One scoop to start: Preqin, a British provider of data on private markets, is exploring a sale that could value the company at more than £1bn, according to people familiar with the matter.

Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance. This article is an onsite version of the newsletter. Premium subscribers can sign up here to get the newsletter delivered every Tuesday to Friday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters. Get in touch with us anytime: [email protected]

In today’s newsletter:

-

Peter Orszag’s Lazard mission

-

Jean Salata on investing in China

-

A ‘marriage’ between the US and UAE

Lazard’s new chief tries to reimagine ‘la haute bank’

One of the perks of being a Lazard banker is the stunning panoramic view offered from the top of 30 Rockefeller where the venerable investment bank has its headquarters.

And fittingly or not, the firm’s new chief executive, Peter Orszag, enjoys the best perch.

He’s put a new personal office on the 64th floor fit for hosting visiting dignitaries (and the odd journalist from time to time).

There are no other bankers on 64, the rest of the Lazard lot consigned to the levels below. And the hoi polloi is wondering if there is some embedded message in that gap.

DD’s Sujeet Indap and the FT’s Josh Franklin investigated the first few months of the Orszag era, when the former Obama administration economist had some big wins in a fairly tough environment.

Deal fees in the past six months are approaching $1bn, which puts the firm ahead of an $8.5mn average revenue per managing director target. The firm’s stock price is up big as well from November lows.

Orszag has been relying on his personal star power to bring back Lazard’s tagline, “la haute banque d’affaires vis-à-vis the world”.

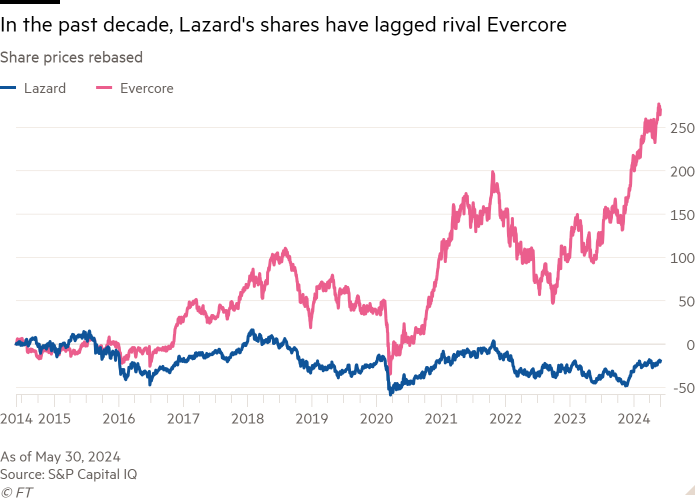

Alexandra Soto, a Lazard veteran, told the FT that Orszag’s shift away from running transactions day to day is exactly what the firm needs as it tries to take on newer rivals such as Evercore and Centerview Partners.

“We have plenty of bankers focused on individual transactions. The CEO of Lazard should focus on setting our strategy, building our stature and connectivity, and leading our people,” she said, likening Orszag to revered past Lazard head Michel David-Weill.

Orszag for better or worse is ruffling feathers among at least some of his troops with a different approach to the job and his message to investors.

Winning hearts and minds is never easy for a new boss, especially when members of the rank-and-file often think they are the smartest in the room.

Orszag has plenty to ponder in his spacious and quiet room high above it all.

A sit-down with EQT’s Jean Salata on China’s investment risk

Ever since PAG chair Weijian Shan was filmed saying China was in a “deep economic crisis” and he was being “extremely careful” about its portfolio in the country, it has been rare for Hong Kong-based private equity bosses to say much in public about investing in the world’s second-biggest economy.

Once a lucrative business — in which global private equity and venture capital groups could buy into fast-growing mainland companies then list them in the US and ultimately cash out — it’s a far riskier proposition today.

Chinese companies need regulators’ permission to list offshore, and the Biden administration is restricting some US investment in China.

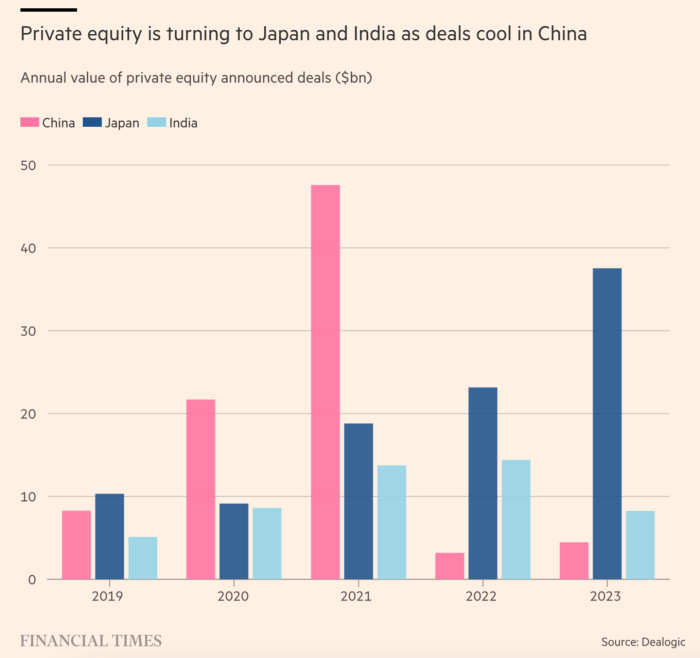

The impact can be seen in the numbers: the total value of private equity deals in China plummeted from a high of $47.6bn in 2021 to $4.5bn last year, figures from Dealogic show.

Now, Jean Salata, the chair of private equity firm EQT’s Hong Kong-based Asia business, has set out his firm’s thinking. “I think the bar is high for new deals in China at the moment,” he said in an interview with DD’s Kaye Wiggins.

“If you invest today, how easy will it be to get liquidity on those investments five years from now?” he added.

Nine per cent of the Asia private equity unit’s invested cash is in China deals, an investor presentation shows.

As Asia-focused buyout groups shift away from China, Japan has been a huge target. Take a look at this chart.

In Japan, attitudes to leveraged buyouts are changing, Salata said.

“There are companies that have sold divisions to private equity firms and have done so successfully. They didn’t get embarrassed, the company wasn’t sort of torn apart and highly levered.”

Salata also had a warning for the wider private equity industry.

Especially in the US, he said, the sector has benefited from “market dynamics that led to a lot of multiple expansion and essentially a lot of market beta which drove returns” in recent years — favourable conditions that he said were unlikely to be repeated.

DD wonders how many of those gathering in Berlin for SuperReturn this week would accept his thesis as they struggle to raise new funds.

The artificial intelligence ‘marriage’ between the US and UAE

The United Arab Emirates’ powerful national security adviser, Sheikh Tahnoon bin Zayed al-Nahyan, is in Washington this week.

While top Emirati and US officials have plenty of geopolitics to discuss, especially the war in Gaza, one thing is likely to be at the top of Sheikh Tahnoon’s agenda: artificial intelligence.

He is at the forefront of Abu Dhabi’s push to lessen its economic dependence on oil and become one of the world’s most important centres of AI development, a plan that needs the help of the US to make into reality, the FT’s Chloe Cornish reports.

US companies are ahead of the pack so far on the emerging technology.

That co-operation, which the UAE’s minister for AI likened to a “marriage” in an FT interview, has been given an official stamp of approval through a $1.5bn investment deal between Microsoft and Sheikh Tahnoon-chaired G42, the UAE’s commercial AI champion.

To make that happen, G42 had to promise to dump Huawei hardware from its systems. The US has export controls on semiconductors needed for training AI models, and requires assurances that sensitive technology will not be leaked to its rival China.

If that was the first step, Abu Dhabi is looking to go further.

We’ll let this State Department readout, from Sheikh Tahnoon’s meeting with deputy secretary of state Kurt Campbell on Monday, do the talking:

“[The two] discussed opportunities for the two countries to work together to use artificial intelligence and other cutting-edge technologies to drive economic growth and broaden opportunity, both bilaterally and in Africa and India.”

Job moves

-

Guggenheim Securities has hired Nicholas Riddle to join its healthcare investment banking team in London as a senior managing director. He will focus on advising European biotechnology and life sciences companies, and is set to start in August. He joins from JPMorgan.

-

A group of investors previously at 3i have launched the European infrastructure fund Alba. The fund will be led by managing partners Stéphane Grandguillaume, John Cavill and Antoine Matton.

-

BlackRock has hired Camille de Lamotte as co-head of private debt origination in France and head of origination in Spain. He most recently worked at Goldman Sachs.

-

Paul Hastings has hired 11 partners from King & Spalding who specialise in private credit and restructuring.

Smart reads

Diplomatic strengths HSBC, a bank known for its complex global footprint, is on the hunt for a new chief. At a time of such geopolitical volatility, diplomatic prowess is a must, DD’s Kaye Wiggins writes.

Birkenstock’s dynasty How a German orthopaedic shoe company dating back to the 1700s endured fads, family drama and going public — all while becoming a luxury empire, Bloomberg reports.

The new kingpin Private equity has snapped up bowling alleys across the US in a push to juice profits from one of America’s favourite pastimes, The Lever investigates. But what happens when they’re all bought up?

News round-up

Court suspends arrest warrant after Lars Windhorst agrees to attend hearing (FT)

BBVA raises fresh capital after prosecutor pushes for spying trial (FT)

Adani stocks crash as India election results show weaker Modi mandate (FT)

Shari Redstone leaves investors guessing as Paramount-Skydance agree merger terms (FT)

Blackstone in UK rental housing push with £580mn Vistry deal (FT)

US prosecutors probe global hacking-for-hire operation (WSJ)

South Africa’s MultiChoice supports $2.9bn offer from France’s Canal+ (FT)

Due Diligence is written by Arash Massoudi, Ivan Levingston, Ortenca Aliaj, William Louch and Robert Smith in London, James Fontanella-Khan, Sujeet Indap, Eric Platt, Antoine Gara, Amelia Pollard and Maria Heeter in New York, Kaye Wiggins in Hong Kong, George Hammond and Tabby Kinder in San Francisco, and Javier Espinoza in Brussels. Please send feedback to [email protected]

Recommended newsletters for you

Full Disclosure — Keeping you up to date with the biggest international legal news, from the courts to law enforcement and the business of law. Sign up here

Unhedged — Robert Armstrong dissects the most important market trends and discusses how Wall Street’s best minds respond to them. Sign up here