One deal scoop to start: UK events group Informa is in advanced talks to acquire listed rival Ascential, which owns global conferences including advertising festival Cannes Lions, for more than £1.1bn.

And shareholders turn up the heat: Reckitt is under pressure from top shareholders to revisit a sale of its nutrition business, following litigation and other setbacks at the division that have sent the company’s share price to decade lows.

Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance. This article is an on-site version of the newsletter. Premium subscribers can sign up here to get the newsletter delivered every Tuesday to Friday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters. Get in touch with us anytime: [email protected]

In today’s newsletter:

-

Tracking down private equity’s debt

-

How the Wiz-Google talks blew up

-

GIC hunts for western groups’ China units

Who’s on the hook in private equity’s web of debt?

It’s well known that private equity is fuelled by debt.

But how far does that debt reach, and what risks does the sector pose to the broader economy if there’s a shock to the system?

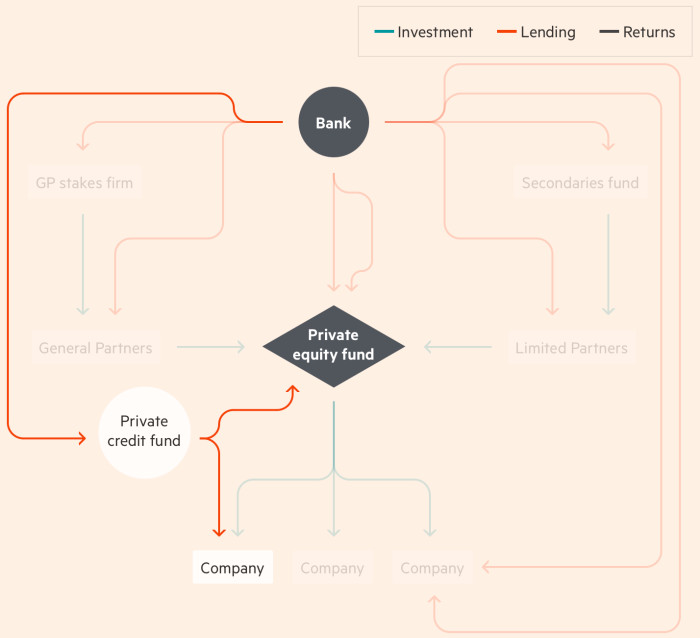

A team of FT journalists — including DD’s Ortenca Aliaj and Kaye Wiggins — set out to answer that. They mapped out (with an elaborate accompanying visual) who’s on the hook for private equity’s leverage and how banks could be left exposed when portfolio companies unravel.

Today, private equity giants — such as Apollo Global Management, Blackstone and the Carlyle Group — control about $8tn in assets. That’s quadruple what these firms oversaw in 2012.

The team laid out not only how these funds raise money, but the various financial levers they pull to get access to more capital and eke out cash for investors.

While it’s well-known how these funds use debt to finance the age-old playbook for leveraged buyouts, that’s only the beginning of the story.

Net asset value loans, subscription lines, dividend recapitalisations and secondary funds are all part of the equation. And in recent years, these tactics have become a bigger part of how private equity firms operate.

The resulting heap of leverage has raised concerns for regulators. The Bank of England’s Nathanaël Benjamin said in April that there were “natural questions about the risks of these financing arrangements, and the growth in kinds and quantity of leverage, or ‘leverage on leverage’, throughout the ecosystem”.

Read the full story to understand how private equity’s tentacles — reaching from traditional banks to private credit funds and back again — make it so that any stress could ripple across the broader financial system.

Wiz dodges antitrust purgatory, says ‘LFG’

Twice, venture capitalists Sequoia Capital and Index Ventures have lined up for billion dollar-plus paydays after nascent start-ups proved attractive acquisition targets to technology giants Adobe and Google.

And now, twice, their dreams of big payouts have been dashed over antitrust fears.

Design start-up Figma’s proposed $20bn sale to software design company Adobe fell through late last year after a year in regulatory limbo.

In the case of Wiz — a fast-growing cyber security start-up that looked like a way for Google to better compete with cloud computing rivals Microsoft and Amazon — regulatory concerns came a bit sooner.

Members of both Google’s parent company Alphabet and Wiz boards of directors harboured concerns over a lengthy antitrust review, DD’s Maria Heeter, James Fontanella-Khan and George Hammond, and the FT’s Stephen Morris reported.

When the potential deal was made public — the fear of advisers angling for a mega deal-sized fee — both board factions stepped up their opposition and ultimately scuttled the deal, people familiar told the FT.

While Wiz employees and investors are losing out on a big payday, the cyber security start-up will avoid a regulatory waiting room that’s hurt others like it.

Take the case of Figma. After abandoning its proposed deal with Adobe, the company halved its internal valuation to about $10bn and grappled with deflated employees who had been counting on cashing out.

Or the case of animated images platform Giphy. As the UK antitrust authority probed Meta’s purchase of the GIF search engine — think, cat reactions and other memes — Giphy staffers were reportedly forbidden to speak with anyone from their new parent company.

(Meta later sold the company for just $53mn, a fraction of its $400mn price tag.)

So, while early Wiz employees will have to delay their yacht purchases, they may be better off by avoiding antitrust purgatory.

When breaking the news that the company is back on IPO-track, founder Assaf Rappaport used a phrase that means “let’s freakin’ go”, or sometimes a more expletive-loaded version of that.

He told employees: “As we always say: LFG.”

Singapore’s Gin & Tonic

At least one banker in Singapore jokingly uses booze-themed codenames for the city-state’s giant state-owned investment groups, GIC and Temasek: Gin & Tonic.

Two weeks ago we wrote about Temasek, which made big and lucrative bets on the rise of China and private markets over the past two decades. (It may be feeling something like a hangover as those bets become trickier.)

On Wednesday, Singapore’s other state-owned investment group GIC, published its own numbers. It, too, has made bets in those areas.

How do they compare? Well, they don’t — literally, DD’s Kaye Wiggins reports.

Temasek disclosed that the value of its portfolio rose just 2 per cent in the year to March, at a time when the S&P 500 index rose 28 per cent. GIC doesn’t publish annual returns at all.

That would be “too short-term in relation to [its] 20-year investment horizon”, it says.

Instead, it publishes average annual returns over a five, 10 and 20-year period. In each of those timeframes, it underperformed a “reference portfolio” that it compares itself to, of which 65 per cent is global equities and 35 per cent is global bonds, it said on Wednesday.

After adjusting for inflation, GIC has made an average return of 3.9 per cent per year over the past two decades, its preferred time horizon.

It’s not clear what contribution private equity — 18 per cent of GIC’s assets as of March — made to its performance. But it is clear that, after declaring a year ago that the golden era for private equity was over, it’s not walking away.

GIC on Wednesday said it had become “one of the largest players” in the market for private equity secondaries, which includes buying stakes in private equity funds from pension funds and other investors so that they can free up cash they had previously agreed to lock away for a decade.

GIC is also looking to partner with buyout groups on what is potentially a more politically-fraught endeavour: buying the China units of multinational companies that want to exit or reduce their exposure to the country as Sino-US tensions rise.

DD would be keen to know who picks up their calls after reading this piece.

Job moves

-

Julius Baer has hired Stefan Bollinger as chief executive, a role that’s been unfilled since Philipp Rickenbacher left in February. Bollinger was most recently a banker at Goldman Sachs.

-

Persimmon has appointed Paula Bell as an independent non-executive director, who’s currently the chief financial and operations officer of Spirent Communications.

-

Moderna has named Carlyle Group co-founder David Rubenstein to the company’s board of directors.

-

Elliott Investment Management portfolio manager Pawel Serej has left the firm after working there since 2016. He previously worked for Mid Europa Partners and JPMorgan.

Smart reads

Musk operator Yorkshire-born former music photographer Nick Pickles has risen to become one of the most prominent executives at Elon Musk’s X — and in effect chief executive Linda Yaccarino’s right-hand man, the FT reports.

Fee boost With regulators thwarting big deals, investment bankers are pushing to preserve their fees even when a transaction doesn’t get through, Reuters writes.

Tourist backlash In Spain, a wave of tourists is spurring backlash from locals. Policymakers are caught trying to strike a delicate balance without scaring them off entirely, the FT reveals.

News round-up

Tesla misses profit estimates as Elon Musk delays ‘robotaxi’ launch (FT)

Transparency rules for US private funds lapse after SEC allows deadline to pass (FT)

FCA takes push for $700mn BlueCrest Capital redress plan to Court of Appeal (FT)

Meta warns EU regulatory efforts risk bloc missing out on AI advances (FT)

KKR agrees to buy broker dealer Janney Montgomery Scott (FT)

KKR in talks to buy a stake of up to 25% in Eni’s biofuel business (FT)

Rolls-Royce boss warns of prolonged supply chain strains (FT)

Billionaire founder of Kakao arrested in K-pop stock manipulation case (FT)

Due Diligence is written by Arash Massoudi, Ivan Levingston, Ortenca Aliaj, and Robert Smith in London, James Fontanella-Khan, Sujeet Indap, Eric Platt, Antoine Gara, Amelia Pollard and Maria Heeter in New York, Kaye Wiggins in Hong Kong, George Hammond and Tabby Kinder in San Francisco, and Javier Espinoza in Brussels. Please send feedback to [email protected]

Recommended newsletters for you

Full Disclosure — Keeping you up to date with the biggest international legal news, from the courts to law enforcement and the business of law. Sign up here

Unhedged — Robert Armstrong dissects the most important market trends and discusses how Wall Street’s best minds respond to them. Sign up here