BlackRock’s Larry Fink wants everyone to know that he still loves the job.

Though the chief executive and chair of the world’s largest investment manager once talked of retiring in the early 2020s, the 71-year-old now shows no sign of wanting to let go of the firm he helped found 36 years ago. Over the past seven months, he has been in 14 countries and spearheaded two deals worth close to $16bn combined that further push BlackRock into private markets, an area that the firm has highlighted for strategic growth.

At the same time, Fink insists that he has succession planning well in hand. He has told investors that he has “no higher priority” than putting together a team to replace himself and Rob Kapito, BlackRock’s president, who is 67 and the only other founder still in an operational role. There are five clear candidates for top leadership, insiders say.

Fink has been walking this tightrope for more than a decade. A reshuffle back in 2014 was widely described as an early step towards grooming potential CEO replacements. Speculation has ratcheted up with every reorganisation since.

The lack of clarity is deliberate, insiders say. Fink credits BlackRock’s success to a team ethos and has told investors and employees he wants to ensure that tradition continues by treating the next generation as a collective rather than a group of individual stars.

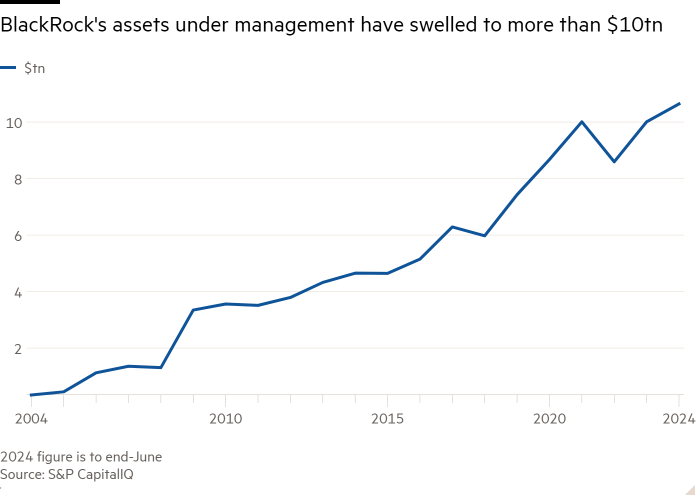

But the recent departures of several second- and third-tier executives to head rival asset managers, a substantial acquisition and a reorganisation in January that Fink described as “transformational” have increased anxiety internally and among investors about the future of the $10.6tn money manager.

“You do wonder about the long-term succession planning, does it get a wrench put in it when you have senior leaders who aren’t patient enough to stick around,” says Jason Kephart, the Morningstar analyst who covers BlackRock.

The acquisition of Global Infrastructure Partners will inject more uncertainty by adding a strong new board member in the shape of GIP chief executive Adebayo Ogunlesi, along with new shareholders and new talent to the firm’s upper ranks.

The $12.5bn deal, along with the £2.55bn purchase of data firm Preqin, seeks to make BlackRock a top-tier player in private markets. But this ambitious vision could take years to materialise, meaning Fink and the board must allocate responsibilities wisely among those being groomed to collectively drive BlackRock’s next phase.

BlackRock’s leadership matters not just to its investors and nearly 20,000 employees but also globally. As the world’s largest asset manager, it influences the way thousands of companies are run and helps direct where trillions of dollars are invested. Fink routinely uses his bully pulpit to raise awareness of issues such as the need to tackle climate change, build infrastructure and rethink retirement planning.

Fink insists the process is on track. “When I believe the next generation is ready, I am out,” he said at an event this month.

Interviews with more than two dozen executives, shareholders and analysts reveal concern about the continued uncertainty.

Almost no one would speak publicly for fear of setting off Fink’s legendary temper or angering Kapito, widely seen as the standard bearer for BlackRock’s internal culture. They also caution that the list of potential leaders has changed before and could well change again.

There is no appetite among large shareholders to force Fink’s hand on the timing of his retirement. Although he was hospitalised with peritonitis last year, he has recovered and is full of beans. An activist shareholder proposal seeking to force him to give up either the chair or CEO role failed resoundingly in May, attracting just 13 per cent of the votes cast.

And by many external measures the company is thriving. BlackRock shares trade at 22 times earnings compared with 12 times for peers. Assets under management set a new all-time high in the second quarter, and 17 of the 21 analysts who cover the company rate it a buy, according to Bloomberg data.

Fink contends that BlackRock’s big recent investments in infrastructure and private markets data will pay off handsomely as large investors seek to do more business with fewer money managers.

But the stock is down 13 per cent from highs set before Russia’s invasion of Ukraine, and some investors and analysts want more clarity on who and what will power future growth. Adding to the uncertainty, the lead independent director, Murry Gerber, plans to retire next year, meaning someone new will probably supervise the succession. He and Fink declined to give interviews for this article.

A successful transition will require the board to replace not just Fink’s energy, global connections and strategic vision but also Kapito’s internal discipline. The five executives leading the sweepstakes to collectively provide those skills and serve as a supporting edifice around the top leadership are being asked to take on responsibilities for business development and talent selection that go beyond their day jobs.

Two of them, Rob Goldstein, the chief operating officer, and Mark Wiedman, head of the global client business, would be in the pole position to replace Fink if he does retire in the next couple of years. They have been in the succession race for a solid decade as other potential hopefuls have come and gone, including Salim Ramji, who took the top job at Vanguard, the world’s second-largest asset manager, and Mark Wiseman, who stepped down after failing to disclose a relationship with an employee who reported to him.

Each has held multiple senior jobs but is publicly associated with the growth of a premier BlackRock business. Goldstein comes out of the technology services arm, known colloquially as Aladdin, which now provides 8 per cent of firm revenue, and heads up BlackRock’s digital asset strategy, including its popular bitcoin exchange traded fund.

Wiedman is a business builder; most prominently, he led the integration and massive growth of the iShare index-tracking and ETF business that powered BlackRock past rivals to become the largest money manager. In 2022 he was put in charge of wooing new clients and deepening existing relationships.

The lone woman in the group, Rachel Lord, was recently promoted to head BlackRock’s international expansion efforts which include an ambitious Indian joint venture with a company controlled by Mukesh Ambani, the country’s richest man. A relentless deal maker with a strong commercial focus, she is important to the overall mix but few believe she will end up as CEO, in part because she has made it known she would prefer the role of president.

The last two candidates have only recently joined the succession list. Martin Small, the only one under age 50, has risen rapidly in recent years. He was recruited from the legal department to the business side by Wiedman and they worked together to speed the growth of the iShares business. The board elevated him last year to chief financial officer and put him in charge of long-term strategy, in part because they wanted to see him up close, insiders say. A clear and vivid communicator, he recently made a tour of European large investors to make the case for putting money into BlackRock shares, rather than just its investment products.

Raj Rao, the current GIP president, will not officially join BlackRock until the deal closes in September but he is very much a potential next generation leader, unlike Ogunlesi, who is 70.

Rao has the distinction of being the only competitor who actually has invested money for clients. His chances would be strongly enhanced if BlackRock, after years of mediocrity in private assets, finally becomes a top competitor in the sector. As a GIP founder, he will receive a large slug of BlackRock stock when the transaction closes and over the next few years. He and Small negotiated the transaction and are sharing responsibility for getting it finalised.

Insiders describe Fink as being on a quest for the “Founders 2.0”, a group who can replicate the ethos of the eight partners who started BlackRock back in 1988.

Fink and Ralph Schlosstein, the firm’s first president, took larger shares as the senior executives, but the other six insisted on having equal stakes and the same compensation for the first three years to ensure collegiality.

Over the years, that approach has become known internally as “One BlackRock”, where everyone is supposed to work together across business lines to serve clients and silos are discouraged. Fink also has a rude private slogan to describe how he wants people to behave, which, stripped of its expletives, boils down to no dimwits and no jerks.

Fink’s possible successors

Rob Goldstein

Chief Operating Officer

A BlackRock lifer, Goldstein, 50, joined the money manager right out of college in 1994 and has been a succession candidate for more than a decade. Dubbed “Goldie”, he is known for steadiness and operational focus. He helped build the Aladdin technology business, oversaw the firm’s move to Hudson Yards and led the growth of seven regional tech hubs. Sometimes typecast as a techie, he has won praise for his ability to cultivate large clients.

Rachel Lord

Head of International

Based in London, Lord, 58, is the daughter of a cargo ship captain and a teacher and was the first in her family to go university. She spent her early career in trading at Citi and Morgan Stanley, where she developed an outspoken style involving lots of colourful language. Lord joined BlackRock in 2013 to expand index and ETFs outside the US. She is a top talent spotter and dealmaker. Since January, she has led BlackRock’s efforts to grow outside its American base.

Top managers are encouraged to make suggestions about each others’ domains, and responsibility for important projects is often shared. Goldstein and Lord are co-heads of the India joint venture, and Goldstein and Small teamed up to run multiyear planning sessions last year.

“People who want to be part of a team, that’s the secret of our success,” says one insider. “It’s about listening and challenging . . . If you didn’t like it, you left.”

That makes sense to veterans of the firm like Schlosstein, who was BlackRock’s president for 20 years and remains in close touch with Fink and other top executives.

Raj Rao

President of Global Infrastructure Partners

Rao, 53, is the lone investor among the leadership cadre. Born in India where he studied engineering, he moved to London, got a graduate degree and landed at Barclays. After working at Credit Suisse as an energy banker, in 2006 he became the youngest of GIP’s founding partners. Rao helped to pioneer GIP’s first successful deal for London City Airport. Calm and measured, he was named GIP president in 2022, and led the deal talks from the GIP side.

Martin Small

Chief Financial Officer

After starting his career as a lawyer at Davis Polk, Small, 49, has risen through BlackRock’s financial markets advisory consulting arm and its iShares ETF unit and presided over record revenue growth in the wealth advisory businesses. He became CFO last year. Whip-smart with fervent enthusiasm, he negotiated the GIP acquisition and leads the integration efforts. He is trying to link strategy more closely to annual budgets and recently did his first tour of European investors.

“BlackRock should not be GE [General Electric], where one person gets the job and two or three others leave,” he says. “It’s incumbent on those who believe they are being considered to make sure that the solution creates an opportunity [and] a career path for those who may not be selected as CEO.”

But some investors, analysts and insiders are less enthusiastic about Fink’s insistence on grouping the potential succession candidates as an undifferentiated team below him and Kapito, who has served as president since 2007. They point to departures several rungs below the top candidates as a signal that promotion ladders are clogging up and worry that BlackRock could lose talented individuals it wants to keep.

“BlackRock is blocked up, constipated,” says a second insider.

In the past 18 months, at least three BlackRock executives have left to head other asset management businesses: Daniel Gamba to Northern Trust, Zach Buchwald to Russell Investments and, most recently, Ramji to Vanguard.

Top leaders at BlackRock have said they have no concerns about the departures because the firm still has a deep bench of executives. They also point to the January reorganisation and a series of follow-on changes that involve the creation of new roles and big promotions for up and coming talent.

“BlackRock is proud to have a record of our firm’s alumni going on to lead multiple investment management companies and financial institutions,” the firm has said.

Many expect the next step in the succession process to involve a change of roles for Kapito and the elevation of one or more candidates to a number two role. Kapito is widely credited as the leader who calls or visits when staff and their families are in crisis. But some younger employees said they cringed when he described Nigerian-born Ogunlesi’s name as “unpronounceable” at the January town hall introducing the GIP transaction.

Like Fink, Kapito shows no obvious signs of wanting to retire. “Whenever there are founders involved, they always seem to take longer than you expect” to name successors, says Kyle Saunders, an Edward Jones analyst who has been following BlackRock and other asset managers for about a decade. “They paid a lot for [GIP and Preqin]. How long is it going to take to pay off? This is going to extend beyond Larry.”

Mark Wiedman

Head of the Global Client Business

A lawyer by training, Wiedman, 53, joined BlackRock in 2004 after stints at the US Treasury and McKinsey. He co-founded BlackRock’s financial markets advisory consulting arm and led the 2009 purchase and integration of Barclays Global Investors, BlackRock’s most important deal. Wiedman has also led strategy and recruited and promoted a clutch of future top BlackRock executives. Quick-witted to the point of being brash, he builds and nurtures relationships and since 2023 has held the top client role.

Shareholders said they expected the handover process to be measured, with Fink likely to stick around as executive chair for a significant period of time. Some worry that if Fink leaves it too long, he will have less time to adjust if the plan does not work out.

In private conversations, they draw direct parallels to JPMorgan Chase, where half a dozen potential successors to chief executive Jamie Dimon left to head other financial firms. Now aged 68, Dimon repeatedly rebuilt JPMorgan’s stock of top executives. He recently told investors he would step down in less than five years, while in January his longtime number two, Daniel Pinto, relinquished one of his roles to two of the leading succession candidates.

Investors and analysts also point to the varying fortunes of the big private equity firms as their founders turned over the reins. KKR, Blackstone and Carlyle were all founded in the decade before BlackRock by men with outsized personalities and reputations.

KKR’s leaders successfully handed off to co-chief executives Joe Bae and Scott Nuttall in 2021. Blackstone’s transition is in process: Steve Schwarzman remains CEO even as president Jon Gray has taken an increasingly visible role. But Carlyle’s first transition attempt fell apart in 2022, when founders David Rubenstein, Bill Conway and Daniel D’Aniello took back control of their firm from Kewsong Lee.

BlackRock leaders argue that the firm has taken visible steps to prepare for the future and has been sharing information with shareholders and clients as appropriate.

At last year’s investor day, BlackRock paraded 14 executives across the stage in four hours, including the four current executives now considered top succession candidates. Fink boasted that “everyone here is an extremely talented individual. But we’re much better as a team . . . I’m not planning to leave BlackRock anytime soon, but BlackRock’s board and I have no higher priority than developing the next generation of leaders for BlackRock and hopefully you’re seeing that.”

BlackRock’s board also approved substantial new stock option awards for what was described in the group’s 2024 proxy filing as “a select group of senior leaders who we believed would play critical roles in BlackRock’s future”. Wiedman and Goldstein each received $8mn and Small received $6.5mn. The options vest gradually over six years, and unvested shares are forfeit if the participant leaves.

Fink said they would promote “a continued, collaborative, long-term performance culture” but investors have been less than thrilled. Proxy advisers ISS and Glass Lewis recommended shareholders vote against the awards because pay was higher than at peers and not tied closely enough to performance. More than 41 per cent of the votes cast were negative, up from 8 per cent last year.

At the event where Fink was asked about retirement, he acknowledged that his juggling act could not continue indefinitely. “I love what I do, but as a founder of my company, I am passionate about having the next generation running it,” he said.

“I don’t want to be somebody sitting there and just blocking and tackling,” he added, deploying an American football metaphor. “I don’t want to be a blocker.”