Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

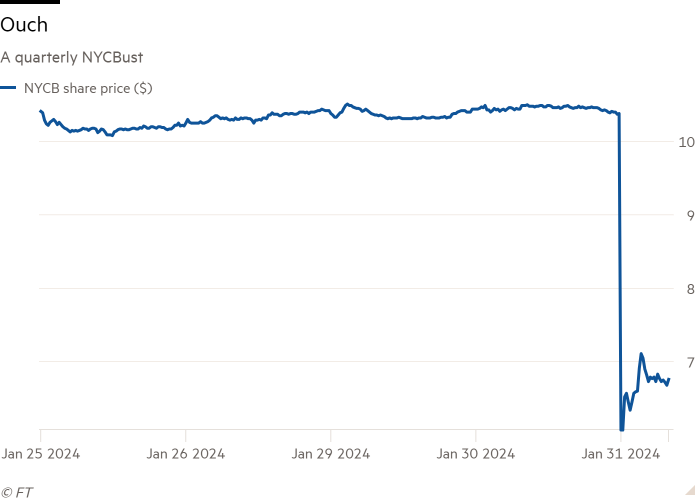

Shares of New York Community Bancorp are getting wrecked Wednesday after a quarterly earnings report full of bad surprises.

Management’s go-to message was that NYCB’s acquisition of Signature Bank, one of the banks that shut down last year, pushed it into a new size category for regulation. That requires the bank to take extra steps to build a stronger capital base. From management on today’s earnings call (transcript via AlphaSense):

However, this acquisition ultimately will become a $100 billion-plus bank sooner than we had anticipated, subjecting us to enhanced prudential standards, including risk-based and leverage capital requirements, liquidity standards, and requirements for overall risk management and stress testing . . .

We are also accelerating our capital build by reducing our common stock dividend to $0.05 per share. We understand the importance and the impact of this decision to our stockholders. This was not made lightly. While NCYB remains well-capitalized under all applicable regulatory requirements, resetting our capital allocation priorities was a necessary step to accelerate the building of our capital.

NYCB mentioned building reserves for losses on offices as well, and had to write down a couple of sizeable loans. Again, management pointed to the new regulatory size category to explain:

We looked at the marketplace, looked at the office perspective and the general office weaknesses throughout the country, and we really did a deep dive in the office portfolio as well as thinking through payment shock and interest rate shock given the rise of interest rates that we’ve experienced over the past few quarters, in particular the impact to our customers in respect to repricing. We took into account that perspective and clearly had significant additions to our reserve build where a lot of that reserve build went into the office in particular. I believe the number went from 200 basis points reserve from Q3 to 800 basis points reserve in particular for office . . .

That being said, 800 basis points, I believe, gets us very close to – in line with our current peer group, which is a new peer group Category IV banks as I indicated in my previous remarks. And we’re confident that we continue to look at the portfolio at – in significant detail as we are now benchmarking ourselves into a marketplace that has changed – no question has changed, and with focus being on payment shock, interest rate shock, and the developments in the commercial.

As you might guess from the share-price chart above, there’s more going on here. For one, management mentioned last year’s 90-per-cent (!!) slowdown in originations of loans for multifamily housing.

But its steep and surprising decline in net interest margin is key.

NYCB reported NIM much lower than it itself had previously forecast. Management mentioned that higher deposit costs contributed to that as well, which doesn’t fit as nicely with its “blame the regulators” message:

The fourth quarter net interest margin came in at 2.82%, down 45 basis points compared to the third quarter. This was 18 basis points lower than our guide, down 27 basis points. The 18 basis points variance to the guidance was largely due to actions related to increase our on balance sheet liquidity and higher deposit costs.

The following exchange, between management and JPMorgan’s Steven Alexopoulos, was especially notable (our emphasis):

Q: So if I put together everything you guys just said, why not just give us what you think net interest income will be in 2024, so we’re not all guessing and maybe your stock won’t trade down to $7? Like, John, why don’t you just tell us where you – you might be wrong, because you said – basically we do. We just took earning assets. We applied your margin. We go – said, okay, this is where NII is. It’s falling out with the other mid-points and it’s down substantially. You’re saying it’s not that, but you just cut the dividend, maybe do your shareholders a favor and tell us what do you think NII will be in 2024. You know better than we do because what was impacted fully in the quarter. There’s certain actions you took which didn’t fully impact the quarter. So why not just give the color? So why don’t just . . . give the number, make life easy.

A: Yeah. Absolutely. When we looked at…

Q: . . . your stock’s at a 25-year low. I can’t imagine you’re happy with this. So unless you want – I don’t know why you wouldn’t take this opportunity to level set expectations.

A: Well, Steven, we’re very focused that the market will truly understand the strategy going forward. We’re in a Category IV bank strategy. We were well-positioned in the closing of Flagstar at the end of last year and an opportunity came up to acquire Signature Bank. We took advantage of that opportunity. We’re very grateful to have the FDIC approve that transaction and we’re in a different perspective when it comes to our peer group. These necessary steps need to happen in respect to rightsizing ourselves around the category peers. And clearly, going forward we’re focusing on building the bank and the market understand the strategy. We appreciate your commentary on guide. We wanted – we felt it was prudent for us to give some guidance for the full year. As you know, Steven, you’ve been covering us for a long time giving quarterly guide. We want to expand that.

But as John indicated, a lot of this is significant cash balances at a slight negative carry that’s impacting the drag on the margin. And as we reset ourselves into the future, we believe that the market will truly understand the expectations of our Category IV both the capital build, which is driven off the dividend adjustment along with the guidance that we have, which is we feel it’s something that we felt more transparent as going out a full year, not just the quarter, to show where our CET1 expectations will be at the end of 2024 and more importantly, rightsize ourselves for the future as we build out a new Category IV expectations.

Not much of an answer here, besides “hey, at least we’re forecasting the full year instead of the quarter like we used to.” Going by today’s trading, shareholders might’ve preferred the status quo.