Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

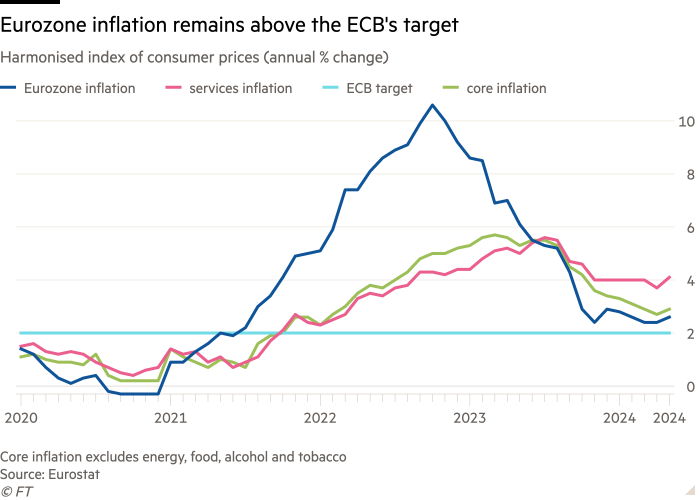

Eurozone inflation rose for the first time this year, adding to worries about how slowly the European Central Bank will cut interest rates if price pressures remain high.

The 2.6 per cent rise in consumer prices across the single currency zone in the year to May was up from 2.4 per cent in the previous month and slightly above the level forecast by economists in a Reuters poll.

Core inflation — which strips out energy and food to give an idea of underlying price pressures — accelerated from 2.7 per cent to 2.9 per cent, in a troubling sign for investors hoping the ECB will cut interest rates aggressively this year.

Until this month, Eurozone inflation had been gliding gently down towards the ECB’s 2 per cent target all year, allowing policymakers to clearly signal they expect to start cutting their benchmark deposit rate from its record high of 4 per cent next week.

The ECB is still widely expected to go ahead with next week’s rate cut — which would make it the first major central bank to ease monetary policy since the biggest inflation surge for a generation started three years ago.

But with price pressures picking back up again this month and the Eurozone economy returning to growth in the first quarter, investors expect the ECB to adopt a more cautious approach to lowering rates for the rest of this year.