Swedish gaming break-up powers up stock for struggling investors

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Sweden is Europe’s capital markets winner of the past decade, with more companies listing than in Germany, Italy or France.

Games maker Embracer is doing its bit to maintain that trend: it announced plans on Monday to split into three separate groups — all listed on the Nasdaq Stockholm exchange. This is a pragmatic solution to the company’s excessive debts but an attractive one.

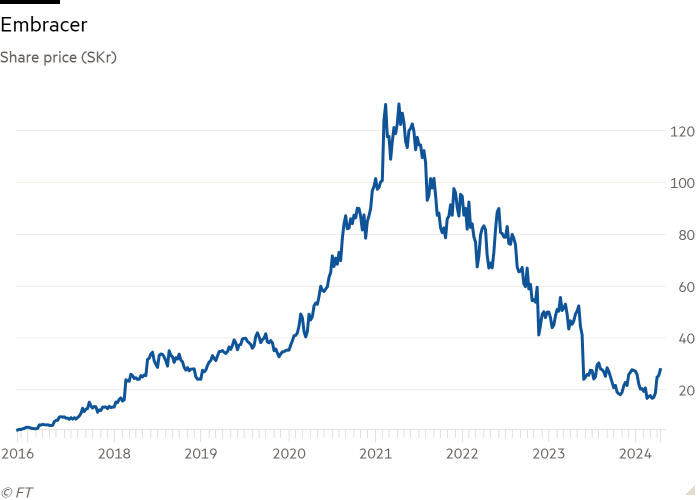

Embracer is the creation of entrepreneur, chief executive and controlling shareholder Lars Wingefors. He started out selling used comic books and video games as a teenager. The company — which operates across tabletop, mobile, PC and console gaming — rode the pandemic gaming boom, with its shares soaring more than threefold between 2020 and 2021. Slowing revenue growth brought a sharp return to reality. Asset sales have reduced debts. A break-up is a radical but necessary next step to progress.

The split along divisional lines makes sense. Board games will be spun off first this year under the name Asmodee: steadier revenues and lower capital requirements mean it will carry the existing debt burden. Coffee Stain & Friends, maker of mobile and free-to-play games, will be a second spin-off next year. The remaining group will contain the marquee names such as Lord of the Rings and Tomb Raider and continue trading as Middle-earth Enterprises & Friends.

The debt from years of dealmaking, plus the failure of a slightly mysterious strategic partnership, in effect forced Embracer’s hand. Net debt stood at about €1.4bn at the end of last year; a promise to halve that by March was going to be missed. The sale of Gearbox Entertainment and Saber Interactive earlier this year took net debt to some €0.9bn today.

Almost all of that will be taken on by Asmodee once it is spun off. Its leverage will be 3.9 times ebitda, high but manageable given the lower volatility in earnings. Shorn of this debt, the two other businesses — with more volatile earnings from video game development, especially in blockbuster titles — should be a more straightforward proposition for investors.

All that should help close the discount on the company’s shares. These rose by a tenth on the deal’s announcement to value the equity at €3.3bn, or an enterprise value of just over 4 times 2025 ebitda. Debt free, the two computer game makers should be worth closer to six times forward ebitda. Another €1bn in equity gains could follow as the deal moves through the next levels.