Stellantis joins global carmakers in Brazil push with $6bn investment

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Stellantis has unveiled a R$30bn (US$6.1bn) programme to upgrade production in Brazil, taking a wave of investment pledges by global carmakers in Latin America’s largest economy this year to $14bn.

The owner of the Fiat, Peugeot and Jeep brands on Wednesday said its capital expenditure commitment for the five years to 2030 was a record by any carmaker for the South American automotive industry.

Stellantis’ updated strategy will focus on adding an electric component to so-called ‘flex-fuel’ vehicles, which can run on petrol or ethanol and are common in Brazil. Its first flex-hybrid offering will be launched later this year under a drive to release 40 new models by the end of the decade.

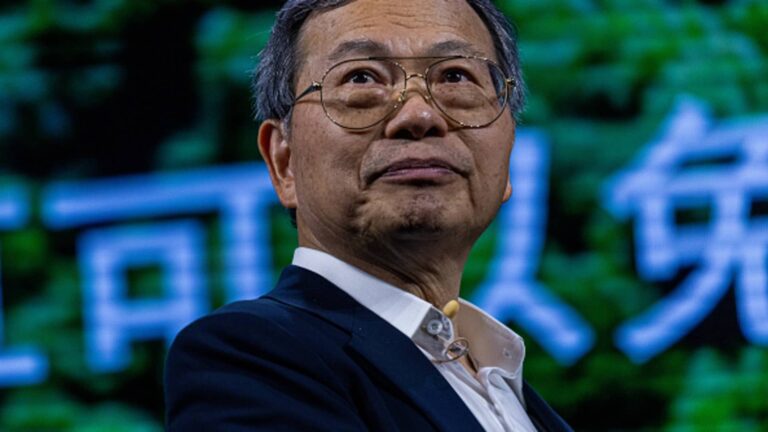

“As a fundamental part of our growth strategy, South America will assume a leading role in accelerating the decarbonisation of mobility,” said chief executive Carlos Tavares.

Multinational carmakers have given a firm vote of confidence in Brazil in 2024, with significant funding also confirmed in recent weeks by Volkswagen, Toyota, Hyundai and General Motors, together totalling R$69bn.

Many of the plans involve some element of electric vehicles or hybrids, in line with President Luiz Inácio Lula da Silva’s aspirations for a ‘green’ revival of Brazilian industry. Stellantis’ announcement followed a meeting between executives and the leftist leader, the company said.

A day earlier, Toyota outlined R$11bn for its facilities in the country by the end of the decade. Its package also includes the production of new hybrid-flex cars, along with the creation of 2,000 jobs.

The investment promises have been trumpeted by the leftwing administration in Brasília, which is offering tax breaks and incentives for companies producing less-polluting cars.

Tavares praised a government policy promoting clean technologies in transport: “[It] is an extremely pragmatic programme, very intelligent in its execution, in its concept.”

Globally, Stellantis is investing some €50bn in electrification over the next decade, with a goal to achieve net zero carbon emissions by 2038.

The company has a target for 20 per cent of its Brazilian sales to be fully electric models by 2030, with the remainder a mix of traditional international combustion engines and hybrids.

Stellantis, which already manufactures EVs in Europe and North America, aims to produce fully electric vehicles as soon as 2026 in South America, said Tavares, adding it would depend on bringing down costs through scale.

Brazil is the world’s sixth-biggest automobile market, according to Statista. But it lags behind on electric vehicle adoption, which experts attribute in part to its widespread flexible fuel engines, which can be filled with ethanol derived from sugarcane or corn. Proponents of the biofuel say it results in less carbon dioxide emissions than petrol.

The world’s largest electric-car maker, China’s BYD, last year chose Brazil for its first factory outside Asia with a R$3bn investment. Its compatriot Great Wall Motor is spending about $2bn on EV and hybrid production in the country.

Additional reporting by Beatriz Langella and Peter Campbell