Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

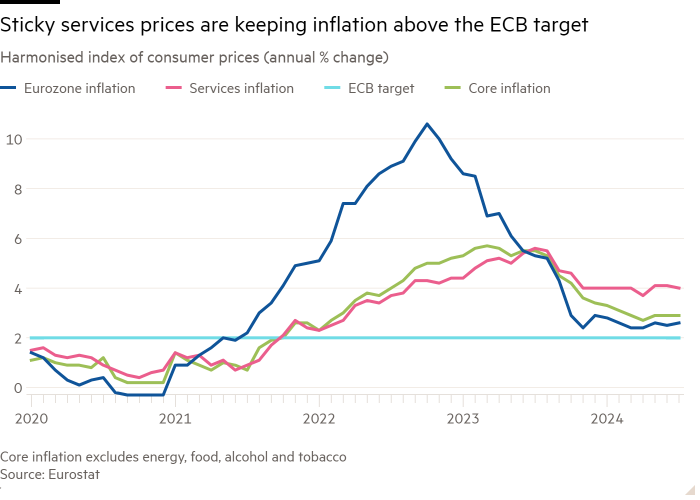

A slight increase in Eurozone inflation, to 2.6 per cent in the year to July, is making it seem less certain that the European Central Bank will cut interest rates in September.

The latest Eurozone inflation figure, out Wednesday, was higher than the 2.5 per cent rise the previous month and above the forecasts of economists polled by Reuters, who had anticipated price pressures to remain flat.

Bigger rises in energy prices and an uptick in goods costs drove overall inflation higher in the 20 countries that share the euro.

Economists at Dutch bank ING said the figures had made the possibility of a cut at rate-setters’ next meeting in September “a very close call”.

Some think a slowdown in price pressures in the dominant services sector — the part of the economy many rate-setters are most concerned about — could prove enough to convince them to back another quarter-point cut to the benchmark deposit rate, now 3.75 per cent.

“The small fall in services inflation in July is probably just enough for a September rate cut to remain the base case,” said Franziska Palmas, an economist at Capital Economics, adding that the decision may hinge on whether inflation falls or keeps rising in August.

Markets still believe the central bank is likely to cut in September, with swaps pricing signalling a 65 per cent chance that borrowing costs will fall. The pricing barely changed on Tuesday, although the probability is now down from 80 per cent a few weeks ago.

Interest rate-sensitive two-year German bond yields remained slightly lower on the day after the inflation figures, down 0.02 percentage points on the day at 2.54 per cent. The movement in yields, which move inversely to prices, suggests that investors are still anticipating several cuts by policymakers.

The ECB started to cut rates in June, ahead of most other major central banks, as it grew more confident that inflation would fall to its 2 per cent target by next year, but kept interest rates on hold this month.

Rate-setters have said inflation will be “bumpy” for much of this year. Some policymakers still worry services prices could keep rising too quickly and keep overall inflation persistently high.

But Eurostat, the EU statistics agency that publishes the data, said services price growth slowed by 0.1 percentage point to 4 per cent in July.

A string of major sporting and cultural events, combined with the start of the summer tourism season, had been expected to push up prices for many services in high demand in Europe, including hotel rooms and airline tickets.

Pictet Wealth Management economist Frederik Ducrozet said July’s higher inflation figure was “not much to worry about, but will keep the ECB on the cautious side”.

Energy inflation accelerated from 0.2 per cent in June to 1.3 per cent in July. Food, alcohol and tobacco price growth slowed to 2.3 per cent while other goods costs picked up slightly to rise 0.8 per cent.

The closely watched measure of core inflation, which excludes energy and food to give policymakers a better picture of underlying price pressures, was unchanged at 2.9 per cent.

Economists had expected core inflation to slow slightly. But Tomasz Wieladek, economist at investor T Rowe Price, said the higher figure was due to higher container shipping costs, which pushed up goods inflation.

Wieladek said the ECB was unlikely to worry much about this as the futures market for betting on shipping rates show “it is likely to be temporary”.

In June, the ECB lowered its benchmark deposit rate from an all-time high of 4 per cent in anticipation of inflation hitting its 2 per cent target by next year.

When the ECB left rates unchanged two weeks ago, its president Christine Lagarde said its next decision in September was still “wide open” and would depend on how the data develops.

ECB executive board member Isabel Schnabel said last week that “persistent services inflation shows that the ‘last mile’ of the fight against inflation is particularly difficult.” But she added in an interview with Frankfurter Allgemeine Zeitung that inflation was still expected to “gradually converge” to its target next year.