Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

It takes decades to build a trusted and respected brand. Losing stature happens much faster. Authentic Brands Group has built a $20bn empire acquiring the intellectual property behind such fashion names as Brooks Brothers, Aéropostale and Nine West as well as celebrities such as Elvis Presley.

In 2019, it bought the storied but downtrodden Sports Illustrated (SI) for just over $110mn. It believed that the revered magazine could become a lifestyle brand with extensions in sports betting and ticket sales.

Authentic then signed a licensing deal, with media mini-conglomerate Arena Group, to publish a version of SI. Arena would earn ad revenue while paying an annual $15mn royalty to Authentic.

What seemed like a masterstroke by Authentic has ended up in federal court. Arena failed to make a recent $3.75mn quarterly payment to Authentic. Authentic has sued Arena and its controlling shareholder over the payment and a $45mn termination fee Authentic believes it is owed.

Authentic’s model should be easy pickings: take over downtrodden brands and charge a licensee to do the hard work of attempting the resurrection. But identifying the right partner is harder than it looks.

Authentic, founded by entrepreneur Jamie Salter, filed an IPO prospectus in 2021 but never completed a listing. The filing said that in 2020, Authentic had revenue of about $500mn with an ebitda margin of almost 80 per cent. It has since taken investments from the likes of General Atlantic that has clinched it a $20bn private valuation.

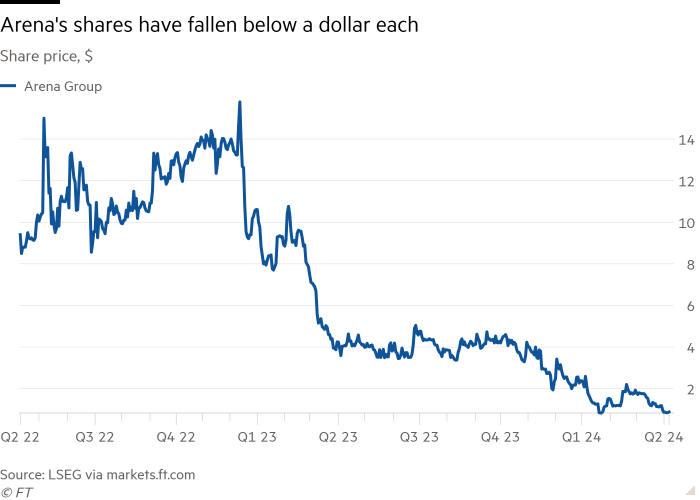

Arena itself is a collection of media properties including finance news site The Street. Its shares have fallen to under $1 each. Arena’s proprietor, Manoj Bhargava, made his fortune through marketing 5-Hour Energy, a sports drink.

Bhargava has been wheeling and dealing at Arena in recent months to keep it afloat. This includes buying more stock of Arena as well as merging Arena with another company affiliated with him. Authentic says these moves are to entrench his control of Arena.

Authentic said in 2021 that it was the third biggest licenser in the world (Disney was first). Like a portfolio of stocks, a few winners can make up for more than a few disappointments. The company said it had a whole science to reinvigorating moribund brands.

There can, however, be something grim about the process. Wringing out dollars in any way possible can feel crass. In the instance of Sports Illustrated, its journalism has eroded at the same time as Authentic has mined its long-standing prestige into a gaudy content farm.

It may be that these harvesting vehicles are keeping cherished brands alive. But what survives may inspire little nostalgia.