Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

BlackRock believes the exchange traded funds industry is at a “turning point” as it launches a further five actively managed ETFs in the European market, according to a senior executive.

The suite of “enhanced” funds doubles BlackRock’s existing European active ETF roster and is a further sign of where the world’s largest asset manager is increasingly focusing its attention.

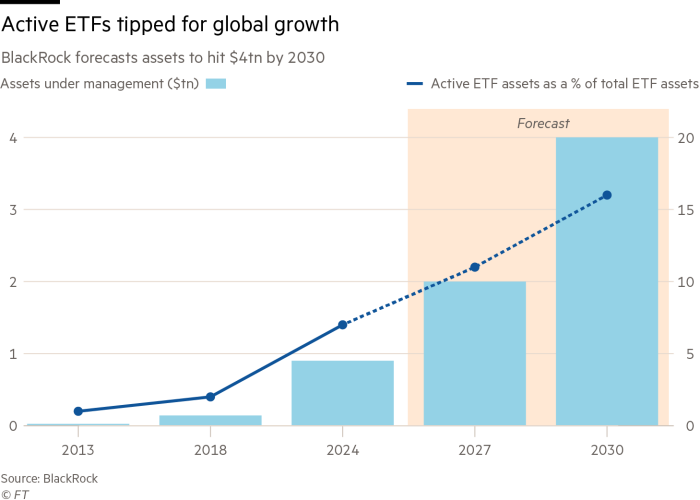

Globally, BlackRock currently holds just $35bn in active ETFs, less than 1 per cent of its total ETF book of $4tn. However, earlier this month it forecast that assets across the active ETF industry will quadruple from $900bn at present to $4tn by 2030.

“Throughout the course of the year we have been focusing a lot on a very exciting innovation, which is active ETFs,” said Manuela Sperandeo, BlackRock’s Europe and Middle East head of iShares product.

“We think we are at a turning point in the industry. There is the opportunity to innovate across the spectrum,” Sperandeo added. “In the US, the balance of product innovation is happening in [the active ETF] space, in line with the broad adoption of the ETF as the wrapper of choice. These two trends are going to move in parallel. It is a very fast-moving landscape.”

The roots of the ETF industry lie in low-cost passive index-tracking funds. However, actively managed ETFs are increasingly gaining traction in the US, where ETFs receive more favourable tax treatment than mutual funds — the traditional mainstay of active management.

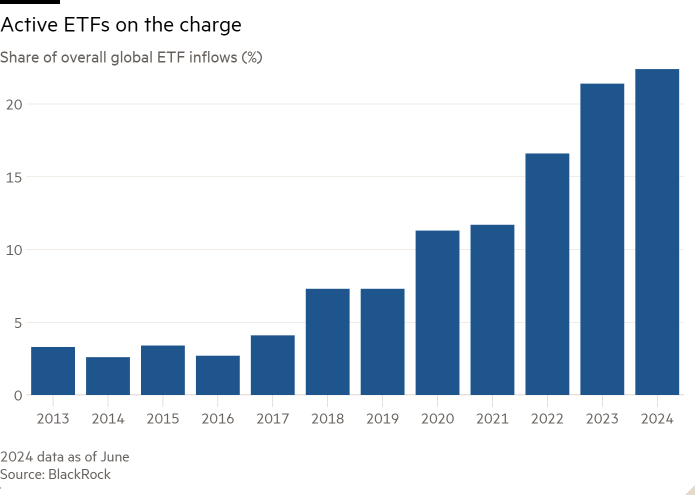

As a result, active ETFs seized a record 22.4 per cent share of the $665bn net inflows into ETFs globally in the first half of 2024, according to BlackRock, well ahead of their 7 per cent share of assets. They accounted for 41 per cent of global ETF launches over the same period.

However, they have been slower to take off in Europe, where there is no tax advantage over mutual funds.

Despite growth of 40 per cent in the past year, European active ETFs currently hold just €45.5bn, according to Morningstar, less than 2 per cent of the continent’s total ETF assets. Net inflows in the first half of 2024 were €5.6bn, about equal to the full-year totals for 2022 and 2023, helped by the arrival of new entrants such as Ark Invest and BNP Paribas Asset Management.

BlackRock is set to launch the five iShares Equity Enhanced Active Ucits ETFs later on Wednesday. They will be focused on global equities, the US, Europe, emerging markets and Asia ex-Japan.

The ETFs will be managed by BlackRock’s 220-strong systematic investing team, who will attempt to “outperform their parent benchmarks and target consistent, repeatable alpha [excess return]” with a tracking error — a measure of their deviation from their underlying benchmarks — of just 1 per cent, Sperandeo said.

They will target an information ratio — a risk-adjusted measure of excess return — of between 0.7 and 1, depending on the strategy, “based on a very strong active track record”, Sperandeo added.

The ETFs mirror the broader landscape of the global active ETF market thus far, where, with the odd exception such as Ark Invest, old school, red-blooded stockpicking remains rare. Instead, relatively timid, low-risk products have grabbed the lion’s share of assets.

In the US, the most successful active product so far has been the $34bn JPMorgan Equity Premium Income ETF (JEPI), which uses derivatives to create an income-focused product that is lower risk than a standard benchmark tracker.

Dimensional Fund Advisors, which specialises in a highly systematic, structured investment approach, has also proved hugely popular.

JPMorgan is also the runaway market leader in Europe, led by its research-enhanced equity series, which seeks to “modestly” overweight stocks deemed to be undervalued and underweight those seen as overvalued, with low tracking error.

“The only thing surprising about this is that it hasn’t happened sooner. We have already seen big players like JPMorgan roll the dice,” said Kenneth Lamont, senior fund analyst for passive strategies at Morningstar, of BlackRock’s new active launches.

“They are following in the footsteps of what we have seen elsewhere in Europe. We don’t see strong growth in [stockpicking-based] active ETFs. It’s usually index-plus type strategies, at least the ones that have gained momentum.”

Lamont believed that “most of the squares have been filled in now” in terms of ideas for passive ETFs, so “the competitive focus has shifted to active ETFs” where asset managers may have some “sustainable competitive advantage”.

“Active is a bit more of a differentiated product,” Lamont added. “The focus of innovation has moved towards active ETFs and will continue to do so for the foreseeable future, I would imagine.”

The new BlackRock ETFs will have fees of between 0.2 and 0.3 per cent, and be listed on the London Stock Exchange, Euronext and Xetra.

Additional reporting by Will Schmitt