Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Putting a roof over your head is all part of growing up. Most in Britain use property portal Rightmove to do it. The site, a formidable monopoly and earnings generator, may soon get a chance to move up the ladder itself. Its new home would be Rupert Murdoch-owned REA Group of Australia, which said it was considering a cash and shares offer on Monday.

Shares in Rightmove jumped by a quarter in response and those in the potential buyer fell by almost a tenth. Limited overlap between the businesses and growing risks to Rightmove’s UK dominance may explain the hesitancy.

If a firm offer arrives, Rightmove shareholders will have to ask whether they are selling out at the top. In price terms, probably not. Even a 30 per cent premium on the undisturbed share price would be a tenth below the record high set at the end of 2021. Its shares were trading at more than 30 times forward earnings then but languished at under 20 times before Monday’s news.

A downbeat point in the housing cycle is one reason for that. But Rightmove could be facing other hurdles, including the entrance of US property giant CoStar into the market via the acquisition of OnTheMarket last year. But others have tried and failed to do what CoStar hopes to achieve, thwarted by ingrained network benefits for Rightmove.

REA’s shareholders should have bigger questions on strategic logic. It operates mostly in Australia and is expanding in Asia, suggesting limited cost savings. Lowering Rightmove’s administrative costs by a tenth would save just £12mn.

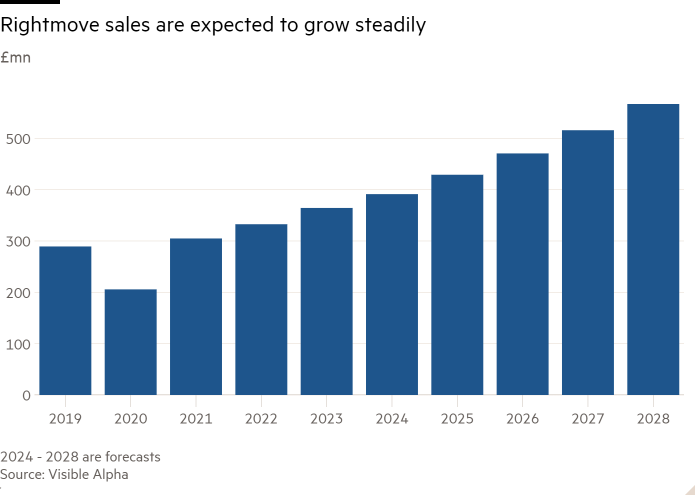

And Rightmove could prove costly: its standalone prospects look strong. It plans to expand into new markets such as mortgages, commercial property listings and rental services. Revenue growth should start to pick up. Consensus expects almost 10 per cent growth in 2025 versus 7 per cent expected this year, according to Visible Alpha.

As such the company could hit the potential £5.5bn takeover price by 2027 anyway based on profit growth alone. A recovery in valuation multiples would add to that — something that seems likely as interest rates fall and the new government promotes a building boom. New home sales were 15 per cent of revenues for Rightmove in 2022.

All of which means REA should need an oversized premium to entice Rightmove shareholders into a deal. With limited strategic gains or an earnings boost on offer, this deal may struggle to get much beyond this first viewing.

Lex is the FT’s flagship daily investment column. If you are a subscriber and would like to receive alerts when Lex articles are published, just click the button “Add to myFT”, which appears at the top of this page above the headline