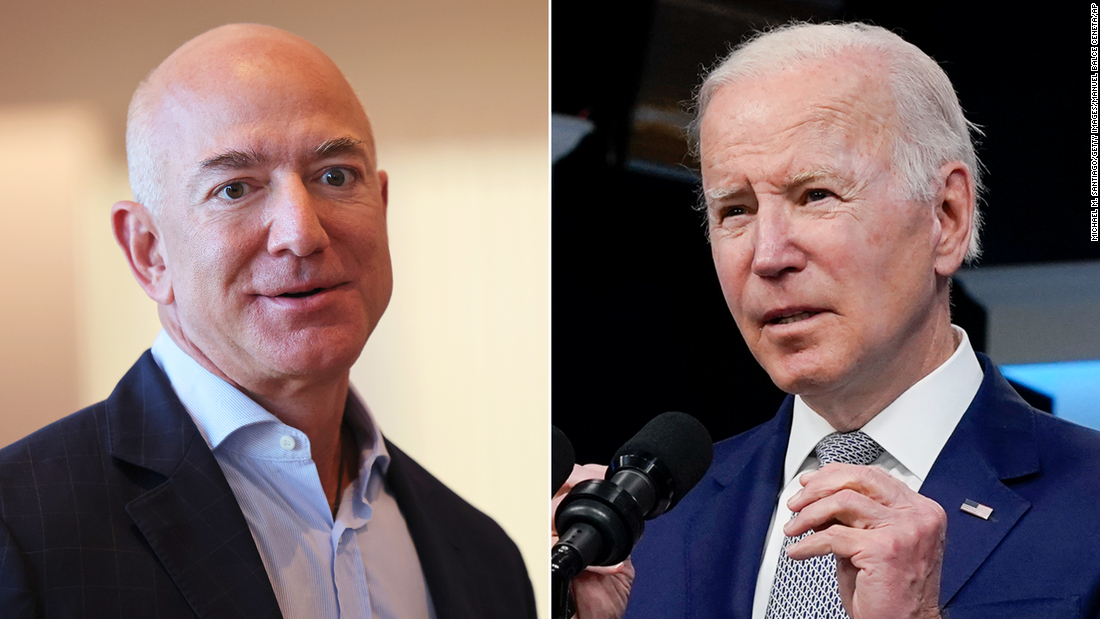

If you’ve been away from Twitter lately, first of all: Good on you. Here’s a quick recap of the dispute between Jeff Bezos and President Joe Biden.

In short, Bezos believes federal stimulus payments caused inflation. Biden says corporate greed is the culprit.

They’re both right. And they’re both wildly overstating their positions.

The truth is that inflation doesn’t have any single cause. Did the nearly $2 trillion in stimulus for families and individuals stoke demand for goods and contribute to the 40-year-high inflation we’re living in? Yes.

The Consumer Price Index was below 2% in Biden’s first full month in office. Stimulus checks started hitting bank accounts in March 2021, when the annual inflation rate rose to 2.6%. In April, it hit 4.2%. It cleared 5% in May, 6% in October, and it’s over 8% now.

That’s one point for Team Bezos. (Though it’s worth noting that unemployment went from 6.2% when Biden took office to 3.6% currently — all of which signals an economy in recovery.)

What neither Biden nor Bezos mention in their tweets are the myriad other factors that are to blame for stubbornly high global inflation. Factors like supply chain bottlenecks and shortages that are still being worked out because of the unprecedented global shutdown of the world economy two years ago.

Another force neither seems keen to mention: The Federal Reserve’s unprecedented intervention in financial markets that began in the spring of 2020. When the pandemic hit the United States, The Fed unleashed a flood of easy money while cutting interest rates to near zero to prevent an economic collapse. The policy, enacted under the Trump administration by the Trump-appointed Fed chair Jerome Powell, kept equity markets humming through 2021, as Bezos certainly knows — Amazon was arguably the largest beneficiary of the pandemic economy, though its shares have been getting hammered along with other tech stocks in recent months.

Despite Biden and Bezos’ implication that inflation can all be sorted out if corporations just stop being greedy or the federal government stop spending so much money, there’s no easy cure.