Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Bollinger is James Bond’s favourite tipple when Martini is off the menu. Swiss wealth manager Julius Baer has been doing some shaking and stirring of its own following a calamitous year that prompted the exit of its chief executive and other senior managers.

On Tuesday, it appointed Stefan Bollinger to the top job. The former Goldman Sachs banker and the first outsider to run the Swiss bank in decades signals change is coming. Consolidation in the Swiss sector is needed but the new boss may struggle to strike deals until its valuation improves.

Julius Baer’s problems began with the collapse of peer Credit Suisse and its subsequent takeover by UBS. Such local trouble should have been a chance to win overlapping client funds. But those gains never materialised. Instead, the implosion of Rene Benko’s Signa property group thanks to real estate losses meant heavy write-offs for Julius Baer. That put an end to tie-up talks with local rival EFG in May and any hopes of a transformational deal that many expected.

Together the two would create a pure play wealth manager with almost SFr600bn ($660bn) of assets under management. Given the presence of a beefed-up UBS, now with some SFr4tn of wealth AUM, that extra scale is needed.

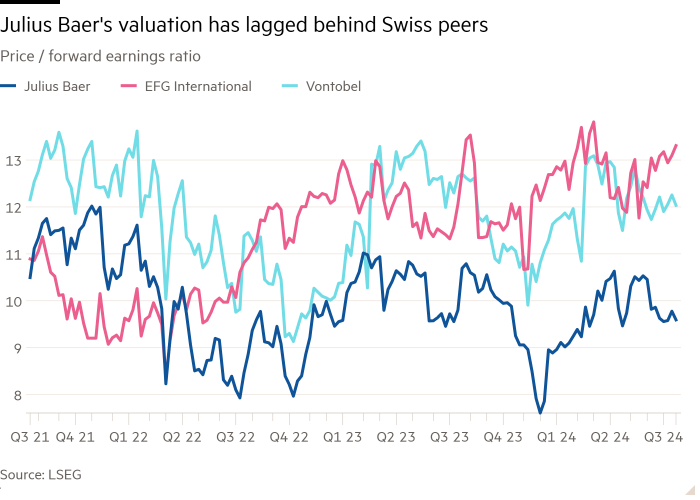

With Julius Baer shares in the doldrums, down almost a tenth over the past year, the deal looks hard to justify financially. Trading at a 25 per cent discount to EFG and a 20 per cent discount to smaller peer Vontobel, if Julius Baer paid half in shares today for either a deal would mean only a low single-digit percentage boost to earnings per share for 2025. Analysts take an even more bearish view, arguing that expected loss of clients would mean earnings benefit wouldn’t arrive until 2028, thinks Citi. Then there are the usual risks of putting two relationship businesses together.

With Bollinger not due to start until next year, keeping a big — and potentially value destructive — deal on the sidelines may be a positive. Julius Baer can instead continue to grow organically, adding new advisers or with smaller bolt-on deals.

How well the bank’s new additions are performing will give a taste of what is to come. Visible Alpha consensus expects net new money to have grown less than 2 per cent in the first half of this year. That seems overly pessimistic given that 100 new wealth managers were added to Julius Baer’s total last year. With stock markets at record highs, that could yet mean a pop for the shares before Bollinger turns up.