The IPO window is (maybe, hopefully, please?) open again — particularly for companies based in Singapore or China.

Per Renaissance Capital’s list of US market debuts last week:

YHN Acquisition I (YHNAU) – China

Deal Size: $60mn Exchange: Nasdaq

Lead Underwriter: Lucid Capital Markets

Blank check company led by executives from boutique SPAC firm Norwich Capital.Cuprina Holdings (CUPR) – Singapore

Deal Size: $15mn Exchange: Nasdaq

Lead Underwriter: Network 1 Financial Securities

Singapore-based provider of skincare and chronic wound care products.Autozi Internet Technology (AZI) – China

Deal Size: $11mn Exchange: Nasdaq

Lead Underwriter: Kingswood Capital Markets

Sells parallel import cars and auto parts in China.Trident Digital Tech Holdings (TDTH) – Singapore

Deal Size: $11mn Exchange: Nasdaq

Lead Underwriter: WallachBeth Capital

Provides business consulting, marketing, and IT services to SMEs in Singapore.Powell Max (PMAX) – China

Deal Size: $8mn Exchange: Nasdaq

Lead Underwriter: WallachBeth Capital

Provides financial communication services in Hong Kong

FTAV wishes each of these companies well, though we’ll be paying especially close attention to Curpina given the track-record of its underwriter, Network 1 Financial Securities, several of whose past IPOs have soared then crashed in spectacular fashion. And the group’s intriguing re-emergence following a fallow period provides as good an excuse as any to check in on some of Nasdaq’s other Chinese micro-cap constituents.

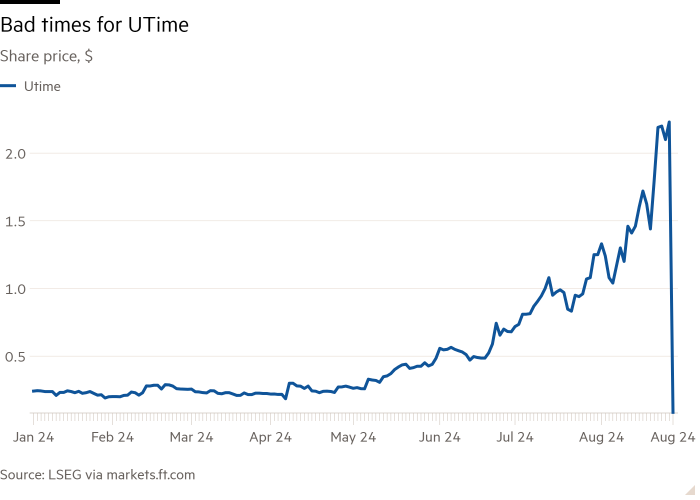

UTime, for example, is a Shenzhen-based, US-listed company “mainly engaged in the design, development, production, sales and brand operation of mobile phones, accessories and related consumer electronics”.

On Wednesday, following a sharp pivot to “disease prevention and health management on a global scale” earlier this year, the company issued an exciting announcement — the signing of a non-disclosure agreement with Bowen Therapeutics, which happens to be working on a vaccine for mpox:

SHENZHEN, China, Aug. 28, 2024 /PRNewswire/ — UTime Limited (NASDAQ: WTO) (“UTime” or the “Company”) has officially announced the signing of a non-disclosure agreement (the “NDA”) with Bowen Therapeutics Inc (“Bowen Therapeutics”) for the acquisition of the Bowen Therapeutics laboratory at UMASS Medical School. This strategic move not only marks UTime’s in-depth expansion in the global vaccine market, but also provides strong support for the registration of the relevant vaccine through the U.S. Food and Drug Administration (the “FDA”) . . . .

Bowen Therapeutics, which UTime intends to acquire, is a company dedicated to R&D of vaccines for infectious diseases. Its laboratory has previously published a number of research papers on monkeypox virus and has proposed a variety of potential vaccine designs. The Noval hexavalent recombinant protein vaccine developed through these studies has been designed based on the characteristics of monkeypox virus using the latest recombinant technology. The technology can effectively increase the level of virus-neutralizing antibodies and significantly enhance the protective effect of the vaccine.

Under the NDA, UTime will take over all of the Bowen Therapeutics laboratory at UMASS Medical School, and will be in charge of ongoing clinical trials and future vaccine development programs. In addition, UTime will utilize its resources and expertise to help the monkeypox vaccine complete the FDA registration process quickly and efficiently. Leveraging this acquisition, Bowen’s core technologies and products are also expected to be more widely used and promoted globally.

Alas, investors weren’t overly enthused. UTimes’ shares fell a cool 94 per cent on Wednesday, making it Nasdaq’s worst performing stock. Trading volumes were a tad higher than usual, at 1,072 times the average.

Why the drop? For a start, there’s little trace online of a link between Bowen Therapeutics and UMass Medical School.

A secretary at the office of the university’s chancellor said they had “never heard” of Bowen Therapeutics, and the company’s website is unhelpfully low on info: the group says only that it “has a team of top-notch scientists in many biopharmaceutical disciplines” as well as a Biosafety Level 2 laboratory, convenient access to many shared research core facilities . . . and USDA accredited alpaca farms in close proximity”.

We called Bowen Therapeutics several times to no avail and our missives to the listed email address bounced back. A call to UTime’s HQ in Shenzhen also went unanswered, but we’ll update this post if we hear back from either company.

UTime investors had had a rollercoaster time of things even before the mobile phone kit company’s vaccine volte-face, however.

A day after it IPO’d back in August 2021, UTime’s shares were briefly up 2,600 per cent, pushing the company’s market value to around $350mn.

The stock ended the day up a more modest 875 per cent, with Bloomberg reporting at the time that the move marked “the best debut in the US since Internet service provider Freeserve Plc jumped by 1,261 per cent during the dot-com frenzy in 1999”.

The IPO was underwritten by a motley crew: Boustead Securities, whom readers may recall; Brilliant Norton Securities, a Hong Kong bank that abruptly closed in early 2023; and Fosun Hani Securities, a Hong Kong securities brokerage. There is no suggestion that any of these three firms have done anything wrong.

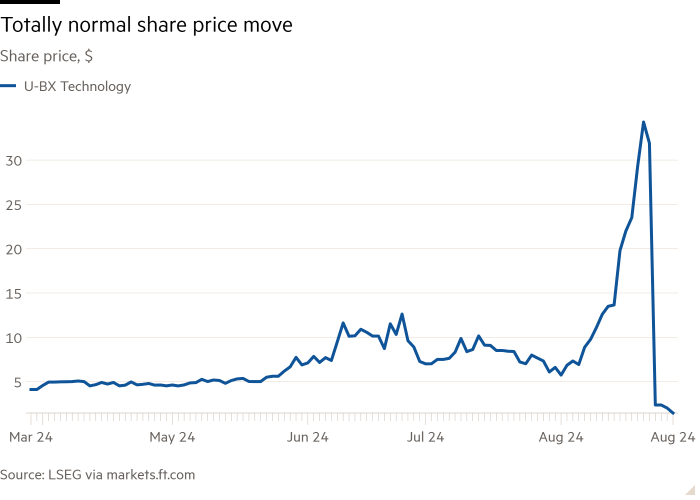

Last week’s second-worst performing Chinese-based, US-listed company (per Stock Analysis) was AI- powered car insurance group U-BX Technology, whose 95 per cent drop all but wiped out a 450 per cent, nothing-to-see-here rally that began in early August. (ZombiEF Hutton acted as sole bookrunner on the company’s IPO earlier this year.)

UBXG stock was allegedly pushed to mom and pop investors via WhatsApp, according to a retail trader we spoke with who played dumb and got herself added to the group chat.

WhatsApp groups like these are pretty common: the WSJ ran a great piece back in March about a flurry of ads on Facebook and other social media sites that looked to have been posted by bigwigs like Cathie Wood, Peter Lynch, Ray Dalio, Bill Ackman and Steve Cohen. The ads were all fake, of course, but succeeded in luring . . .

. . . . victims into joining WhatsApp groups to get stock tips from supposed associates of the big-name investors. In reality, they are just a new take on the classic pump-and-dump scheme. Small-time investors have collectively lost millions of dollars . . .

. . . . Some of the victims of the Cathie Wood scam ads were directed to a Facebook page asking about their investment history and then into a series of WhatsApp groups, often moderated by two fictitious people who claimed to be associates of Wood at a separate make-believe company called Red Sea Fortune Investment.

The victims were later urged to join a “VIP room” to get specific stock picks. One victim said a fake assistant, who went by the name Ava Evans, would share pictures of her breakfasts and flowers and ask personal questions as she encouraged her to invest more with each trade.

Judging by the tone of the messages sent, the UBXG WhatsApp group seems to have been run by “the same syndicate of Red Sea” and Wisdom Capital Management, the retail trader told us, referring to another fictitious firm.

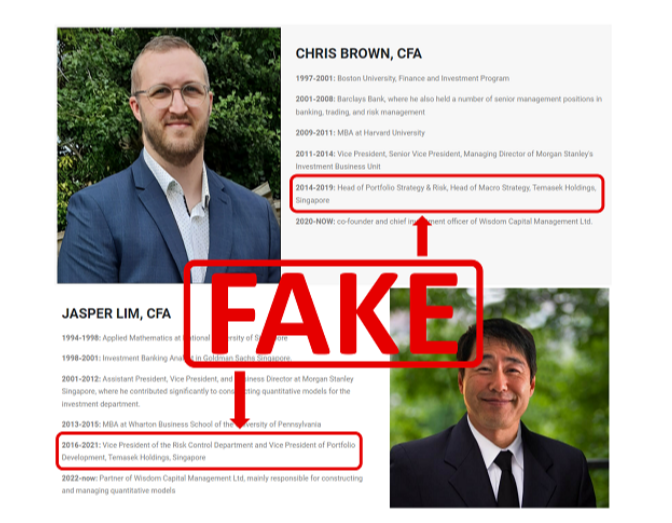

Whoever is behind Wisdom and Red Sea has been at all this for a while. In January, Singapore’s state-owned fund Temasek was forced to issue a press release to clarify that Wisdom Capital’s made-up co-founder and chief investment officer were not, in fact, former Temasek employees, as Wisdom’s website had claimed.

Chris Brown may well not be real at all. The image above (higher-res on the Wisdom Capital Management site) has a lot of signs of AI generation: the glasses blur into his right eyebrow and fade into his hairline, the bench behind his left shoulder is angled all wrong, and the suit breast pocket line is unusually wiggly. Separate pictures we found of “Chris” at a wedding are also weirdly warped and blurred. We did find a bloke who plays a lot of basketball in Sheffield that bears a striking similarity to “Chris Brown”, but suspect that is a total coincidence.

Anyway, the WhatsApp retail trader tells us to “keep watching” another Shenzhen based company, Baiyu Holdings, whose shares have climbed 400 per cent over the past 30 days.

Additional reporting by Sam Learner.