Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

A revival in dealmaking has boosted the coffers of the UK’s “magic circle” law firms with combined profits at three of the largest elite groups reaching £2.8bn last year.

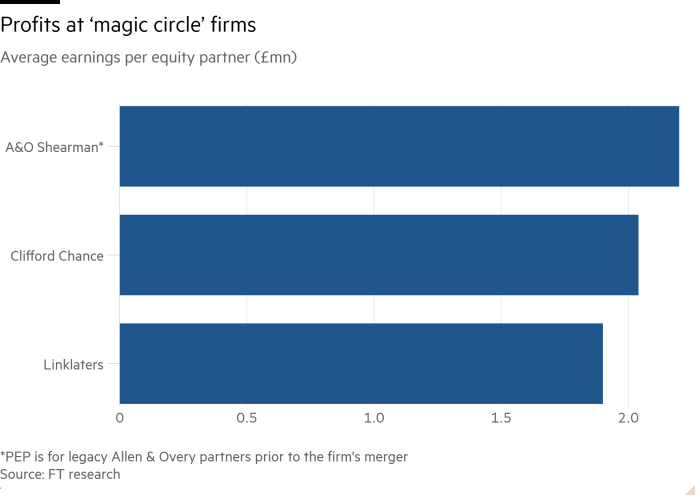

A pick-up in M&A this year and the fruits of heavy investment in US expansion enabled equity partners at Clifford Chance, Linklaters and Allen & Overy to pocket about £2mn on average.

After entering the financial year with a dearth of corporate work, a rebound in deals, along with a number of litigation and restructuring mandates, helped each firm notch up double-digit increases in profits, resulting in a bumper pool for the partners who share in them. Combined, the three firms’ profits rose by 12 per cent year on year, from £2.5bn.

“Large law firms have performed strongly over the past year, achieving average growth of around 8 per cent,” said Jeremy Black, a partner at Deloitte. “While the initial public offering [IPO] markets have been quiet, law firms have shown their resilience with litigation, restructuring, and transaction activity in certain sectors.”

Work on the failed £39bn merger of miners Anglo American and BHP, and Barratt’s £2.5bn deal with Redrow helped Linklaters post record annual pre-tax profits of £942mn.

Meanwhile Clifford Chance and Allen & Overy, now A&O Shearman following its transatlantic tie-up in May, were boosted by mandates including roles on the £2.9bn takeover of Virgin Money by Nationwide. Profits at Allen & Overy and Clifford Chance hit £1bn and £856mn respectively.

High-profile litigation work also helped Clifford Chance ride out a slower period for deals last year, including its successful defence of former Autonomy chief executive Mike Lynch, which culminated in his 12-week trial in San Francisco.

The magic circle’s earnings are a sharp improvement on the previous 12 months, when profits stalled at the group of international law firms amid the dealmaking slump and high spending on lawyer salaries to fend off competition from US rivals.

An improvement in the economic outlook this year and a rebound in capital markets activity has stoked a renewed war for legal talent in the City, with all three firms, along with “magic circle” peer Freshfields Bruckhaus Deringer, raising pay for newly qualified lawyers to £150,000 this year.

UK-founded law firms have been fighting to retain market share in London as a group of top US law firms such as Paul, Weiss, Rifkind, Wharton & Garrison have invested heavily in the UK capital over the past few years, forcing the incumbents to increase pay at both the junior and senior ends.

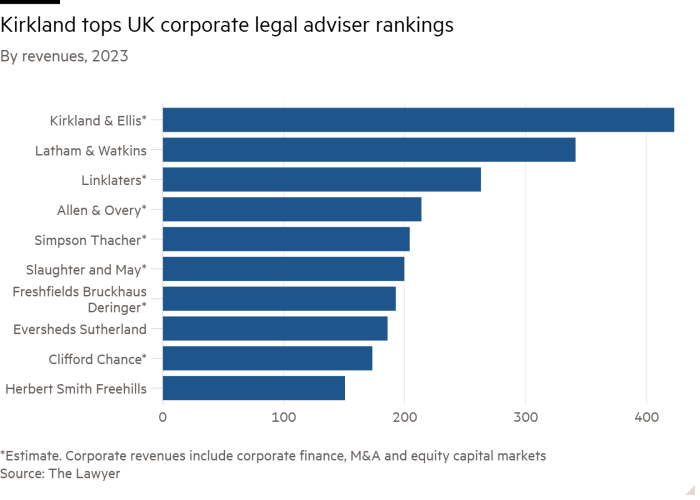

While much of the growth has been driven by US firms looking to capitalise on their American private equity clients investing in Europe, a number of firms, such as Los Angeles-founded Latham & Watkins, have been expanding into more traditional corporate work historically dominated by the “magic circle”

Rankings released by trade magazine The Lawyer this week place Kirkland & Ellis and Latham & Watkins in the two top slots for revenues from UK corporate work, which includes private equity, ahead of the group of elite UK-founded firms.

“As the American firms continue to invest in London it will add pressure on the magic circle revenue as they compete for market share,” said Chris Clark, a director at London-based legal recruiter Definitum Search.

However, the magic circle has been mounting a fightback, including by expanding across the Atlantic. Clifford Chance and Linklaters both posted record revenue growth from their US offices in the year to the end of April, with a 28 per cent and 24 per cent increase respectively.

Revenues in Clifford Chance’s US arm, which added a Houston office last year, reached $418mn, with the firm adding 19 partners stateside in its financial year.

In an interview with the Financial Times this week, global managing partner Charles Adams said the firm would invest further in America in areas like commercial litigation, while Linklaters has also been growing its footprint, hiring veteran dealmaker George Casey from legacy Shearman & Sterling earlier this year.

Allen & Overy sealed its $3.5bn transatlantic merger with New York’s Shearman & Sterling after the end of its financial year. However, legacy Allen & Overy partners benefited from the sale of a legal technology unit to private equity that valued the business at £200mn, boosting its profits.

Other UK-founded firms outside of the magic circle have also had a good year. Herbert Smith Freehills saw profit per equity partner increase 12 per cent to £1.3mn, while Macfarlanes equity partners took home £2.6mn on average, an increase of nearly 24 per cent.

Freshfields, which has recently made major inroads into the US market, said last year that it would no longer release its financial results in the summer. Global managing partner Rick van Aerssen stated at the time that the firm’s progress should “be based on the quality of business we’ve built and the client mandates we’re winning around the globe”. The firm’s audited results will be published on Companies House early next year.

Slaughter and May, which has a much more domestic footprint than its magic circle peers, is not compelled to file financial results with Companies House as it is not structured as a limited liability partnership.

As listings look poised to pick up in London, the group of elite law firms stand to benefit, according to Deloitte’s Black.

“Increases in IPO activity suggest significant opportunities for firms, however the geopolitical uncertainty and increases in fee earner costs clearly present risks,” he said. “It may be that firms are able to achieve performance improvements ahead of those achieved in the overall economy.”