China’s search for an answer to ChatGPT is just beginning

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The search for hot artificial intelligence stocks is under way in China as local companies create their answer to ChatGPT.

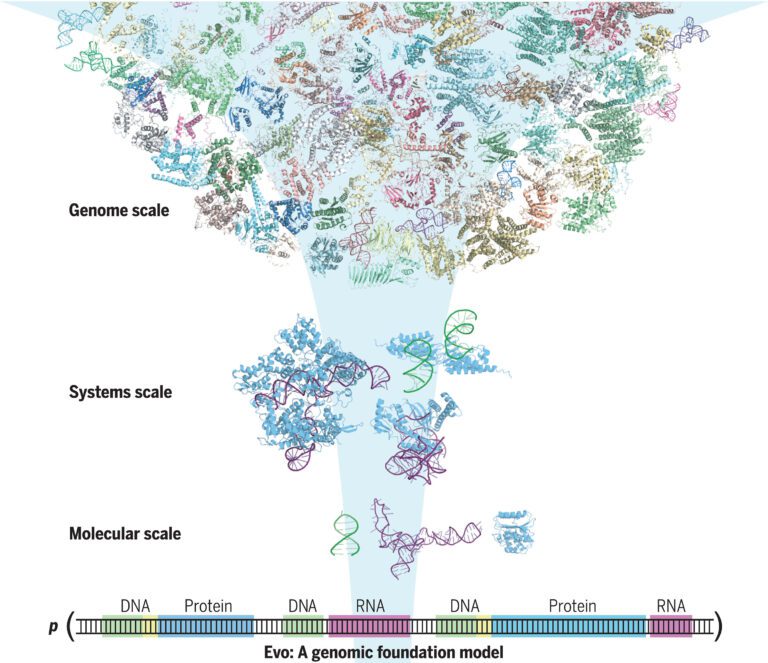

China’s biggest AI systems company SenseTime is a veteran of this technology; the latest version of its generative AI model has been going through upgrades at a rapid pace. Given its rock-bottom valuation, the company’s head start in AI could outweigh the obvious risks weighing on its valuation.

The company revealed the latest version of SenseNova 5.0 during its Tech Day event in Shanghai on Tuesday. The next day its share price jumped more than 30 per cent. This update has significantly improved linguistic and creative capabilities. Its breakthroughs with tools for generating videos using text prompts mean the tech group could soon have an answer to Open AI’s text-to-video tool Sora.

SenseTime had a head start in AI research over local rivals. Its SenseNova model, launched in April last year, was among the earliest to win government approval for general public use. But it already had a decade’s worth of research and development and patents in AI, focused on facial recognition technology and automotive software.

Nevertheless, the share price is down 90 per cent from the 2022 peak. SenseTime trades at a multiple of just about 3 times forward sales on an enterprise value basis, just a quarter of global peers.

That steep discount reflects geopolitical risks from US-China tensions. The US blacklisted SenseTime in 2019 on allegations related to human rights violations in Xinjiang and later banned US investment in SenseTime securities, which can hinder investment from other countries. It has denied the allegations.

The scrutiny adds challenges for SenseTime when expanding to some overseas markets. But as Beijing turns its focus to boosting investment in the local AI industry, SenseTime could find a bigger market at home.

Compared with generative AI start-ups, SenseTime’s diversified revenue base is an advantage. Training and running large language models is costly. Most of SenseTime’s revenues come from software licence fees, cloud services and pre-installed products sold to carmakers. Its smart car platform already sits in the cars of 30 automakers. SenseTime has the biggest market share of in-automotive image recognition systems in China.

That gives SenseTime’s generative AI segment, which tripled last year and accounted for more than a third of group revenue, some income back-up from the group’s other business units. Its backers include local ecommerce giant Alibaba and large state-owned enterprises.

It is too early to pick companies that could dominate China’s generative AI market. But at such a depressed valuations, SenseTime offers a low-risk bet on a potential winner.