This article is an online version of our Scoreboard newsletter. Premium subscribers can sign up here to get the newsletter delievered every Saturday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters

Good morning from the US where we are enjoying a holiday weekend. Miki Sudo set a new women’s world record in the annual July 4th hot dog eating contest (video below), fireworks were cracked, beers and beach time were enjoyed by many.

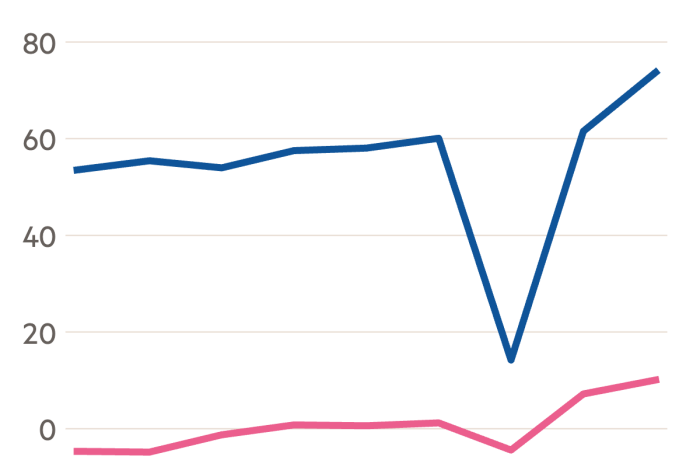

Sadly, one American icon has not been having her best summer ever: Nike. The world’s largest maker of sportswear posted weaker earnings than expected last week, but more crucially, lowered expectations for the year ahead. The stock has taken a beating.

Consumer appetite for Air Force 1s and dunks is waning, and executives were frank that they need to speed up newer, innovative products to drum up demand. The company’s all-out focus on direct-to-consumer sales also appears to have backfired, as online sales slump even as Nike works to re-engage third party retailers including Foot Locker and JD Sports.

I’ve been talking to stakeholders this week about just what went wrong, and what’s next. Watch this space for my story in the coming days, and in the meantime, revisit our 2021 FT Magazine cover story on Nike, explaining the big gamble on DTC and foreshadowing this week’s grim results.

In the meantime, we have dispatches on the surprise sale of the newly-minted NBA champion Boston Celtics, and promotional efforts behind F1’s British Grand Prix. Do read on — Sara Germano, US sports business correspondent

Send us tips and feedback at [email protected]. Not already receiving the email newsletter? Sign up here. For everyone else, let’s go.

Boston Celtics are the newest dynasty for sale

The duck boats had barely made it back ashore this week from the Boston Celtics victory parade when the ownership of the NBA team issued a shock announcement: they’re selling the club.

Fresh from winning their league-record 18th championship just last month, defeating the Dallas Mavericks in five games, the Celtics are now on the market and likely to fetch a record price for a professional basketball club. Their $4.7bn valuation by Forbes was set last October, before the team posted the best record in the league and cemented Jayson Tatum and Jaylen Brown as chip-winning franchise anchors.

So what happened, and why now? The Celtics were bought in 2002 for $360mn by a group of Boston-based billionaires, led by the Grousbeck family. Wyc Grousbeck, a venture capitalist, has been the governor of the club and the face of ownership for the duration, though his father, H. Irving Grousbeck, cofounder of Continental Cablevision, is part of the controlling group. The elder Grousbeck, who will turn 90 this month, is managing his estate and determined that selling the team is more financially advantageous than passing it on as inheritance, according to a person familiar with the matter.

As pro sports valuations continue to skyrocket, the tax implications for passing such assets down to family members becomes more complicated. Such was the case for another recently-sold club, baseball’s Baltimore Orioles, who were acquired this spring by a consortium led by Carlyle Group co-founder David Rubenstein, in a deal structured around the passing of previous owner Peter Angelos.

In the case of the Celtics, selling comes at a peculiar time, as the NBA continues to negotiate its next round of media rights, expected to roughly double from an average of $2.7bn per year. That will probably further juice basketball team valuations.

And having just locked in their core roster, the team is projected to be a title contender for years to come. The Celtics awarded Tatum the largest individual contract in NBA history this week, a five-year $314mn supermax deal, besting the previous record held by Brown.

So who might have the capital to take over? There is at least one confirmed bidder, a current member of Celtics’ ownership group, Steve Pagliuca of Bain Capital, who said he is throwing his hat into the ring. The biggest outstanding question is whether Boston-based sports empire Fenway Sports Group, led by John Henry, is interested in acquiring another trophy franchise.

The younger Grousbeck brought the Larry O’Brien trophy to a party at Henry’s home last month, just ahead of the Celtics victory parade. Scoreboard is told there were whispers about the looming sale, but Henry did not respond to a request for comment, and a spokeswoman said it was “not something anyone here would comment on at this early stage”.

British Grand Prix bets on F1 festival — at a price

Hosting a Formula One race weekend is hard work. Just ask Silverstone, promoter of the British Grand Prix.

Red Bull driver Max Verstappen, who’s leading the championship, and McLaren Racing rival Lando Norris will generate the headlines tomorrow, but they’re not the only attraction on offer.

Under managing director Stuart Pringle, a former tank commander in the British Army, Silverstone has strengthened its finances from the days when its place on the F1 calendar was in question.

Revenues rose to £73mn in 2022, when the British GP welcomed 400,000 attendees over race weekend, from £61mn in 2021, doubling pre-tax profit to £14mn. Attendances leapt again to 480,000 last year, but are expected to drop this time around.

As well as trying to host more events and conferences to reduce Silverstone’s reliance on F1 (the British GP typically provides at least half its annual revenues), Pringle has bet on big-name music acts to ensure that the money isn’t all tied up in racing.

Kings of Leon, Stormzy and Rudimental are performing over the course of the weekend. That kind of talent doesn’t come cheap. Mahiki, a nightclub better known in Mayfair, is another addition.

All that adds to the glitz and glamour, but at what cost? In the build-up to this weekend, seven-time champion Lewis Hamilton urged Silverstone to bear in mind just how much it costs families to attend.

But the problem is that there is all manner of pressure on promoters to keep up with the times — and the standards set by new races on the calendar. Miami and Las Vegas, which are at the forefront of F1’s push into America, have upped the ante.

Liberty Media, which has owned F1 since an $8bn deal in 2017, invested hundreds of millions of dollars in Vegas. In adding Sin City to the calendar, Liberty turned the traditional F1 model on its head by becoming the promoter to the event.

In some ways, that put F1 in the same shoes as other promoters on the 24-race calendar. But it has also added pressure on the others to match Liberty’s Super Bowl-esque standards of spectacle.

As per Liberty’s annual report, “the limited number of weekends in a 24-race calendar raises the bar on quality of experience required to maintain a slot.” As a result, “nearly all” of the recently announced race renewals require promoters to improve “track infrastructure and fan experience”.

Keeping up with Miami and Vegas comes at a price, and not just for racegoers.

Highlights

-

Gareth Southgate’s England team have faced a wall of criticism for their drab performances at Euro 2024. Of all the quarter finalists, England have the lowest number of shots. But, argues Simon Kuper, they are still worthy favourites to win the tournament.

-

The FT’s Gideon Rachman has been following England on the ground in Germany. He has written this weekend essay on what the experience reveals about Europe’s fractured political landscape.

-

French President Emmanuel Macron’s decision to call snap parliamentary elections has cast a shadow over the Olympic Games. Paris 2024 organisers are braced for major policing challenges for an elaborate opening ceremony amid ongoing security concerns.

-

Disney chief Bob Iger and his wife Willow Bay are closing in on buying control of Angel City FC, in a deal that would value the Los Angeles women’s franchise at $250mn, according to media publication Semafor. It is the latest sign that valuations are booming in women’s soccer.

-

Private equity firms are circling Euroleague, Reuters reported, with the men’s basketball competition aiming for a €1bn valuation.

-

LeBron James agreed a two-year contract extension with the Los Angeles Lakers, in a move that pushes the billionaire’s wealth higher.

Transfer Market

-

Aston Martin F1 has hired Andy Cowell as its new group chief executive, as owner Lawrence Stroll tries to build a team capable of winning the world championship. The former Mercedes engine chief will join in October.

-

RC Lens board member Andreea Koenig, former banker at JPMorgan, Goldman Sachs and Bank of America, has joined Ligue Féminine de Football Professionnel as vice-president. LFFP, which runs women’s football leagues in France, is led by former Lyon owner Jean-Michel Aulas and is aiming to professionalise women’s football and increase its relevance internationally.

Final sausage

Here at Scoreboard, we appreciate all kinds of sport. It’s not just about football and basketball, that’s for sure. In that spirit, take a look at the record-breaking exploits of Miki Sudo, who wolfed down 51 hot dogs on July 4. That’s freedom.

Scoreboard is written by Josh Noble, Samuel Agini and Arash Massoudi in London, Sara Germano, James Fontanella-Khan, and Anna Nicolaou in New York, with contributions from the team that produce the Due Diligence newsletter, the FT’s global network of correspondents and data visualisation team

Recommended newsletters for you

The Lex Newsletter — Lex is the FT’s incisive daily column on investment. Local and global trends from expert writers in four great financial centres. Sign up here

Unhedged — Robert Armstrong dissects the most important market trends and discusses how Wall Street’s best minds respond to them. Sign up here