How would an armed conflict, an epidemic, or a flood affect the economy? “Being able to assess—perhaps even predict—the economic impact of such crises is essential when it comes to mitigating and counteracting the damage,” says Christian Diem from the Complexity Science Hub (CSH).

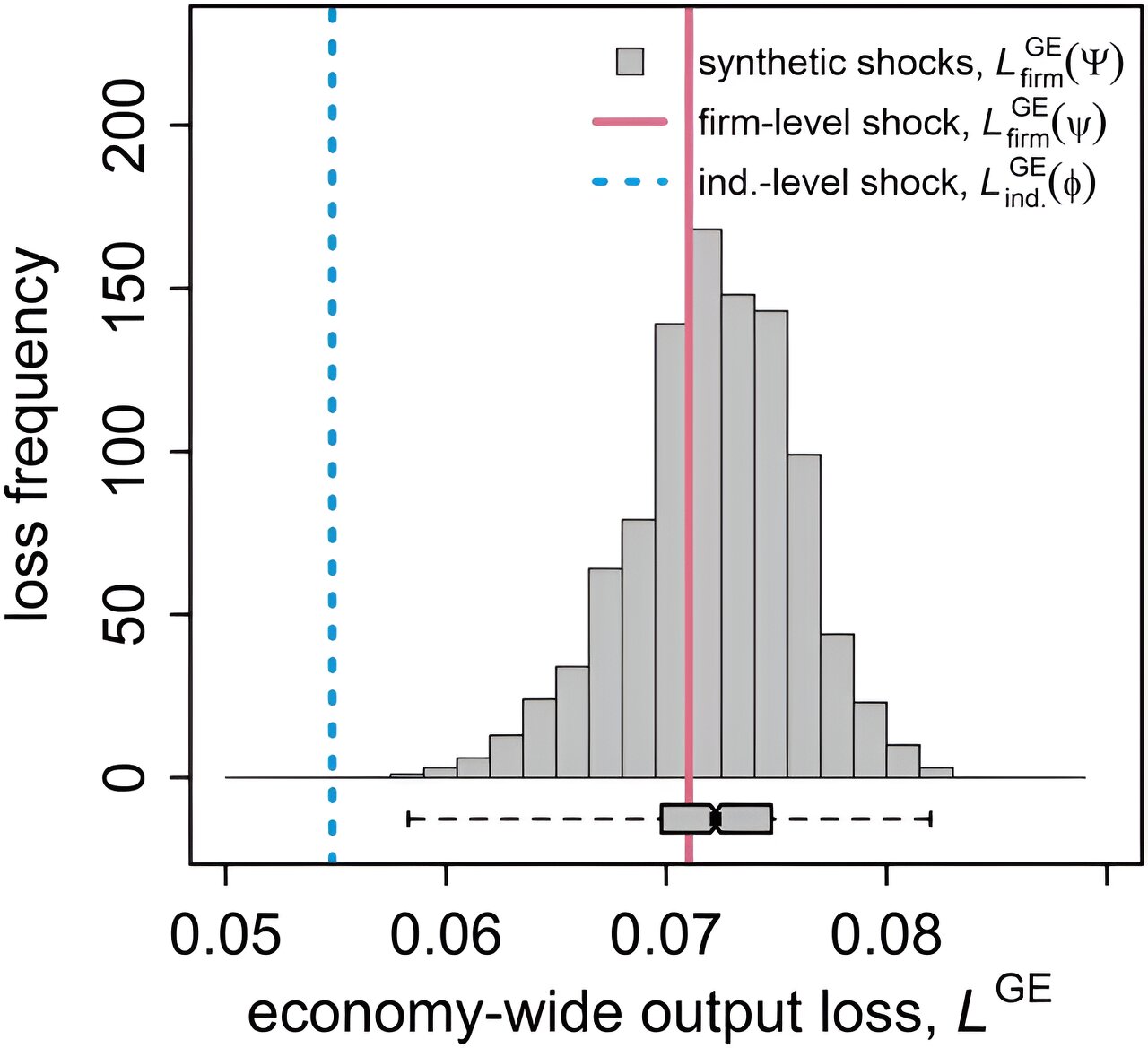

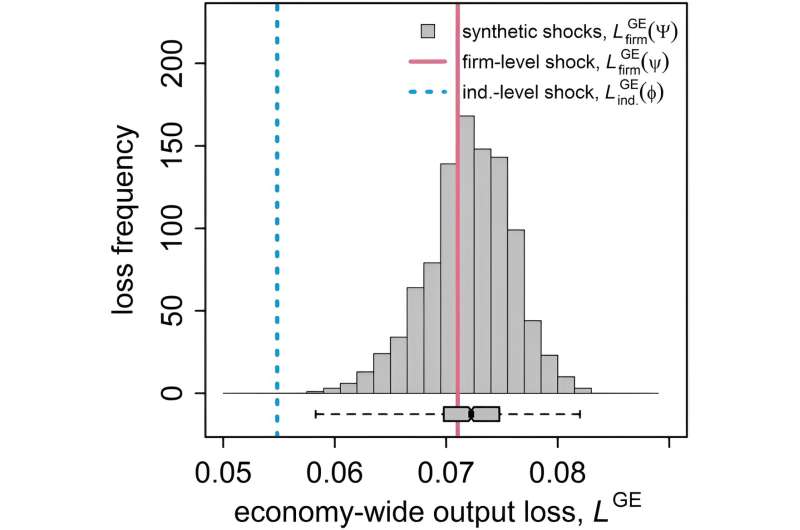

According to a recent study published in PNAS Nexus, countries seeking to prepare better for crises may benefit from a unique dataset of granular supply chain data. CSH researchers report, for the first time, that widely used sector-level economic data can underestimate the economic impact of crises by up to 37% compared with company-level highly detailed data.

VAT data

“We had access to a unique dataset of value-added tax (VAT) information—a general tax that, in principle, is applied to all goods and services—from Hungary for this study. It contains 243,399 companies and allows the reconstruction of 1,104,141 supply relationships, virtually representing the entire national economy,” explains Stefan Thurner from the CSH.

This allowed the researchers to systematically analyze and compare how the effects of crises are assessed differently when either only data on the 88 economic sectors defined by the European Union is available or when detailed supply chain data is available at the company level, which includes all companies and their customer-supplier relationships.

A total of 1,000 hypothetical crisis scenarios were simulated for this purpose. In order to ensure that the scenarios replicated real crises, the hypothetical crises were based on actual empirical data on the economic consequences of the COVID-19 crisis at the beginning of 2020.

“We were very surprised to find that the economic impact of each of the 1,000 simulated crises was systematically underestimated—by up to 37%—if we only used the data for entire sectors, as has always been the case,” explains Diem.

In addition, the results at the company level were much closer to those of the actual recession in the second quarter of 2020. In this way, a crisis’ consequences are always estimated as smaller at the sectoral level than they actually are at the company level.

Atoms of the economy

“Up to now, the economy of a country has mainly been described at the level of entire economic sectors,” explains Thurner. “In other words, we talk about how badly the entire automotive industry is affected by supply bottlenecks. The new data on the entire supply chain at the company level allows us to see the atoms of the economy—the companies—and how they interact with each other. This is a new scientific territory, and it is extremely fascinating.”

“Now we can calculate how individually affected companies within economic sectors are by a crisis rather than just describing the average for an entire sector.”

“There is a great deal of difference between simply stating that an economic sector is going to suffer 20% losses, for example, and whether a simulation can reveal which companies are likely to be actually affected by the crisis and which are not. Perhaps even more important is to show how this spreads through the supply network—how it affects their direct and indirect trading partners,” adds Diem.

More than 160 countries have a VAT system and could, in principle, use it to reconstruct their supply networks—one notable exception is the United States. As of now, only a dozen countries collect the data that can be used to reconstruct supply links. The list includes EU member states like Spain, Belgium, and Hungary, as well as countries like India, China, and some African and Latin American nations.

For countries that don’t collect their VAT data in the right way—for instance, Germany and Austria—a small tweak in the VAT reporting of firms would do the trick while creating minimal additional bureaucratic work for companies. “This could be automated through firm accounting software,” explains Diem. It could also reduce forms of VAT fraud.

“With this study, we wanted to show how much estimates based on aggregated sector data can differ from estimates based on granular data and the actual economic impact and how important it is to collect detailed data at the company level,” says Diem. No matter what the threat is, whether it is a flood disaster, CO2 emissions, or the consequences of political interventions, an accurate assessment can help anticipate the consequences and, above all, react quickly and accurately.

More information:

Christian Diem et al, Estimating the loss of economic predictability from aggregating firm-level production networks, PNAS Nexus (2024). DOI: 10.1093/pnasnexus/pgae064

Provided by

Complexity Science Hub

Citation:

Value-added tax data could help countries prepare better for crises (2024, March 27)

retrieved 27 March 2024

from https://phys.org/news/2024-03-added-tax-countries-crises.html

This document is subject to copyright. Apart from any fair dealing for the purpose of private study or research, no

part may be reproduced without the written permission. The content is provided for information purposes only.