Singapore’s GIC, one of the world’s biggest institutional investors, has said it will seek to buy stakes in multinational companies’ China units if they exit the country amid slowing growth and rising geopolitical tensions.

The sovereign wealth fund, which has estimated assets of more than $700bn, outlined the strategy as one way it would continue to invest in China, in its annual results presentation on Wednesday.

“There are companies that are rethinking, or have rethought, their focus and exposure in China . . . and are looking to de-risk, or sell down entirely, their businesses,” said Jeffrey Jaensubhakij, GIC chief investment officer, in an interview with the Financial Times ahead of the results.

“If the right asset comes at the right price, because someone has made a change in strategic direction, then it’s an opportunity,” he explained, adding that GIC would look at buying into such units as a co-investor, alongside private equity firms.

GIC has been an important backer of China’s economic boom over the past two decades — investing in real estate, and in Ant Group, whose planned initial public offering was halted by regulators in 2020. Last year, however, the FT reported that GIC had put the brakes on private investments in China as it rethought its strategy.

Jaensubhakij declined to name specific deals but said that “if we were looking at technology growth as the main area to deploy capital [in China] in the past, clearly we are looking at other interesting opportunities 1721774576”. He added: “Over the last two or three years, when foreign investors have decided to exit China . . . you can get decent valuations.”

Western companies have been working on plans to separate or reduce their exposure to Chinese operations in recent years, with options including partial divestments and splitting off units. For example, in June 2023, the FT reported that AstraZeneca had drawn up plans to break out its China business.

Jaensubhakij said GIC, in addition to buying stakes from multinational companies, would look to invest in domestic consumer businesses and the green economy in China.

A presentation by the sovereign wealth fund said China’s “past growth model” had ended, but the country’s “long-term fundamentals remain attractive”. It cited a large population, “deep engineering talent pool”, and “innovative entrepreneurs” — although it acknowledged geopolitical risks would be difficult to resolve.

GIC’s comments come weeks after Temasek, Singapore’s other state-owned investor, said it would be “cautious” about China after poor performance in the country hit its returns.

GIC publishes relatively little detail about its investment performance and, unlike Temasek, does not reveal its returns over the past year. It argues that doing so would be “too short-term, in relation to [its] 20-year investment horizon”.

However, its results on Wednesday showed that over five, 10 and 20 years its average annual returns had underperformed a “reference portfolio” to which it compares itself, of which 65 per cent is global equities and 35 per cent is global bonds.

Without adjusting for inflation, GIC made an average return of 4.4 per cent a year over the five years to the end of March, below the 7 per cent figure over the same period from the reference portfolio — although the latter does not include costs and fees.

After adjusting for inflation, GIC made an average return of 3.9 per cent a year over the past two decades — its preferred time horizon — down from 4.6 per cent a year ago.

“The profound uncertainty we face is likely to continue to weigh on returns,” said GIC chief executive Lim Chow Kiat in the report.

GIC said the decline in performance was partly because last year’s 20-year number included returns from an “exceptional” period in 2003-2004, which are no longer included in the calculation. But the group added that it was also partly due to a “conservative strategy in recent years”, and weak returns from emerging market equities.

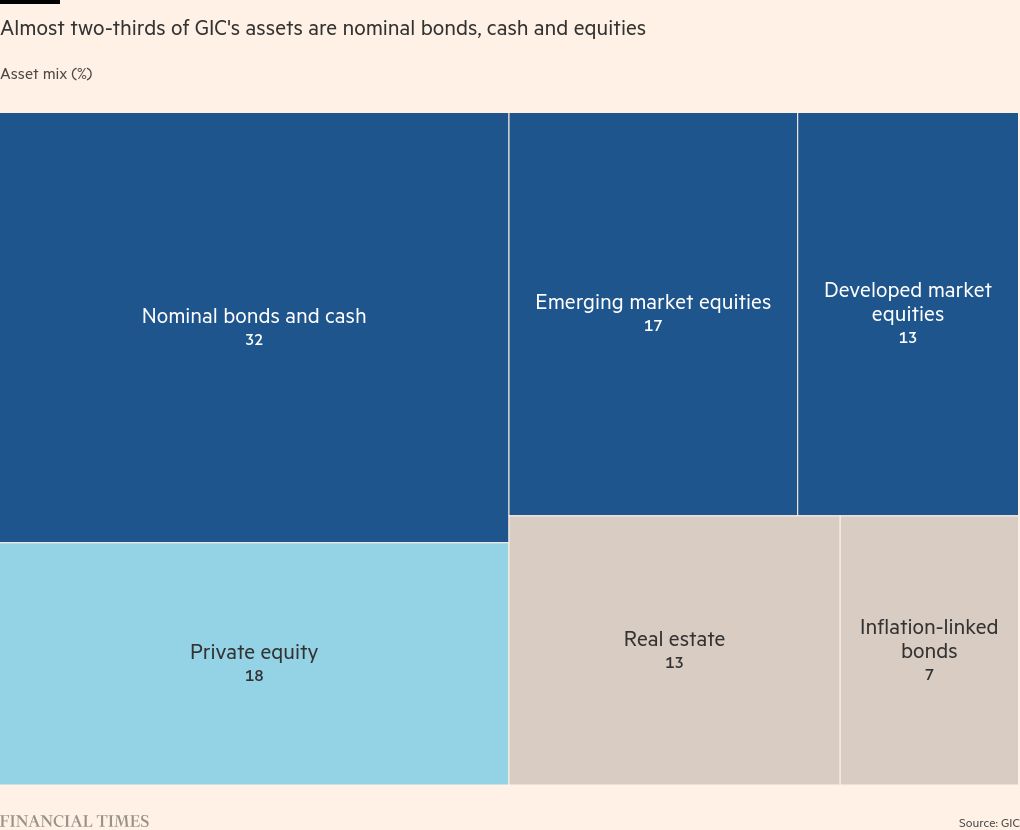

GIC stressed that its portfolio, of which 18 per cent is in private equity and 13 per cent in real estate, was less volatile than the reference portfolio of stocks and bonds.

Last year, the Singapore investor — which is frequently one of the first names that buyout groups turn to when seeking to raise funds or find co-investors in deals — warned that the golden age for private equity had “come to an end”. Nevertheless, it reported that it exposure to the industry rose by one percentage point, to 18 per cent, in the year to March 31.

GIC said it had become “one of the largest players” in the market for private equity secondaries: stakes in private equity funds bought from pension funds and from other investors needing to free up cash they had previously agreed to lock away for a decade. Last year, GIC bought stakes in more than 50 private equity funds, which in turn owned stakes in more than 500 companies, it said.

Jaensubhakij said that if “you find a willing seller who needs the liquidity [and] is willing to take a little bit of a discount . . . you can step up your private equity allocation into secondaries, at a discount that allows you to earn slightly higher returns than you would have in the past”.

GIC also said it has started using generative AI tools to produce the first drafts of investment reports, as well as to help with its internal audit work and to answer due diligence questions about its private equity investments. It has a chatbot called ChatGIC, with a similar interface to ChatGPT, but used only for processing information “within a ‘walled garden’“.

GIC — which is owned by Singapore’s government and chaired by Lee Hsien Loong, who stepped down as the city-state’s prime minister in May after 20 years — manages the country’s foreign reserves.