Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Flo Health has pulled in $200mn from private equity firm General Atlantic to become the first fully digital female health start-up valued at more than $1bn as investors tap into the growing market for fertility and menopause products.

The world’s largest period and fertility tracker by user numbers will put the funding towards building features such as symptom analysis for the estimated 450mn women worldwide, according to McKinsey, who experience perimenopausal or menopausal symptoms annually.

The UK-based app intends to “deliver the most personalised experience for users of all ages and demographics”, including the “untapped” area of women experiencing perimenopause and menopause, chief executive Dmitry Gurski told the Financial Times.

Targeting these users was “the natural next step” for Flo, which previously only addressed users who still menstruate, said Anna Klepchukova, the company’s chief medical officer.

Investors are finally waking up to the potential of the $36bn market — as estimated by Dealroom — for women’s healthcare, which researchers say has previously suffered from a dearth of research and years of under-investment.

Funding for start-ups specifically targeting female healthcare grew 5 per cent between 2022 and 2023, defying a broader downturn in health investment, according to analysis by Deloitte of PitchBook data.

General Atlantic’s principal Jessie Cai and managing director Tanzeen Syed will join Flo’s board of directors as part of the transaction. The private equity group is known for previously backing fast-growing technology companies including Alibaba, Facebook, and ByteDance.

London-headquartered Flo, which was co-founded by Dmitry and Yuri Gurski in Belarus in 2015, said it had nearly 5mn paid subscribers as of last month. It expects its revenues from subscriptions, which vary by region but start at £4.99 monthly in the UK, to exceed $200mn this year.

Flo is the latest start-up seeking to tap into the growing market for menopause and perimenopause therapeutics. The sector has grown rapidly in recent years as discussions about menopause have become more mainstream.

“People are thinking about it, talking about it, and investing in it,” said Elizabeth Bailey, co-founder of specialist venture capital fund RH Capital.

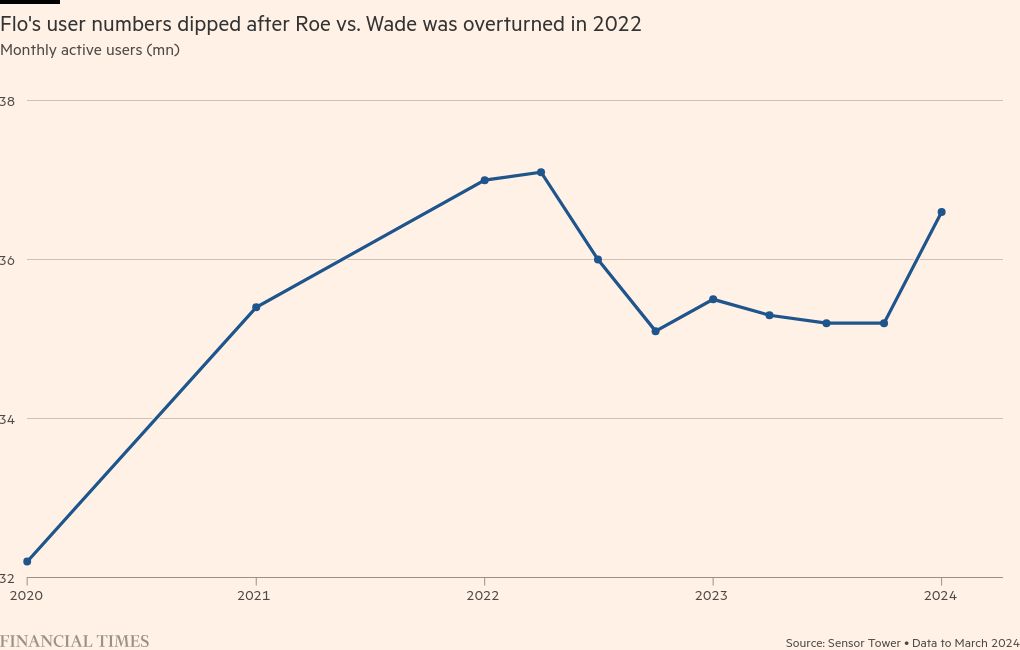

Flo attracted attention in September 2022 when it launched a free “anonymous mode” after the US Supreme Court overturned women’s constitutional right to abortion and catapulted privacy concerns to centre stage. The setting gives users the power to log and analyse their symptoms without linking any intimate data to their name.

Flo’s update, however, only came after the company received a public reprimand and agreed to improve its product in 2021 following an investigation from the US Federal Trade Commission over allegations it had shared data on users’ menstrual cycles and pregnancies with analytics teams at third-party companies, including Google and Facebook.

Active users on Flo slipped immediately after the Supreme Court ruling as fears escalated that women’s personal data could be used to incriminate them if they sought an abortion. The numbers have since returned to growth, according to Sensor Tower.

Flo’s rivals include sexual wellness app Rosy, which announced in May that it was expanding its services to target menopause, as well as endometriosis and fibroids.

Period and fertility tracker Clue, meanwhile, launched a perimenopause mode in September so users could log symptoms such as hot flushes, sleep changes and mood.