Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Apple may have halted its efforts to build an electric car but Chinese smartphone maker Xiaomi is accelerating. Even with Tesla and BYD dominating the home market, being a smartphone maker gives it the potential to carve out space in China’s saturated EV market.

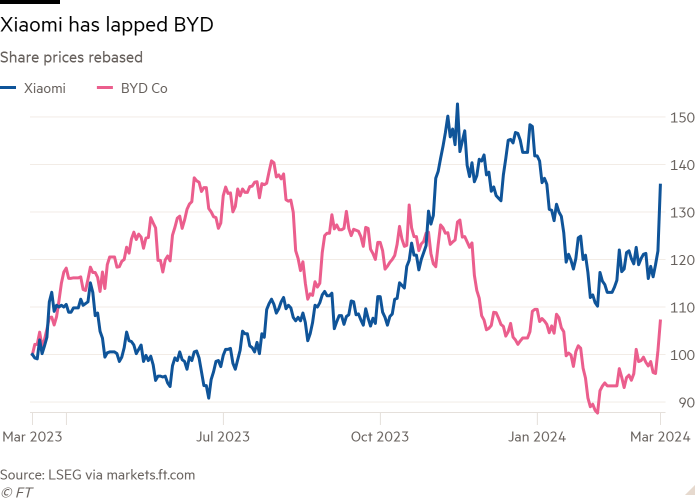

Xiaomi’s shares rose 12 per cent on Tuesday, after it said it would start selling its much-anticipated SU7 vehicles this month. The company has spent more than Rmb10bn ($1.4bn) and more than three years to develop the cars.

During those three years, China’s BYD has taken hold of the local market with more than a third of the sector. Generous state reimbursements for EV purchases ended in 2022. In the past year, a price war between local groups and Tesla has intensified, putting pressure on margins. Meanwhile, sales of battery-powered EVs rose 18.2 per cent in the first two months of the year, slower than the 21 per cent for the full year last year, according to data from the China Passenger Car Association.

Despite the growing challenges, Xiaomi’s SU7 has several differentiating factors. One is its partnership with state-owned Beijing Automotive Group Co to produce the EVs, which gives it an edge in manufacturing. Another is performance, the SU7 can go from 0-100km/h in 2.8 seconds and has a reported range of up to 800km.

The biggest advantage however will come from its access to smart technology and the ability to integrate the car with its smartphones and other electronics in its portfolio.

Until now, local EV makers have either focused on affordable mass market EVs or high-end segments by rolling out supercars or full-size luxury SUVs. There is room to carve out a profitable niche by differentiating vehicles using software and smart functions.

Smartphone makers, which own a wide range of technologies such as cameras, sensors and satellite connectivity have a head start in the race to create smart cars. Xiaomi, for example, owns proprietary autonomous driving technology that uses perception algorithms, high-definition cameras and ultrasonic radars for enhanced visibility, driving precision and to avoid collisions. Local smartphone maker Huawei also launched the Aito M9 priced at about $66,500 at the end of last year.

Xiaomi shares are up about 30 per cent in the past year and trade at 20 times forward earnings, a premium to both local smartphone and EV rivals. That reflects growth expectations from its EV business. Xiaomi must use the brand loyalty of its millions of smartphone users to overcome its late arrival in the EV market.