Welcome to FT Asset Management, our weekly newsletter on the movers and shakers behind a multitrillion-dollar global industry. This article is an on-site version of the newsletter. Subscribers can sign up here to get it delivered every Monday. Explore all of our newsletters here.

Does the format, content and tone work for you? Let me know: [email protected]

In today’s newsletter:

-

Investors revive ‘Trump trade’ in bet on US bonds

-

Livin’ la dolce vita in Milan

-

Traders pour billions of dollars into Turkish lira trade

Hedge funds position for Trump’s return

The US increasingly seems like it’s heading towards a second Donald Trump presidency, and hedge funds are positioning to profit from his return, writes Costas Mourselas in London.

Joe Biden’s disastrous debate performance last month has led to growing calls from senior Democrats that he step aside and allow another candidate to run on the Democratic party ticket.

With the Democratic party in disarray and Trump ascendant, hedge funds are betting that his return will lead to higher inflation as he cuts taxes and takes on China in a new trade war.

This would generate profits for hedge funds’ so-called “steepener” trades, which benefit when the gap in yield between short and long-dated Treasury bonds increases. This is because long-dated bonds like the US 10-year are highly sensitive to increases in inflation, with their yields increasing with inflation.

“People are getting more excited about Trump and a red sweep and those odds have clearly gone up, with the assassination attempt jump-starting that a bit further,” said a US macro hedge fund executive who has put on the trade.

A key second component of the trade are expectations that the US Federal Reserve will soon cut rates to boost the economy, which would decrease short-term yields and generate profits for hedge funds.

Investors are also considering further allocations to cryptocurrencies, as Trump and his new running mate JD Vance are perceived to be more pro-crypto than the Biden administration.

At the Republican national convention in Milwaukee, Trump said he would “ensure that the future of crypto and the future of Bitcoin will be made in the USA”.

The growing likelihood of Trump’s return has had an impact on other markets.

Chip stocks such as Nvidia, AMD and AMSL fell last week after he said that Taiwan should pay for its own defence and the US was reported to be considering tougher restrictions on trading chips with China. Taiwan is the world’s leading manufacturer of the world’s most advanced semiconductors.

La dolce vita: wealthy influx gives Milan ‘a bit of a moment’

As Milan’s world-renowned Salone del Mobile furniture fair kicked off in April, the founders of the high-end lifestyle magazine Cabana threw a party to open their first shop and celebrate the publication’s 10-year anniversary.

“Our main markets are the UK and the US and we were originally planning to open our first store in London or New York,” said co-founder Martina Mondadori. Choosing Milan “would never have happened five or six years ago but suddenly on our doorstep there’s a completely different footfall”.

Mondadori, the fourth generation of a publishing family, left London and moved back to Milan in 2020 for family reasons, one of a number of Italians to have returned in recent years. They are increasingly being joined by wealthy foreigners, many fleeing the prospect of higher taxes in the UK and France.

In this article, Silvia Sciorilli Borrelli and I explore how the influx is bringing a newfound energy — and strains — to a city that has historically been perceived as parochial and ill-equipped to receive foreigners.

“The Milan I’m living in now is a completely different place to the Milan I grew up in,” said Mondadori. “It’s suddenly very dynamic and interesting.”

Milan’s momentum partly has its roots in the svuota Londra (“empty London”) offer announced post-Brexit by then prime minister Matteo Renzi’s centre-left administration. A new foreign resident — or an Italian who has lived abroad for at least nine years — can pay a flat tax of €100,000 a year on any foreign income and assets for up to 15 years, and be fully exempt from inheritance tax on foreign assets during that period.

The flat tax has attracted the likes of Cristiano Ronaldo, as well as private equity executives, oligarchs and entrepreneurs. It’s gaining further traction as the UK abolishes its 225-year-old non-dom regime and explores a fiscal crackdown on the private equity industry.

“Milan is having a bit of a moment right now,” says David Giampaolo, founder of Pi Capital, a London-based investor club. “I know of 10 non-dom families who are reluctantly leaving London — eight are moving to Milan, one to Switzerland and one to the UAE.”

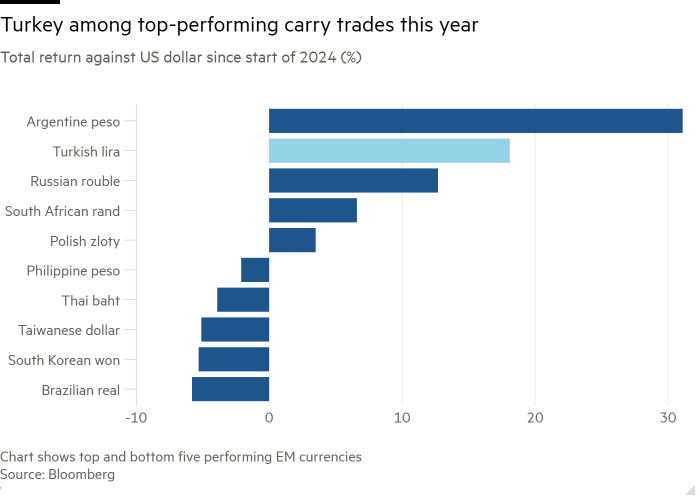

Chart of the week

Hedge funds and other traders have pumped billions of dollars into the Turkish lira in recent months as they chase juicy returns, write Adam Samson, Mary McDougall and Costas Mourselas. But the rush of “fast money” has also left the country more vulnerable to sudden swings in sentiment, say investors and analysts.

Money managers have since October poured around $24bn into trades that seek to profit from Turkey’s high interest rates — currently 50 per cent — according to Istanbul-based Bürümcekçi Research and Consultancy.

Managers borrow the money for the trade in a currency with lower interest rates to maximise their gains, while hoping that the exchange rate does not move against them in the meantime.

The race into the lira is the latest sign of how Turkey’s pivot towards conventional economic policies, which began last summer, is helping draw back international fund managers who had fled the market in recent years as unorthodox measures fuelled runaway inflation.

“The lira . . . has been a very popular trade,” said Grant Webster, co-head of emerging market sovereign and foreign exchange at investment manager Ninety One.

“Turkey has seen meaningful foreign inflows” as a result of high interest rates and a shift away from unorthodox economic policies, he added.

Investors are running the biggest position in the Turkish lira above the benchmark index weighting in about five years, according to a June survey of JPMorgan clients.

A significant portion of the influx has been in the form of “fast money” flows — investors such as hedge funds who can rapidly exit in the event of international or domestic shocks, analysts and investors say.

“The share of fast money in trades like this has been increasing and that definitely does make them more prone to reversals,” said Kieran Curtis, head of emerging market local currency debt at fund manager Abrdn.

Five unmissable stories this week

Investors are creating a “barbell effect” in fixed income markets by opting for low-cost exchange traded funds and alternative assets rather than traditional bond funds, BlackRock chief executive Larry Fink said, as the world’s largest money manager announced a new high of $10.6tn in assets under management.

Pershing Square founder Bill Ackman has told potential investors in the US-based investment fund he is working to take public that his prolific social media presence will help the vehicle trade at a premium valuation.

Ken Griffin, the Citadel hedge fund founder, has paid $44.6mn for a 150mn-year-old stegosaurus known as “Apex”, making it the most valuable fossil ever sold at auction. The fossil — which is 11ft tall and 27ft long — surpassed its presale low estimate by more than 11 times, according to Sotheby’s.

City grandees have urged Rachel Reeves to tackle the “impending crisis” facing British retirees because of a lack of long-term savings. Meanwhile Reeves has threatened to force town hall pension funds to pool their £360bn of assets at greater scale unless they do so voluntarily.

Blackstone increased its pace of investing to a two-year high in the second quarter as the world’s largest alternative asset manager prepared for the US Federal Reserve to begin cutting interest rates.

And finally

I’m late to the party but I recently chanced upon Accidentally Wes Anderson, a website exploring the “unique, the symmetrical, the atypical, the distinctive design and amazing architecture that inspires us all.” If you follow me down this rabbit hole, among the more famous places you’ll find is the Hotel Belvédère in the Swiss Alps. You may remember it from the 1965 James Bond film Goldfinger. Bond, played by Sean Connery, drives through the Furka Pass in his silver Aston Martin while trailing the villain Goldfinger and his henchman Oddjob in a yellow and black Rolls-Royce.

Thanks for reading. If you have friends or colleagues who might enjoy this newsletter, please forward it to them. Sign up here

We would love to hear your feedback and comments about this newsletter. Email me at [email protected]

Recommended newsletters for you

Due Diligence — Top stories from the world of corporate finance. Sign up here

Working It — Everything you need to get ahead at work, in your inbox every Wednesday. Sign up here