Airlines are bracing for the end of the “revenge travel” boom, cutting ticket prices to fill surplus seat capacity as a two-year post-pandemic surge gives way to a more uncertain outlook.

Carriers from Ryanair to Emirates reported record profits last year, with strong passenger demand and high ticket prices helping offset higher costs for fuel, labour and aircraft.

But Ryanair sent shockwaves through European aviation on Monday when it warned that air fares would be “materially lower” in the summer months, following a 15 per cent year-on-year fall in the spring.

Chief executive Michael O’Leary said Europe’s largest airline by passenger numbers was contending with weaker-than-expected consumer spending, and that recent efforts to raise prices had been “meeting resistance” from passengers.

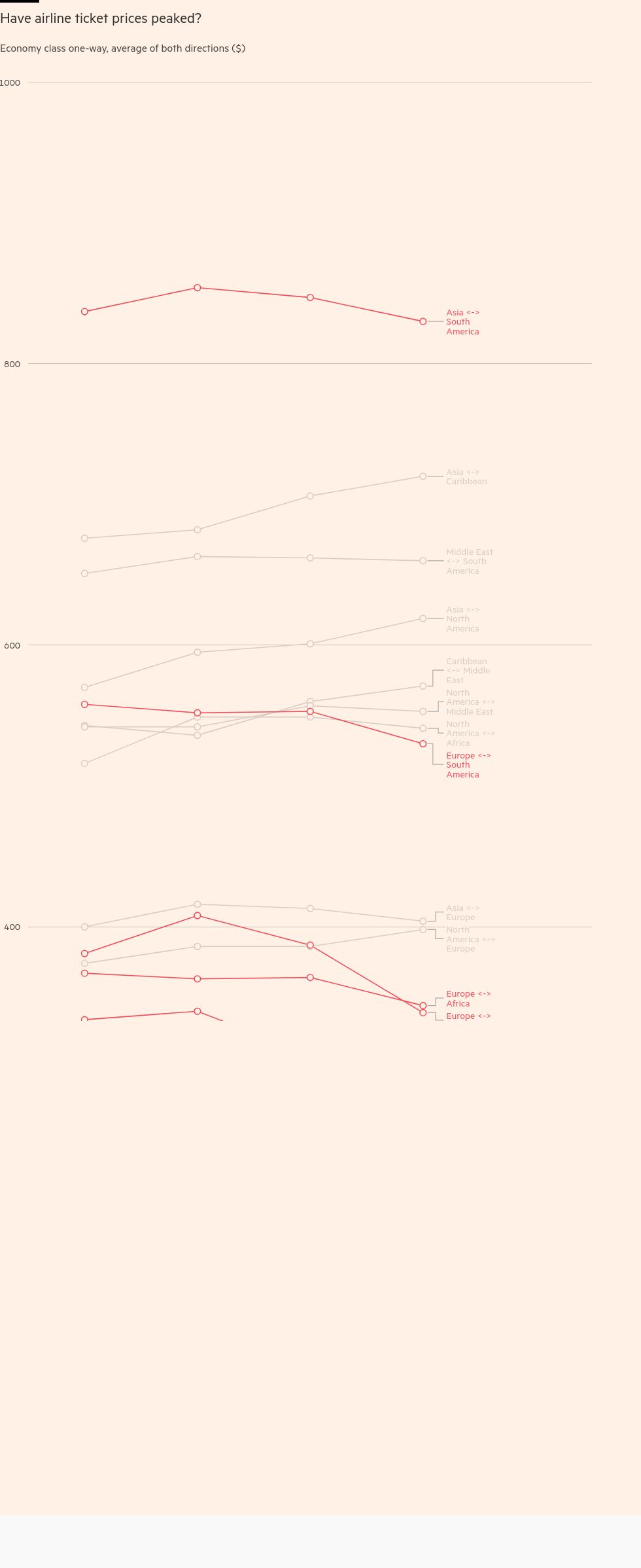

Many carriers have been forced to drop ticket prices to fill their aircraft in recent months, in a sharp turnaround from a period of high fare rises following the end of pandemic lockdowns, when passengers were desperate to travel and the industry suffered from a shortage of aircraft.

“Customers are going back to basics,” Güliz Öztürk, chief executive of Turkish airline Pegasus, said at the Farnborough Air Show this week, adding that the industry should prepare for a period of “normalisation” as the post-pandemic phenomenon of “revenge travel” unwound.

Air India chief executive Campbell Wilson agreed that demand patterns were “always going to normalise” following the “egregious imbalance between supply and demand post-Covid”.

Stronger results on Wednesday from Europe’s second-biggest airline easyJet, which reported a sharp rise in profits and said ticket prices would be stable this summer, show the gloom is not consistent across the sector.

But such is Ryanair’s dominance of the European market — it operates roughly double the number of flights of easyJet — that analysts warned heavy discounting by the Irish carrier would probably force others in the short-haul market to follow suit.

EasyJet’s performance raised “more questions than it answers: a gap of this magnitude between Europe’s two largest point-to-point airlines is unusual,” analysts at Bernstein said.

Ryanair’s warning came after Lufthansa said it would struggle to break even this year amid pressure on yields, a measure of average ticket prices that takes passenger numbers and distance flown into account.

North American airlines have also been reducing prices to fill their planes after laying on too many seats in the domestic market this summer.

Air Canada on Tuesday cut its profit guidance, citing a “lower yield environment”. US budget carrier Spirit Airlines warned in May that “significant pressure” on yields would continue into the third quarter after a surge in capacity in the US domestic market.

Larger carriers are affected too, although executives say the oversupply of seats will ease by the end of August.

Andrew Nocella, chief commercial officer of United Airlines, told investors last week that while demand was strong, “capacity growth was just so significant that it pressured yield”.

Ryanair’s results sparked a sell-off in European airline shares as the world’s largest air show began in Farnborough near London on Monday, although a partial recovery followed easyJet’s earnings on Wednesday.

Many airline bosses at Farnborough were confident of absorbing any hit to fares, and said the wobbles in demand had not been broad-based.

Virgin Atlantic chief executive Shai Weiss said demand on the carrier’s routes across the Atlantic remained strong, particularly in premium cabins and from US customers.

However, he added: “I do see a bit of weakness in the third quarter, in consumers out of the United Kingdom. It is no surprise to any of us living in this country: cost of living, uncertainty, change of government and so forth.”

Luis Gallego, chief executive of British Airways owner IAG, said that even where there had been softness in yields on highly competitive routes, such as those between European destinations, they were still above pre-pandemic levels.

Cracks have largely come in the short-haul market in Europe and the US, and in economy class, with longer trips and more expensive flights in business or first-class less affected. Airlines remain confident that demand for travel is still strong enough to keep air fares well above 2019 levels and sustain earnings.

Christian Scherer, chief executive of the commercial aircraft division at Airbus, the world’s largest planemaker, acknowledged that the company had seen “some signs of declining yields” but stressed that it was “too early to say whether this is a slowdown, whether it’s anecdotal or structural”.

“In the US, we have seen the early signs,” he added, but noted that the company’s customers, which include easyJet and Wizz Air, “wish they could have aeroplanes quicker”.

One executive pointed to the recent cooling in UK inflation and wage growth as signs the industry was reflecting a broader economic picture, as the era of high inflation draws to a close.

The travel boom of the past two years has led airlines to race into ordering aircraft, leading to a record backlog of new planes, raising concerns these could flood the market just as demand for travel wanes.

Tufan Erginbilgiç, chief executive at aerospace and defence company Rolls-Royce, played down concerns that manufacturers would be increasing output just as airline yields were starting to fall, predicting that supply chain problems would last for at least another two years.

The industry’s fundamentals were positive, he said, with strong passenger growth expected, while the airline industry remained “highly competitive” and “every airline will be in a different place”.

“I am not awake at night [worrying] about growth in this industry.”

Additional reporting by Patrick Mathurin