Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Tom Hayes has failed in his attempt to overturn his conviction for rigging an interest rate benchmark as the Court of Appeal in London upheld the guilty verdict handed to the former UBS and Citigroup trader nine years ago.

Hayes became the first person in the world to be found guilty by a jury over the Libor scandal and served five-and-a-half years in prison. He was one of nine individuals successfully prosecuted by the UK’s Serious Fraud Office for rigging benchmark rates.

Handing down the Court of Appeal ruling on Wednesday, Lord Justice Bean said there was “indisputable documentary evidence” Hayes had sought to move Libor. He had also made “frank admissions of dishonesty”. This “carried the clear implication that he knew what he was doing was not permitted”.

The Court of Appeal heard Hayes’s case this month alongside that of Carlo Palombo, a former Barclays trader similarly convicted of manipulating Euribor, another benchmark rate, who received a four-year sentence.

They were given the chance to clear their names after a review by the Criminal Cases Review Commission, which investigates potential miscarriages of justice.

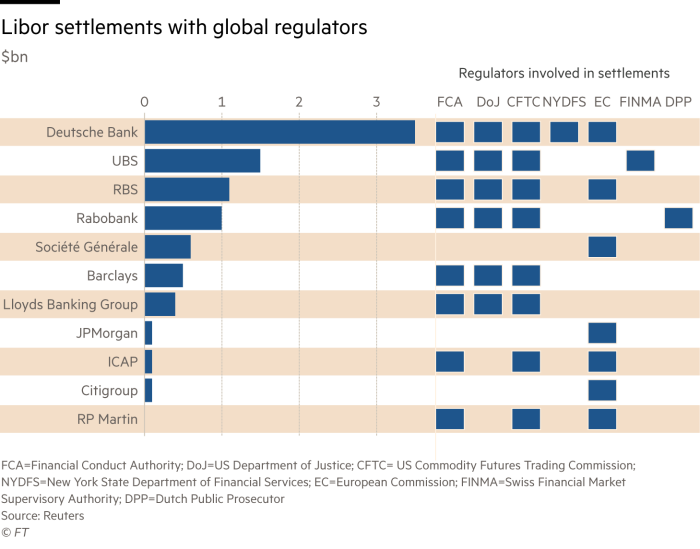

The pair made their appeal over a decade after the scandal erupted over Libor — or the London Interbank Offered Rate — which sent shockwaves through financial markets and went on to cost banks billions in fines and settlements.

A central part of Hayes’s appeal case was that a 2022 judgment in the US had overturned the convictions of two former Deutsche Bank traders, Matthew Connolly and Gavin Black, for their part in an alleged Libor rigging scheme, and led to all charges against Hayes in the US being dropped.

However, in a summary of the Court of Appeal judgment, Lord Justice Bean — who heard the case alongside Lord Justice Popplewell and Mr Justice Bryan — on Wednesday said that the US ruling did not “cast doubt on the correctness of the previous decisions” of the English courts “as a matter of English law”.

“Both appeals are dismissed,” he said.

Speaking after the decision, Hayes called for the UK’s Supreme Court, which sits above the Court of Appeal, to hear the case. He said the decision handed down on Wednesday was inconsistent with Libor court rulings in several other jurisdictions. It was “time to hear this at the highest level”, he said.

“Frankly it’s a shock,” said Hayes of the ruling. “I felt that we made very strong arguments” during the appeal.

Hayes was convicted after a two-and-a-half month trial in 2015. He was found guilty by a jury of eight counts of conspiring to rig Libor and described by one investigator in the case as the “Machiavelli of Libor”.

The former trader was sentenced to 14 years in prison, the toughest sentenced handed down in the UK for financial fraud, later reduced on appeal to 11 years, of which he served about half.

Nicknamed “Rainman” as he was deemed to be obsessed with numbers, Hayes was a star yen derivatives trader at UBS in Tokyo between 2006 and 2009 and claimed to have generated more than $280mn in profits for the bank. He was poached by Citigroup with a $4.2mn joining bonus but dismissed 10 months later as the Libor scandal gained pace.

Libor was a benchmark interest rate, since replaced, determined by daily submissions from several “panel banks”. It was used for decades to underpin trillions of pounds of products around the world such as loans and mortgages.

During his 2015 trial, Hayes said that he was only trying to do his job well and did everything with the knowledge of his superiors. Prosecutors said Hayes acted as the ringleader in manipulating yen Libor by asking rate setters and traders at UBS — as well as at other banks and external brokers — to move the rate up or down in ways that would benefit his trading positions.

At issue during his most recent appeal was whether traders were allowed to take commercial considerations into account when submitting Libor rates.

Hayes’s barrister, Adrian Darbishire KC, had told the Court of Appeal that it was not in dispute that Hayes’s Libor submissions were “intended to advantage [his] trading” but he did not think he was in breach of the rules.

The SFO said in a statement on Wednesday: “The Court of Appeal’s judgment is clear that these convictions for fraud are still as relevant today as 10 years ago.

“No one is above the law and the court has recognised that these convictions stand firm.”