Stay informed with free updates

Simply sign up to the European economy myFT Digest — delivered directly to your inbox.

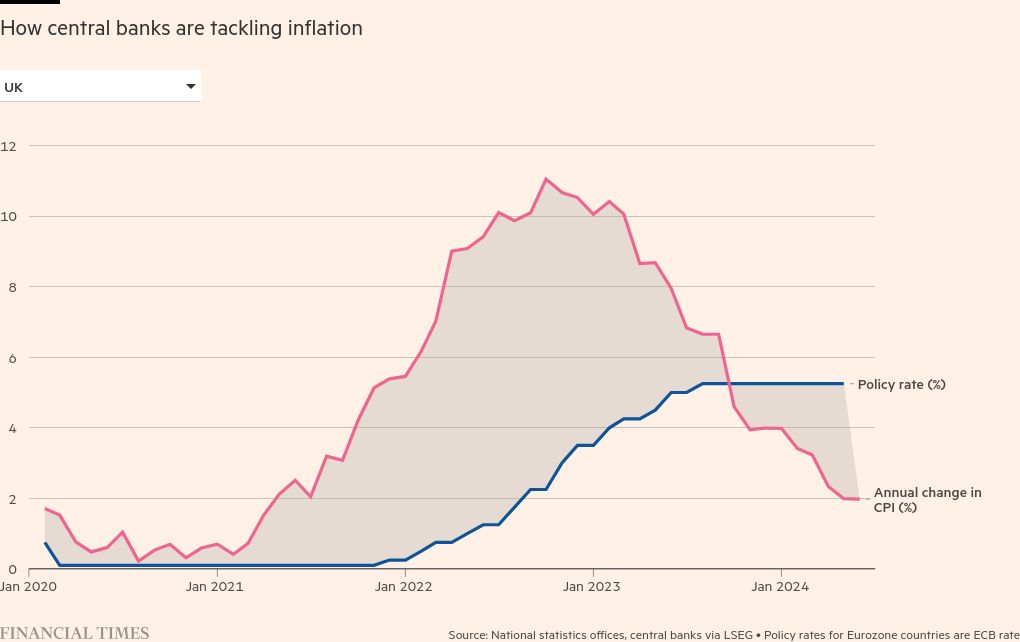

Investors are underestimating the risk that surging shipping costs will push up inflation and slow the pace of interest rate cuts by the European Central Bank and Bank of England, economists have warned.

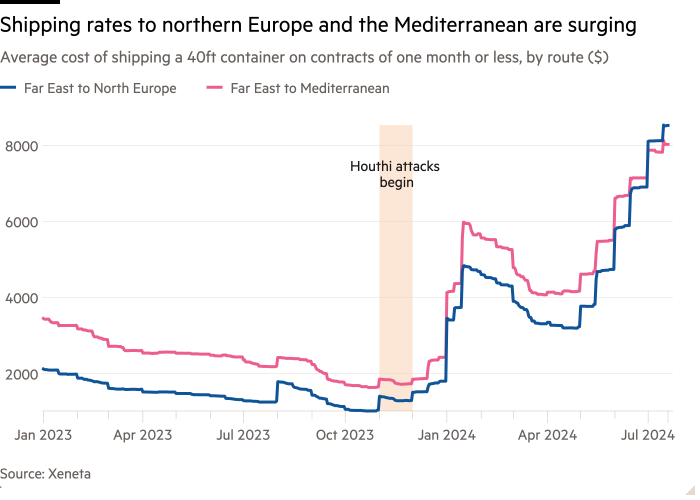

The cost of moving a 40ft container between Asia and northern Europe at short notice has more than doubled since April from $3,223 to $8,461, according to shipping data specialists Xeneta, following an intensification of Houthi rebel attacks on ships travelling through the Red Sea to the Suez Canal.

When freight prices began to rise in December, policymakers were sanguine that it would not drive up the prices of consumer goods as a much bigger spike did after the pandemic.

But Christine Lagarde, the European Central Bank president, this week flagged heightened geopolitical tensions as an upside risk to inflation as they could “push energy prices and freight costs higher in the near term”.

Some economists are now sounding the alarm too.

Researchers at the investment bank Nomura see little immediate prospect of shipping costs easing, given ongoing tensions in the Red Sea, potential strikes at US and German ports, low water levels in the Panama Canal and an earlier than usual rush to build inventories ahead of the holiday season.

Andrzej Szczepaniak, economist at Nomura, argued that there was now more potential for companies to pass these costs on as a consumer-led recovery gathered strength in the eurozone and UK.

“Real wages are improving, headline inflation is coming down, there will be stronger consumption going forward and an acceleration in growth,” he said, estimating that shipping costs could add 0.3 to 0.4 percentage points to UK and eurozone inflation by the end of 2025, even if they plateaued at current levels and then gradually fell.

Brian Coulton, chief economist at Fitch Ratings, expects a similar effect and thinks investors are not paying enough attention to the risk that central banks will have to delay rate cuts to cover the difficult “last mile” in bringing inflation back to target.

“In the last year, [the narrative] has all been about the stickiness of services inflation,” he said. “There has been quite a lot of comfort taken by market participants from the stabilisation in core goods prices . . . I think this is quite an important fly in the ointment on that narrative.”

Some economists do not share this view — or at least, not yet.

Holger Schmieding, economist at Berenberg, said shipping costs were “a modest irritant rather than a worry” and would raise inflation by only 0.1-0.2 percentage points, as manufacturers were not well placed to pass costs on.

Simon Macadam, at the consultancy Capital Economics, also said any inflationary effect from shipping costs would be “small beer” compared with the much bigger challenge posed by sticky services prices.

The spike in freight rates on outbound routes from China was “not representative” of overall global shipping costs, Macadam said, and shipping costs represented only a small fraction of the value of goods. Even if manufacturers had as much pricing power as in the “perfect conditions” of 2021 and 2022, they would pass only half the increase on to consumers, raising inflation by 0.2 percentage points at most.

Meanwhile Claus Vistesen, at the consultancy Pantheon Macroeconomics, said there was no doubt that if sustained, higher shipping costs would “show up in consumer prices at some point” — but only after warning signals in surveys and factory gate prices. “They are not going to come like a thief in the night.”

But Simon French, chief economist at the investment bank Panmure Liberum, said even a relatively small pick-up in goods prices could be a worry for central banks and a potential brake on monetary easing.

“Central banks have set out an easing path . . . that is predicated on benign goods inflation,” he said. “Shipping rates at current levels could derail that . . . The market hasn’t absorbed that yet.”