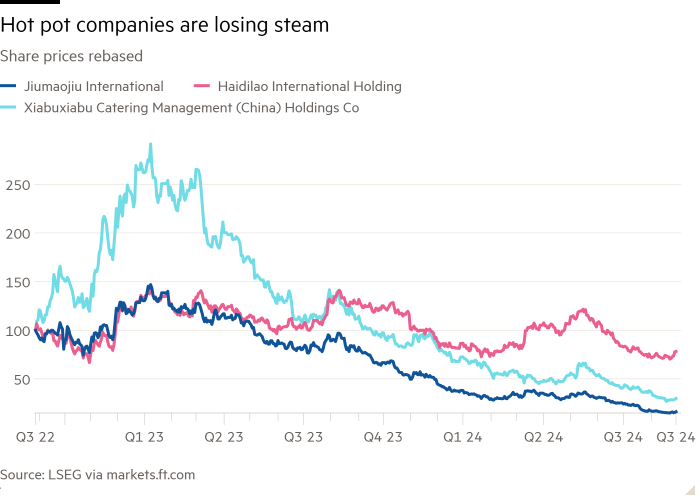

China’s largest hotpot chain, Haidilao International, reported a 10 per cent fall in group profit to Rmb2.03bn ($285mn) for the first half, as consumer spending continued to weaken. Average spending per guest also declined. Another problem is that the local market has been getting increasingly saturated, with rivals Jiumaojiu and Xiabuxiabu aggressively expanding.

Shares in these companies have slumped in the past year. Haidilao trades at just 13 times forward earnings — less than a third of its valuation during the pandemic. This reflects China concerns, given sales at home account for nearly 97 per cent of Haidilao’s total.

There is room for growth outside of China. Chinese food and beverage groups have been gaining traction in international markets, including North America and Europe. Reception has been especially strong in south-east Asia. Haidilao’s overseas operator, Super Hi International Holding, has more than 110 stores globally.

The focus on international markets is starting to pay off, in terms of revenue growth and table turnover rate. Overseas expansion has also helped profitability, with operating margins at Haidilao rising over the past three years, and doubling over the past year to more than 13 per cent.

But the rapid expansion drive comes at a price. Higher costs are one of the biggest, especially staff costs. For Super Hi, those increased 15 per cent in the second quarter — staff costs as a percentage of sales were more than a third of the total. Rising prices are also a challenge: prices of raw materials and consumables used rose more than a tenth.

Without significant fiscal reforms, household consumption growth in China is likely to slow to as low as 3 per cent in real terms over the next five to 10 years, according to research from the Rhodium Group. That would compare with an average annual rate of about 7 per cent between 2015 and 2019. Betting on international expansion for growth in the meantime is the right strategy for hot pot companies, even if higher costs in the short term mean returns will not be steaming hot.