Stay informed with free updates

Simply sign up to the EU trade myFT Digest — delivered directly to your inbox.

The EU’s trade deficit in goods with China has shrunk to its lowest quarterly level for almost three years, despite fears about the bloc being flooded with cheap Chinese products.

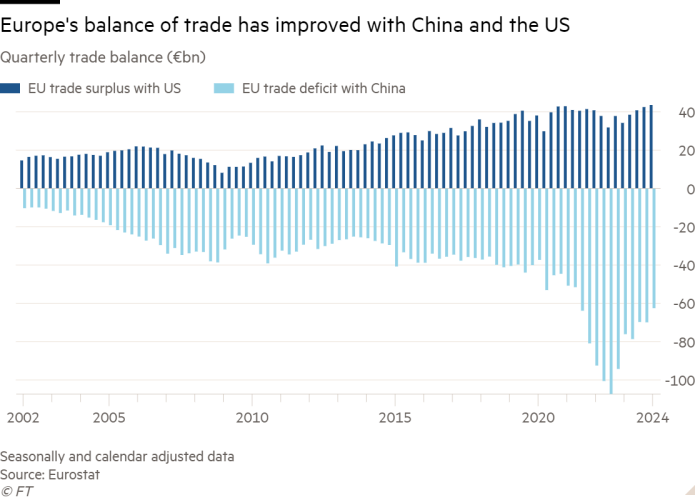

There are also signs of growing transatlantic demand for European products, after the EU’s trade surplus with the US rose to a record high in the first quarter, according to data published by Eurostat on Tuesday.

Economists said the improvement in Europe’s balance of trade reflected the region’s weak domestic demand and a reversal of the post-pandemic shift in consumer spending from services to goods.

Andrew Kenningham at Capital Economics said much of the shift was “explained by the strength of US domestic demand and weakness of EU demand”.

In the three months to March, the EU’s trade deficit with China fell to €62.5bn, down 10 per cent from the previous quarter and 18 per cent from a year ago. That is its lowest level since the second quarter of 2021, after it peaked at €107.3bn in the third quarter of 2022.

Europe’s trade with China has surged to the top of the political agenda on fears that Beijing is heavily subsidising its manufacturing in an attempt to win a dominant share of global markets in strategic areas such as electric vehicles, green energy and semiconductors.

US Treasury secretary Janet Yellen on Tuesday called for the EU to follow the US lead in putting extra tariffs on Chinese cleantech exports, warning that a glut of cheap Chinese goods could threaten the survival of factories across the world.

EU imports of electric vehicles from China, including from non-Chinese manufacturers with plants there, increased from $1.6bn in 2020 to $11.5bn in 2023. The market share of Chinese brands in the sector rose more than fourfold in that time to 8 per cent last year.

Brussels has opened investigations into allegedly unfair subsidies of Chinese solar panels and electric vehicles. However, European Commission president Ursula von der Leyen has said the bloc would not impose the same levies on Chinese goods that the US introduced last week, adding that the EU would take a different approach to Washington’s “blanket tariffs”.

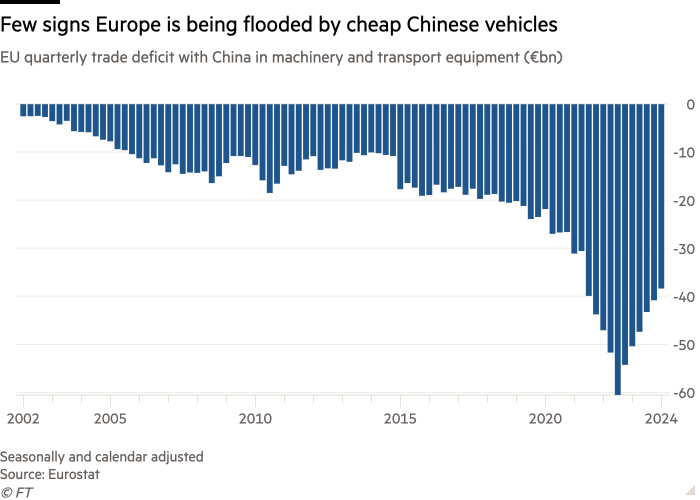

Belying fears about a surge of cheap imports, almost half of the recent reduction in the EU’s trade deficit with China stems from an improvement in the bloc’s balance of trade in machinery and transport equipment — which includes electric vehicles.

EU imports of Chinese machinery and transport equipment have fallen for six consecutive quarters, dropping by a quarter in that period, while EU exports to China in this area have been relatively stable.

Melanie Debono at Pantheon Macroeconomics said the drop in Chinese exports to the EU in this area reflected “a reversal of a 2021 surge” triggered by the pandemic and they have been rising since hitting almost a three-year low in January.

European exporters also appear to have been given a boost by the US putting tariffs on many Chinese imports and offering subsidies to manufacturers of green energy projects.

The EU’s trade surplus with the US rose to a new record high of €43.6bn in the first quarter, up 27 per cent from a year earlier. EU exports to the US have risen almost 4 per cent in that time, while imports from the US have fallen over 5 per cent.

“The US shutting China out already will undoubtedly benefit the EU, as long as the US remains open to European imports,” said Sander Tordoir at the Centre for European Reform think-tank. “The EU is ahead of the US on green tech manufacturing and exports.”

He added that European carmakers had been helped by the extension of tax breaks under the US Inflation Reduction Act to imported electric vehicles if they are bought by businesses that lease them out.