Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

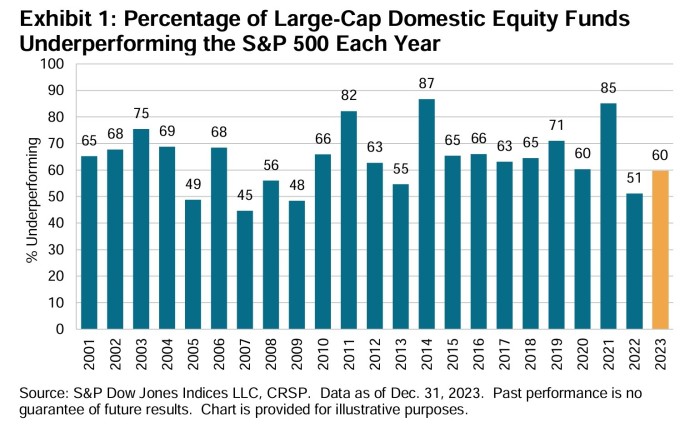

FT Alphaville wanted to let it lie, but the levels of “this is a good time for active management” guff have grown too damn high — even BlackRock is getting in on it, ffs. That’s right: we’re covering the latest SPIVA scorecard.

For the uninitiated, SPIVA stands for the S&P Indices Versus Active, and is the benchmark provider’s regular check-up on how many active mutual fund managers underperform the market. The annual scorecard for the US was released yesterday.

And, lo:

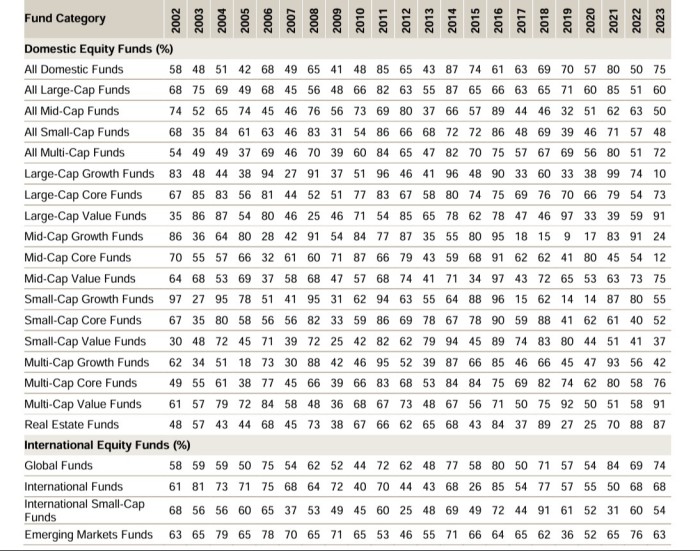

This wasn’t just a narrow large-cap US stockpickers vs S&P 500 issue either.

The more fulsome table shows that only 25 per cent of all US equity funds, 26 per cent of global funds, and 37 per cent of emerging market funds managed to beat their indices last year.

S&P didn’t include the full table for its fixed income categories due to some methodology changes, but noted that only 41 per cent of all bond funds managed to outperform last year — despite it being supposedly easier to generate alpha in fixed income.

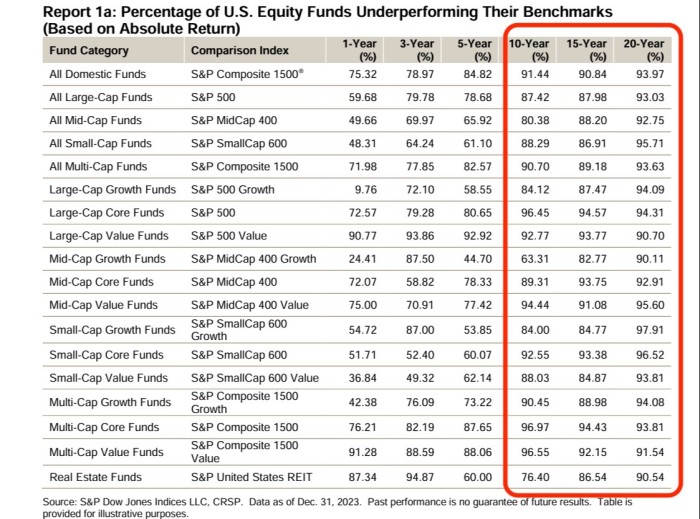

Just to stress, this isn’t because fund managers are bad or lazy (though they do charge far too much, creating a rod for their own back). In fact, they’re so good that consistently generating outperformance is getting harder.

Moreover, as Alphaville has written many, many times before, investment returns are always skewed by a minority of securities. That makes it hard for active managers to beat the market in any given year, and almost impossible in the long run. By the way, that long-term data remains miserable:

However, some eagle-eyed FTAV readers might have spotted an interesting tidbit in the first table: large-cap growth fund managers had a phenomenal year, with only 10 per cent underperforming their benchmarks.

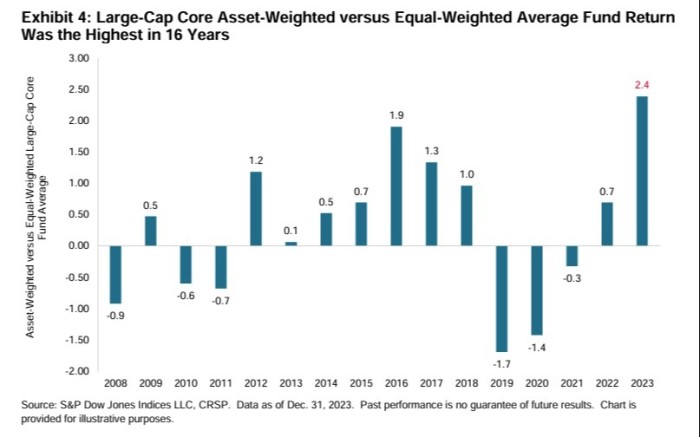

The 90 per cent beat rate is the best since at least 2002, when the SPIVA data starts. This appears to have driven the widest dispersion between the performance of large and small funds on record.

That’s all for now — see you back here next year, when we can once again revisit the annual “active manager comeback” narrative.