Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The head of De Beers seeks to transform the diamond miner into a leading luxury jewellery retailer as it reels from its worst year in more than two decades after a savage industry downturn.

Although De Beers sells diamond jewellery in retail stores globally through its boutiques, chief executive Al Cook is planning to double the number of outlets to push into the territory of profitable luxury brands Tiffany and Cartier.

This is part of its plan to create a mining-to-retail operation to build on its dominance of the gemstone market as owner Anglo American prepares the group for a sale or listing after BHP’s failed £39bn takeover.

“If I look at the future of diamonds, it is way beyond mining,” Cook told the Financial Times. “I’m really excited by the idea that we can really deploy our full strategy all the way to creating the world’s greatest jewellery maison [house], which would not be a natural part of a mining company.”

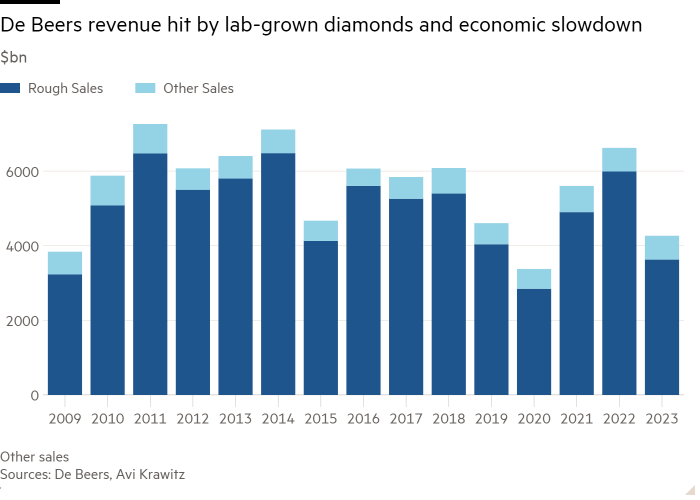

De Beers suffered from a big slump in diamond sales last year as high interest rates and inflation crushed earnings, while competition from synthetic lab-grown gemstones hit demand for those mined by the group.

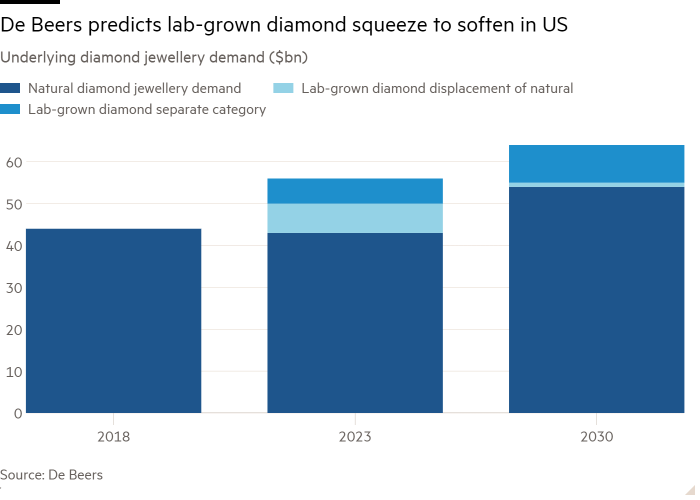

The company estimates $4.5bn of cheaper, lab-grown diamond sales last year deprived mined diamonds of $7bn worth of sales in the US, depressing its core earnings to $72mn in 2023 — its worst year since it delisted from the Johannesburg Stock Exchange in 2001.

This prompted Cook last week to unveil his “Origins” strategy overhaul to fend off the lab-grown threat and capture share in India, which this year is set to become the world’s second-largest diamond market.

He hopes to expand beyond mining with an initial target to have 100 De Beers Jewellery stores worldwide by the end of the decade from 40 currently, while developing new product lines.

De Beers will subcontract manufacturers to turn a minority of its rough stones into polished diamonds for sale in its own-brand stores and other independent retail channels. This is a change from the current set-up, where it sells rough diamonds to a select group of customers and buys them back as polished stones.

Cook has targeted $1.5bn in annual core earnings by 2028.

De Beers is one of four divisions that Anglo, which owns 85 per cent of the group with the remainder held by the Botswana government, will sell or spin off as the UK miner looks to revamp itself after the BHP offers.

Although touted buyers of De Beers include Gulf sovereign wealth funds, Chinese investors, billionaire individuals or luxury houses, a sale of the 136-year-old miner could prove challenging, given a decade of sluggish growth.

Anglo chief executive Duncan Wanblad warned that the state of the market would make it a tough divestment before 2025, while Richemont has denied it is considering buying the group.

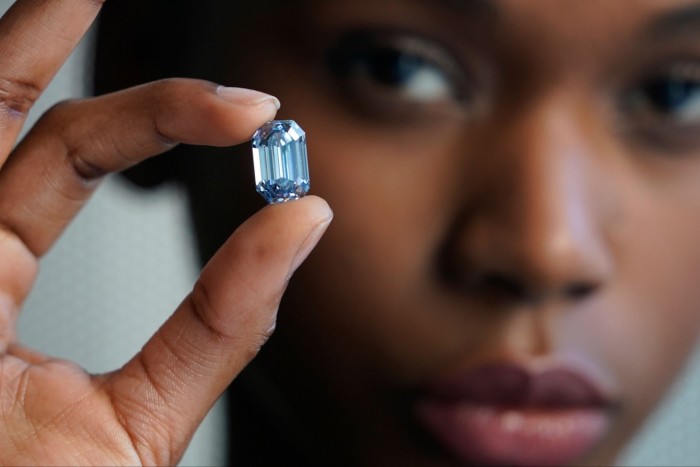

Among Cook’s more radical plans is selling its polished diamonds for the first time outside of exceptionally rare or large stones in a shake-up of its exclusive “sightholder” sales system, in which only 69 buyers can purchase its diamonds at 10 sales events each year.

This would mark a departure from De Beers selling its rough diamonds to these sightholders, who then sell cut and polished diamonds to jewellery manufacturers.

Cook cautioned that polished stone sales would be “relatively small” at first and its return to meaningful profitability would predominantly come from cost cuts and rises in rough diamond prices.

A company presentation showed that 7 per cent of its core earnings in 2028 would come from retail activities, which include its boutique De Beers jewellery shops and Forevermark brand, its largely Asia-focused diamond subsidiary in China, Hong Kong, India, Japan and the US.

“Expanding De Beers Jewellers makes sense as branded jewellery is the industry’s fastest-growing category,” said Paul Zimnisky, an independent diamond analyst.

“I just hope that the company has enough capital and support behind them to execute these initiatives, given the precarious state of the company as it stands with current parent Anglo American.”

As well as struggling with previous attempts to push into retail jewellery, success could also put it in competition with customers such as Van Cleef & Arpels or Hong Kong jewellery group Chow Tai Fook which buy its stones, highlighting the risks of the strategy.

Another change in De Beers’ strategy is dropping sales of lab-grown diamonds for jewellery and focusing on selling them for technology applications such as materials for next-generation 6G semiconductors.