Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Nearly a year ago, soda ash producer WE Soda said it planned to float in London at a $7.5bn equity value, then didn’t. Its postponement was portrayed nearly everywhere at the time as a blow for London, rather than the dodging of a bullet.

Reasons for WE Soda’s parent company Ciner choosing a London listing (as FTAV’s Craig Coben wrote at the time) were all about the limitations of its home market, Turkey, and the City’s historic willingness to welcome emerging-market commodity producers that might struggle to be taken seriously elsewhere. The postponement of the IPO (as Coben also wrote) was because not enough prospective investors could stomach the price wanted.

But WE Soda CEO Alasdair Warren, a former Deutsche Bank EMEA boss, chose to blame the market. “The reality is that investors, particularly in the UK, remain extremely cautious about the IPO market and this extreme investor caution in London meant that we were unable to arrive at a valuation that we believe reflects our unique financial and operating characteristics,” the company said in its IPO death notice.

Two weeks later, Warren told Radio 4’s Today programme that Turkish soda might go down better across the pond:

London made sense for us at this point in our development, we’re growing our business, we’re going to double in size over the next few years. And all of that principally will be in North America. So perhaps when we reconsider coming back to the market, that will be a credible alternative.

The breadth of engagement which I talked about before was absolutely there. The issue was more about valuation … and it’s not just a UK issue. It’s a broader European issue around performance of IPO. And what that’s meant is driving valuations which are, in our opinion, unrealistically low.

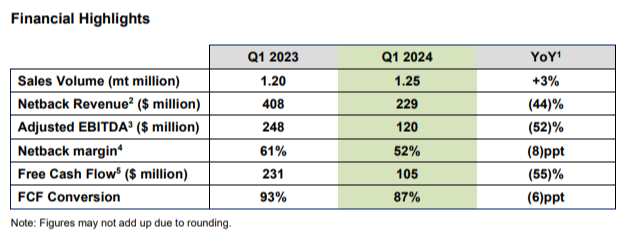

With history the judge, which side now looks unrealistic? WE Soda posted first-quarter 2024 results on Tuesday:

Those are the highlights?

WE Soda reportedly wanted to price IPO shares at an enterprise valuation of up to 10 times forward ebitda. That would’ve been about twice the ratio placed on Solvay of Belgium, its closest peer in European public markets.

The premium price was underpinned by an outsized dividend. WE Soda said in its IPO bumf that it would distribute 100 per cent of excess cash, worth $500mn in 2023. So even towards the top of the putative IPO range, the stock would have a 9 per cent prospective yield and a “progressive” dividend policy.

Shortly after the float was pulled, European soda ash prices slumped on supply additions and weakening demand. A lot of people saw this coming.

Soda ash is a low-value commodity chemical used to make glass, among other things. Industrial production levels set demand and, since its main raw material is coal, pricing rounds tend to track power markets. On the supply side, ash producers including Genesis Energy and Solvay have been adding US capacity and bringing back sites that were idled during the pandemic. China is also a big player, with Inner Mongolia Berun ramping up production aggressively as part of a government push to modernise the industry.

But while international capacity can affect spot pricing, soda ash markets divide up by region. China and the US don’t have much effect on Europe because the shipping costs make imports uneconomic. Europe’s big supply-side mover over the past year has been WE Soda itself, as it fixed production bottlenecks at its Kazan site in Turkey. WE Soda executives could be presumed to have reasonable visibility on such developments.

2023 results from WE Soda show free cash flow down 21 per cent to $587mn, so dividend pledge at IPO would necessitate a payout ratio of about 85 per cent. That leaves not much for growth capex in support of its goal to double total production by 2030. It also draws attention to the Chuckle Brothers nature of a plan to raise $800mn at IPO, most of which would’ve gone towards debt repayments, and then almost immediately give back $500mn.

Spin forward to the 2024 first quarter, where ebitda’s down 52 per cent from the most recent period given in its intention-to-float document. Guidance for the year-end implies 2024 surplus cash might be as low as $345mn, so if the float had gone ahead it’s not unreasonable to imagine dividends being cut by about a third.

It’s all moot now, but if WE Soda had achieved a public market enterprise value of 10 times forward ebitda and was able to retain it, the equity would be valued today at between $4.2bn and $5bn. Ten turns might be a bit rich in light of the massive forecast cuts and an axed dividend within its first year of public ownership, however.

WE Soda management now says ash pricing will hit trough levels this year, and investors in peer companies appear to agree. Solvay trades at a recovery EV multiple of 7 times forward ebitda, versus its through-the-cycle average of 5.5 times.

Put on a Solvay ratio, WE Soda’s parallel-universe equity value falls to between $2.6bn and $4.2bn. That’s quite a way from the $7.5bn it wanted last year, yet it still looks very generous. Solvay has been publicly listed since 2012 and is a diversified chemicals maker for whom soda ash accounts for 40 per cent of sales, whereas WE Soda is a one-trick-pony that would by now have have joined London’s IPO hall of shame.

Using worst-case forecasts and a confidence-free ebitda multiple, it’s fairly easy to arrive at a valuation that would put WE Soda on the cusp of the Small-Cap Index rather than the FTSE 100.

All of this goes to demonstrate one thing: London isn’t always the problem. Blaming market conditions for undervaluing your company is a risky strategy, because future performance can show that you were talking up your ash hole.

Further reading:

— WE Soda’s failure to launch is no big deal for London (FTAV)

— WE Soda is coming to London. Why? (FTAV)