Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Market pressure is growing on the People’s Bank of China to allow the renminbi to weaken, as traders bet that the yawning gap with US borrowing costs will lead more investors to sell out of the Chinese currency.

China’s central bank has maintained a strong yuan policy so far this year, keeping its daily fixing — or reference rate around which the currency is allowed to trade — within an unusually narrow range of 7.09 to 7.11 against the US dollar.

But the currency has recently traded as much as 2 per cent below the fixing rate — the maximum variation the central bank has said it will allow — for the first time in eight years, indicating mounting selling pressure.

Markets are pushing for a weaker yuan to reflect the gap in bond yields with the US — 10-year Treasury yields trade at 4.57 per cent, while 10-year Chinese government bonds offer just 2.3 per cent. Capital tends to flow to markets where interest rates are higher.

“A great number of traders are expecting a one-off depreciation of the yuan, similar to what occurred in 2015, due to the enormous downward pressure that has built up over the past few months,” said one Shanghai-based currency trader.

In 2015, China suddenly devalued the renminbi, which it regarded as overvalued. That triggered turmoil in financial markets, including sharp selling of the yuan by global managers, severe capital outflows and a 1tn yuan fall in the country’s foreign reserves as regulators intervened to try to calm markets.

The central bank is currently reluctant to allow a rapid shift in the exchange rate, instead favouring stability. President Xi Jinping talked of “a strong currency” as one of his top priorities at the start of this year, as part of plans to strengthen the country’s status as a financial powerhouse. A depreciation of the renminbi would have huge implications for global trade, potentially inflaming tensions with Washington by increasing the competitiveness of Chinese imports to the US.

How China manages the RMB

Every day, the authorities calculate a central parity rate against the US dollar, also known as the fixing rate. Traders regard this rate as a main tool to communicate policy guidance from the central bank.

The market exchange rate is allowed to fluctuate within plus or minus 2 per cent of the fixing rate. This is known as the band.

The authorities have a wide range of formal and informal tools to intervene and keep the market rate within the band, which also includes the mobilisation of cash sitting in state banks to defend the yuan. China has been trying to allow more flexibility in the exchange rate, adjusting the fixing rate over time to reflect market pressures.

Recently, however, the fixing rate has been unusually stable even though the market rate is close to the weaker end of the band. That suggests there are depreciation pressures on the RMB that the authorities are resisting.

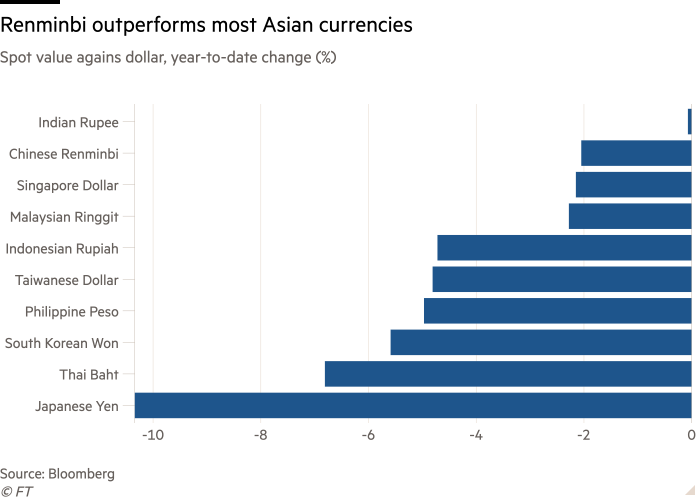

High interest rates in western economies — particularly the US — have recently fuelled an even sharper decline in other Asian currencies against the dollar.

While the yuan has weakened about 2 per cent against the US dollar this year, the Japanese yen has dropped by more than 11 per cent and the Korean won has fallen more than 5 per cent. Both are trade competitors with China.

Analysts are divided on which way the Chinese currency will move next.

“Yuan bears still dominate the market for the time being,” said Tiffany Wang, a China foreign exchange and rates strategist at JPMorgan, with many investors pointing to the gap in interest rates.

While the US Federal Reserve is expected to begin lowering rates later this year, “a shallower cutting cycle this time round will keep US yields above China for the foreseeable future,” she said.

The PBoC has said it would like to keep interest rates low or cut them if required, in response to ongoing weakness in China’s economy following the coronavirus pandemic and a property market crisis.

Some traders meanwhile believe the yuan could suffer if Donald Trump wins the US presidential election in November and increases tariffs on Chinese goods.

IMF first deputy managing director Gita Gopinath urged Beijing at an event on Wednesday to consider allowing more flexibility on its exchange rate, saying that this “would reduce deflation risks and help absorb external shocks”.

Despite market pressure, however, the PBoC has not signalled any plans to alter its course.

In its latest monetary policy quarterly report earlier this month, the central bank said it would “decisively correct the procyclical behaviours in the foreign exchange market and guard against the risk of over-adjustment of the exchange rate”.

Kevin Liu, a strategist at CICC, said it would send a mixed signal if China weakened the yuan even while it increases central government investment to try to beef up growth. The recent issuance of long-dated bonds should offer a “positive catalyst” to support the yuan, he said, as more central government spending should support the economy in the medium term.

From simply a trade perspective, the yuan is not overvalued, said Chen Long, co-founder of Plenum, a Beijing-based consultancy.

“China’s export growth has been strong, and the renminbi usually gains against the US dollar under such circumstances,” Chen said.

Still, the PBoC’s reluctance to let the yuan weaken against the dollar is a clear deviation from its previous policy, under which the yuan tracked a basket of currencies. That has left the central bank uncomfortably exposed.

One currency trader at a state bank in Beijing said the monetary authorities are weighing how to release pent-up market pressures on the yuan, for instance by allowing a gradual weakening of fixings. Traders from Citic Securities believe the central bank could slowly weaken the fixing rate towards 7.11 to 7.12 per dollar over the coming weeks, while avoiding any sharp movement.

The PBoC did not respond to requests for comment.

Additional reporting from Joseph Leahy in Beijing