Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Good morning. We start today with the explosion of Chinese gold trading activity, which has helped supercharge the precious metal’s record-breaking rally this month.

Huge bets by Chinese speculators on rising gold prices have boosted the rally, in a sign that Asian traders are beginning to eclipse their western counterparts in their influence on the bullion market.

Long gold positions held by futures traders on the Shanghai Futures Exchange (SHFE) climbed to 295,233 contracts, equivalent to 295 tonnes of gold. That marks a rise of almost 50 per cent since late September before geopolitical tensions flared up in the Middle East.

Gold volumes on SHFE surged to more than five times last year’s average at 1.3mn lots on the peak day of trading last week. Analysts said the trading frenzy helped explain the ferocity of gold’s record-breaking rally to above $2,400 a troy ounce this month.

“Chinese speculators have really grabbed gold by the throat,” said John Reade, chief market strategist at the World Gold Council, an industry body. Here are some of the firms making bullish bets.

And here’s what else I’m keeping tabs on today:

-

Economic data: Japan and Australia report monthly inflation figures, while the Bank of Korea publishes its Consumer Sentiment Index.

-

US-China relations: US secretary of state Antony Blinken travels to China in the two countries’ latest effort to manage tense relations.

-

Indonesia rate decision: The possibility of a rate increase has risen to arrest the recent slide of the rupiah.

-

Results: Hong Kong Exchanges and Clearing, Samsung C&T, Boeing and Canon are among those reporting first-quarter earnings.

Five more top stories

1. Hong Kong’s biggest initial public offering of the year flopped yesterday as shares of Chinese bubble tea chain ChaPanda dropped as much as 38 per cent from its listing price in its trading debut. ChaPanda, also known as Chabaidao, raised almost HK$2.6bn (US$331mn), with shares priced at HK$17.50. The poor performance comes at a time when the city is struggling to revive its stock market.

2. Elon Musk has pledged to appeal against a court order in Australia to scrub footage of a violent attack in Sydney from his X social media platform, accusing Prime Minister Anthony Albanese’s government of censorship. At least four people were injured in the attack last week on an Assyrian church, which police have called a “terrorist incident” of “religious motivated extremism”. Here’s more on Musk’s dispute with Canberra.

3. Police have arrested a staffer working for a German far-right member of the European parliament on charges of spying for Beijing. The employee was accused by Germany’s federal prosecutor yesterday of being covertly employed by China’s Ministry of State Security, the latest alleged Chinese agent to be unmasked in a trend alarming security authorities across the continent.

4. Exclusive: India is seeking to shore up its access to critical minerals such as lithium, as it rushes to catch up with rivals including China in the race to build next-generation energy supply chains. New Delhi is pushing state-owned mining groups to pursue mineral reserves in South America and Africa as well as inviting bids to develop domestic mining blocks, a government official told the FT.

5. JPMorgan Chase chief executive Jamie Dimon said the US economy is “booming” but warned that he was “on the cautious side” of there being a soft landing. In a wide-ranging interview yesterday at the Economic Club of New York, Dimon also praised Indian Prime Minister Narendra Modi, who is campaigning for another five-year term in power.

News in-depth

Jeff Yass’s Susquehanna International Group first invested $80,000 in ByteDance, the Chinese owner of TikTok, on the back of an idea sketched on a napkin in a Beijing coffee shop more than a decade ago. His global quantitative trading firm followed up with another $2mn months later — a stake that is now worth an estimated $40bn and represents a significant part of Yass’s wealth. But the Republican donor’s fortune is now hostage to the growing political tension between the US and China. Under pressure, he has gone on the offensive.

We’re also reading . . .

-

China-Russia trade: On paper, commercial ties between the two countries look huge. But their trade friendship may not be quite what you think, writes Agathe Demarais of the European Council on Foreign Relations.

-

Secret of sleep: Bamboo pyjamas and sensors in beds — while scientists seek to explain the mechanics of sleep, businesses can keep exploiting our tiredness, writes Leo Lewis.

-

When to loosen: An ECB interest rate cut soon would make sense but the Fed faces a more difficult call in the US, writes Martin Wolf.

Chart of the day

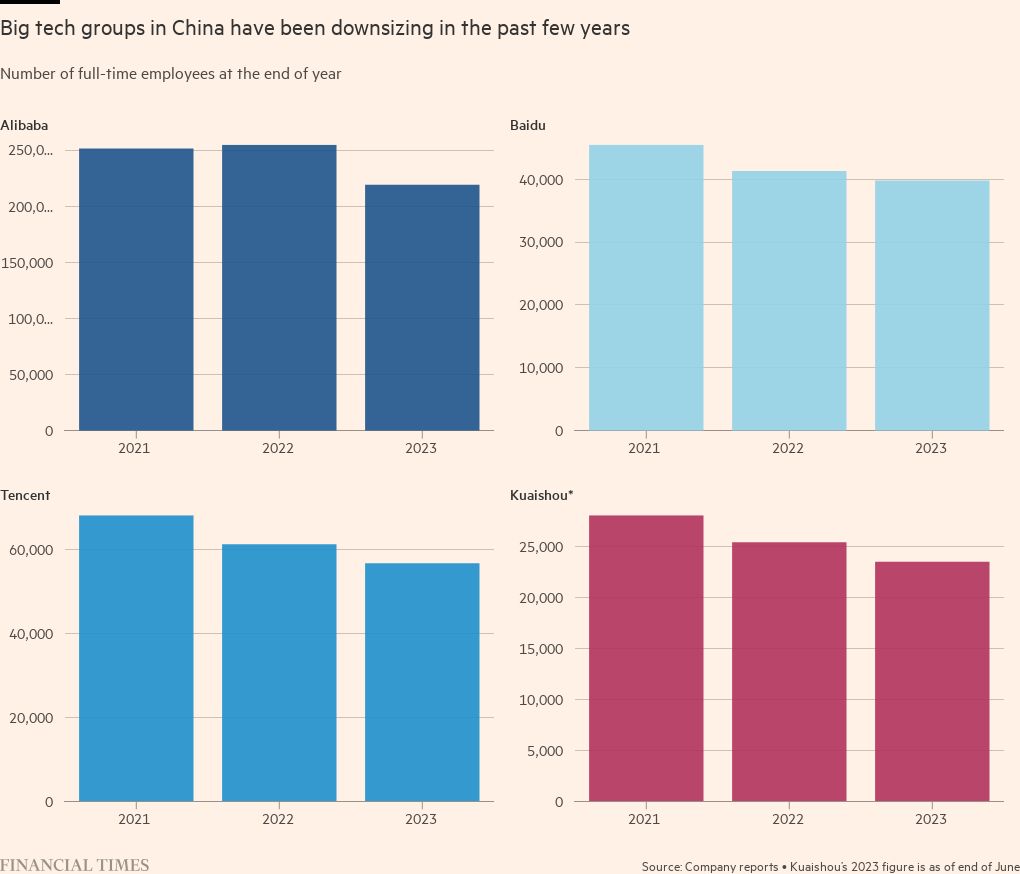

Age discrimination is particularly apparent in China’s tech sector, where older staff are widely perceived as being less willing to put up with the infamous 996 schedule — 9am to 9pm, six days a week. Tech executives openly state their preference for youth, a trend that has become only more entrenched with progressive waves of job cuts in the tech sector, driven by an economic slowdown and regulatory concerns.

Take a break from the news

How can you make work from home wonderful, asks Rhodri Marsden. A walking pad, Razer’s latest chair, a hi-fi speaker and Apple’s newest MacBook Air is what he recommends, and more.

Additional contributions from Nora Redmond and Irwin Cruz

Recommended newsletters for you

Working It — Everything you need to get ahead at work, in your inbox every Wednesday. Sign up here

One Must-Read — The one piece of journalism you should read today. Sign up here