This article is an onsite version of our Energy Source newsletter. Premium subscribers can sign up here to get the newsletter delivered every Tuesday and Thursday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters

Good morning, and welcome back to Energy Source, coming to you from New York.

We start with a scoop that Gunvor is stepping up its bet on biofuels, acquiring half of Varo Energy’s $600mn Dutch biofuel project as the commodities trader seeks to reinvest record profits from the past two years.

The acquisition comes despite lower than expected growth in demand for the fuel. Shell and BP have both paused the development of European biofuel plants last month, while shares in Neste, a Finnish biofuels specialist, have fallen by almost half this year.

Today’s newsletter looks at America’s largest solar panel manufacturer, First Solar, and its race to out-innovate China on solar technologies. The company is a top beneficiary of the landmark Inflation Reduction Act and in its second-quarter earnings on Tuesday reported its net income has more than doubled.

Last month, I toured First Solar’s facilities in north-west Ohio, where it’s quickly become one of the largest employers and a prime example of how clean energy dollars could foster bipartisan support for the energy transition.

Thanks for reading. — Amanda

First Solar bets on innovation to outshine China on clean tech

In America’s Rustbelt, the country’s largest solar manufacturer is intensifying its battle to rival China on solar technology.

First Solar opened the largest US solar research centre in the suburbs of Toledo, Ohio, last month — a 1.3mn sq foot facility dedicated to test tech that has so far only been demonstrated in labs.

The hope is to commercialise these discoveries in its adjacent factory, which is among the largest of its kind in the western hemisphere. Inside, hundreds of robots and autonomous vehicles assemble parts as thin as blood cells under the watchful eye of humans and artificial intelligence monitors.

“This is a sandbox for manufacturing,” said Markus Gloeckler, First Solar’s chief technology officer, who estimates the research facility will provide an 18-month production advantage over rivals. The company is spending almost $500mn on the facility, along with a prototype line for perovskites, an unproven but potentially revolutionary solar technology that would make panels more efficient.

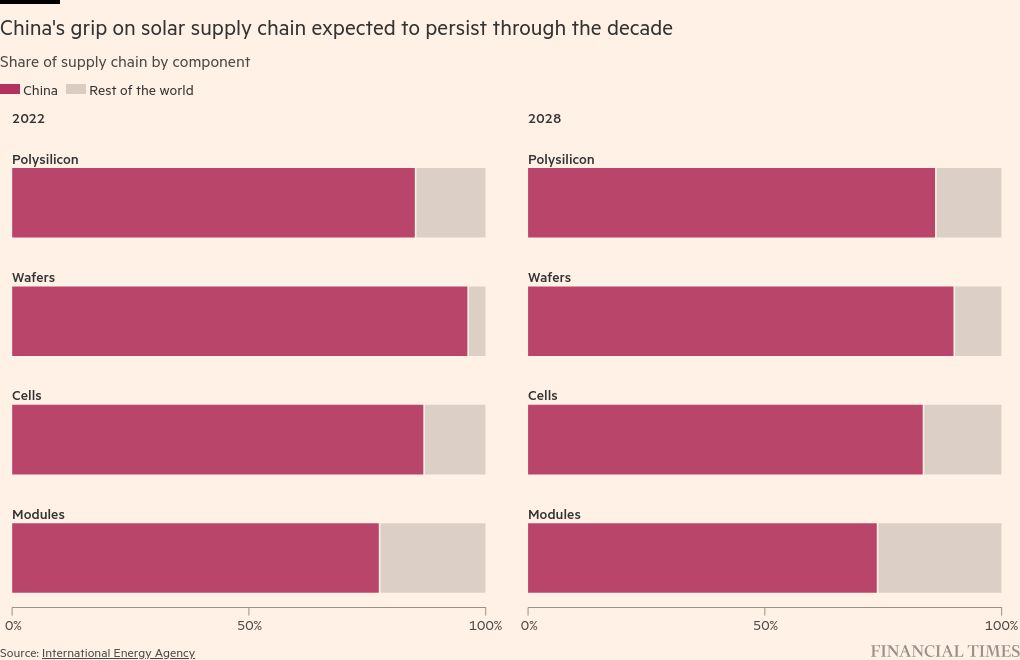

First Solar is pushing into research at the same time it is spending more on manufacturing than any other US solar company. It has continued to construct factories even as overproduction of panels in China has caused global market prices to plunge. Many of First Solar’s competitors are losing money even with subsidies from President Joe Biden’s climate law, the Inflation Reduction Act.

What has helped insulate First Solar is its bet in the 1980s on an alternative technology. While the rest of the world makes crystalline silicon panels, First Solar focuses on thin-film technology, particularly cadmium telluride. While these panels make up a fifth of US projects, almost entirely supplied from First Solar, the technology makes up less than 5 per cent of the global market.

Mark Widmar, chief executive of First Solar, told ES that beating Beijing to the next technology breakthrough will be crucial to create a competitive domestic solar sector.

“If China gets to thin films, perovskites, and commercialises it ahead of First Solar . . . they’re even in a more dominant position than they are right now,” Widmar said.

First Solar’s Ohio research facility will focus on developing “tandem” solar cells, which combine traditional silicon cells with perovskites for higher efficiency. It invested $152mn in research and development in 2023, up 35 per cent from the year before. It also operates research centres in California and Sweden.

But analysts and industry members are sceptical whether innovation will save domestic industry. The US filed less than 350 solar patents last year, while China filed more than 9,000, according to the International Renewable Energy Agency.

“Companies are all trying to persuade us that they have something special, and they don’t, because solar modules are absolutely a commodity product,” said Jenny Chase, solar analyst at BloombergNEF, which estimates that the cost of production for imported panels is roughly half of their US-made counterparts.

Your feedback

In our July 18 newsletter, we dived into the painstakingly long timelines to develop new US mines and what’s at stake for the country’s energy transition and security.

Barbara Frei, executive vice-president of industrial automation at Schneider Electric, shared an insightful response on how the US can be more competitive. Here is what she had to say:

The current delays in transitioning from discovery to production, due to regulatory and permitting constraints, are indeed significant hurdles for the industry at large, but especially contradictory in the US given the fact it has a huge and strategically important critical mineral endowment. The S&P report stated that copper mines are one of the slowest to develop, which is quite the obstacle given how keen the US is to ensure energy security and reinforce the importance of permitting reform.

Considering these challenges, the US must seek alternative pathways to attract greater investment and gain a competitive edge in the global market. One such avenue is the acceleration of decarbonisation efforts within mineral extraction operations. Digital transformation across the supply chain, while minimising waste and emissions through electrified and automated equipment and processes, will have a positive impact on efficiency and the bottom line — all of which appeals to investors.

Moreover, addressing Scope 3 emissions and fostering circularity within the supply chain are crucial steps towards competitiveness. Collaborative efforts to source critical minerals from suppliers prioritising sustainable production methods can enable innovation and further bolster the US position.

By embracing these strategies, the US can position itself as more competitive, thereby reducing reliance on external sources for critical minerals while boosting the US economy.

To have your say on this or any other topic we cover, drop us a line at [email protected].

Power Points

Energy Source is written and edited by Jamie Smyth, Myles McCormick, Amanda Chu, Tom Wilson and Malcolm Moore, with support from the FT’s global team of reporters. Reach us at [email protected] and follow us on X at @FTEnergy. Catch up on past editions of the newsletter here.

Recommended newsletters for you

Moral Money — Our unmissable newsletter on socially responsible business, sustainable finance and more. Sign up here

The Climate Graphic: Explained — Understanding the most important climate data of the week. Sign up here