Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The staggering electricity demand needed to power next-generation technology is forcing the US to rely on yesterday’s fuel source: coal.

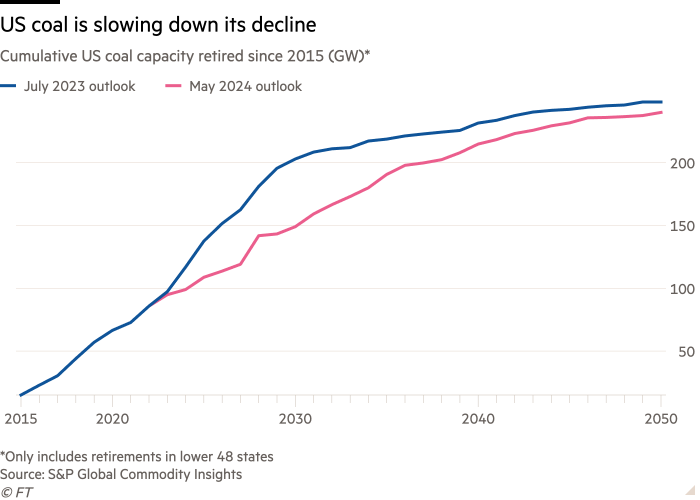

Retirement dates for the country’s ageing fleet of coal-fired power plants are being pushed back as concerns over grid reliability and expectations of soaring electricity demand force operators to keep capacity online.

The shift in retirement plans for coal-fired plants underscores a growing dilemma facing the Biden administration as the US race to lead in artificial intelligence and manufacturing drives an unprecedented growth in power demand that clashes with its decarbonisation targets. The International Energy Agency estimates the AI application ChatGPT uses nearly 10 times as much electricity as Google Search.

An estimated 54 gigawatts of US coal power generation assets, about 4 per cent of the country’s total electricity capacity, is expected to retire by the end of the decade, a 40 per cent downward revision from last year, according to S&P Global Commodity Insights, citing reliability concerns.

“You can’t replace the fossil plants fast enough to meet the demand,” said Joe Craft, chief executive of Alliance Resource Partners, one of the largest US coal producers. “In order to be a first mover on AI, we’re going to need to embrace maintaining what we have.”

Operators slowing down retirements include Alliant Energy, which last week delayed plans to convert its Wisconsin coal-fired plant to gas from 2025 to 2028. Earlier this year, FirstEnergy announced it was scrapping its 2030 target to phase out coal, citing “resource adequacy concerns”.

Grid Strategies, a consultancy, forecasts US electricity demand growth of 4.7 per cent over the next five years, nearly doubling its projection from a year earlier, citing new manufacturing and industrial capacity and data centres used to power everything from AI to crypto mining to the cloud. A study released on Wednesday by the Electric Power Research Institute found that data centres would make up 9 per cent of US power demand by 2030, more than double current levels.

The White House has set a target to reach a carbon pollution-free power sector by 2035. Last month, the Environmental Protection Agency finalised controversial rules to phase out coal-fired plants starting in 2032 unless they install expensive carbon capture systems.

The EPA found in its analyses that the power sector can meet demand while reducing pollution and providing reliable, affordable electricity under these rules, said a spokesperson, adding that the agency “believes the rules are on firm legal ground”.

Indiana is leading a group of 25 states in a lawsuit to stop the EPA rules.

“We need more energy, not less,” Indiana’s Republican governor, Eric Holcomb, told the Financial Times. “We absolutely as Americans can’t afford to lose the AI war.”

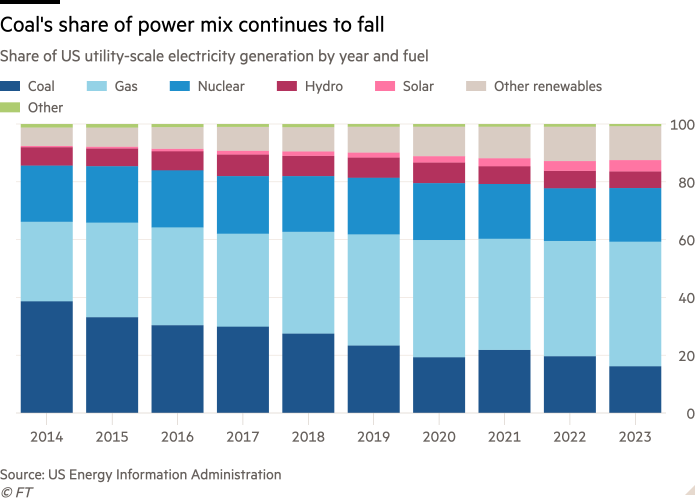

US coal-fired power generation is in long-term decline, making up 16 per cent of the country’s electricity supply last year, down from nearly 40 per cent in 2014, according to the US Energy Information Administration.

Seth Feaster, a data analyst at the Institute for Energy Economics and Financial Analysis, cautioned against equating reports of retirement delays to higher generation. The EIA projects that US coal power generation will fall another 4 per cent this year and utilisation rates at coal-fired plants remain low.

“Simply pushing back a retirement date does not mean that those plants will be used,” Feaster said. “The trajectory of coal hasn’t really moved.”