South African minister hits out at BHP’s £31bn bid for Anglo American

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

South Africa’s minerals resources minister has voiced his opposition to BHP’s £31bn proposal to take over Anglo American, fuelling doubts over a deal that would combine two global mining companies.

Gwede Mantashe told the Financial Times on Thursday that he was not in favour of the bid because South Africa’s previous experience with BHP was “not positive”, though he cautioned he was not expressing an official government position.

BHP in 2001 merged with South African miner Billiton, creating one of the largest mining groups at the time. PIC, a South African state-owned entity is Anglo’s biggest shareholder.

Mantashe, a close ally of President Cyril Ramaphosa, said that the transaction that led to the formation of BHP Billiton “never did much for South Africa” and led to capital leaving the country.

“What we saw is that it dumped coal and then created a small company called South32, which is now marginal.”

PIC declined to comment on the offer price, saying “any transaction presented will be assessed to ensure value creation for our clients”.

“The mining sector remains a critical part of the South African economy, impacting a wide variety of stakeholders, therefore, new opportunities that may arise in the sector need to take these factors and long-term sustainability into account,” it said.

Earlier on Thursday Anglo’s largest shareholders criticised BHP’s proposal to take over its London-listed rival as an “opportunistic” bid that substantially undervalued the company.

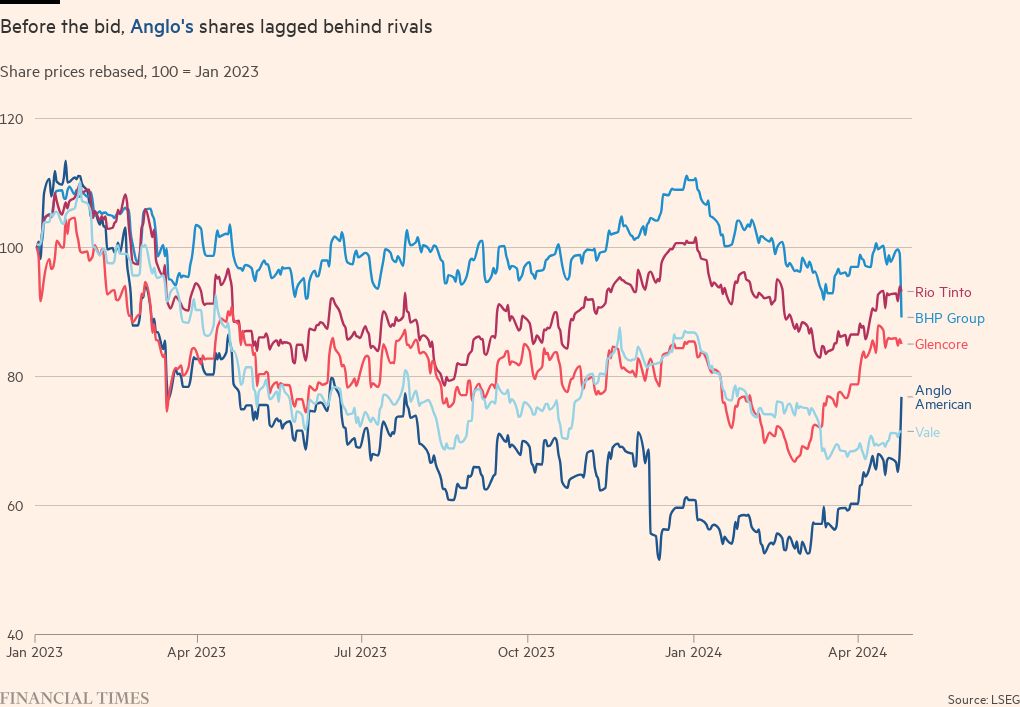

The move by the world’s biggest mining group came after Anglo had suffered its worst one-day share price drop in 15 years in December preceded by a period of its stock underperforming its peers.

Nick Stansbury, head of climate solutions at Legal & General Investment Management, Anglo’s 11th-largest shareholder, said BHP had made a “highly opportunistic approach” that was capitalised on Anglo’s “depressed” valuation and represented “an unattractive proposition for long-term investors”.

“The offer price has the feel of an initial bid which you hope would be revised higher,” said Iain Pyle, a fund manager at Abrdn, a top-25 shareholder in Anglo. “It feels opportunistic.”

A third investor, who is a top-20 shareholder in Anglo, said the bid price was “way off”. He added: “If I was a BHP shareholder and I was still capable of doing a cartwheel I’d do two if I got it at this price.”

A combination of BHP and Anglo would rank as one of the industry’s largest transactions in years. The Australian group said on Thursday that it had offered 0.7097 BHP shares for each Anglo share, as it sought to expand its portfolio of copper mines, a mineral for the decarbonisation of the global economy.

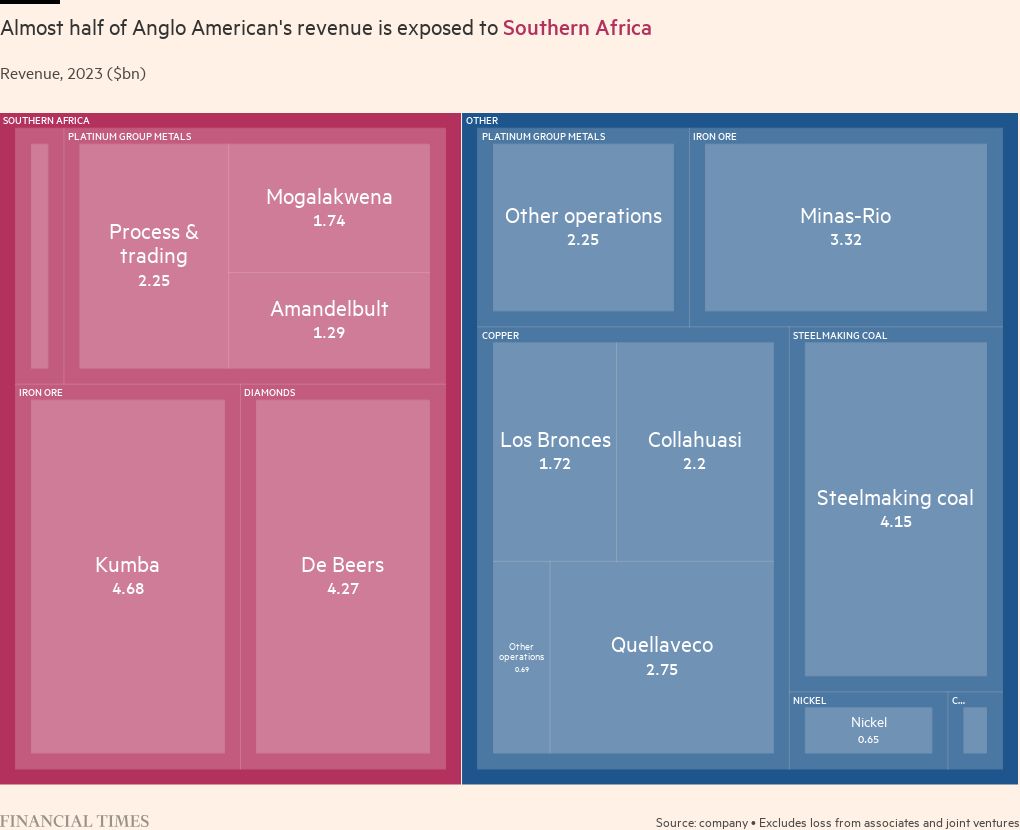

BHP said its offer valued each Anglo share at £25.08. Anglo shares surged 13.5 per cent to £24.9 in London, giving the company a market capitalisation of £33.2bn. Under the takeover proposal, Anglo would spin off its South Africa-based De Beers diamond and platinum metals divisions.

The value of Anglo’s prized copper mines in Chile and Peru is obscured by the rest of its sprawling business, analysts say.

“It’s hard to price these things because these are long-duration assets. The copper is the real thing here — the copper is first-class,” said the top-20 investor. “If you believe in the structural growth of copper, the offer price is too low.”

A fourth big investor, who holds shares in both Anglo and BHP, said Anglo would need to push for a higher price from BHP or offer up another proposal that could involve selling assets and combining with similar-sized industry peers such as Teck Resources, Freeport-McMoRan or South32.

“The timing is not surprising considering Anglo is reviewing its business,” the person said. “Anglo will need to create a compelling alternative if they’re going to defend this.”