Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

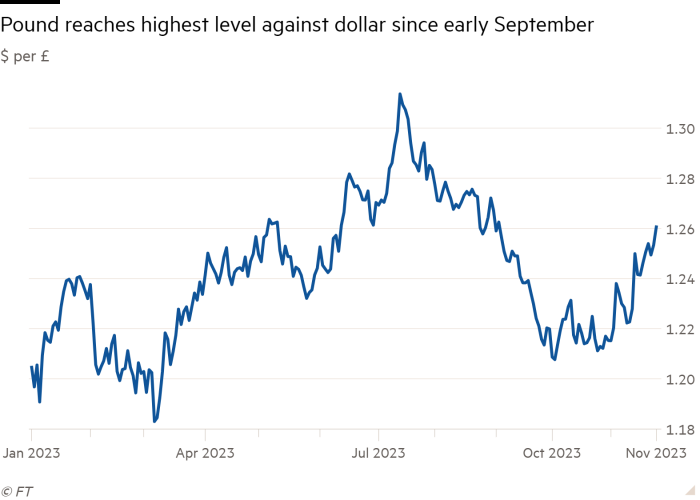

UK consumer confidence rose sharply in November, according to a closely watched survey on Friday that damped expectations of interest rates cuts and pushed the pound to a 12-week high.

The GfK consumer confidence index rose six points to minus 24, outperforming expectations and raising hopes of higher spending on Black Friday and the festive season.

The index — a measure of how people view their personal finances and broader economic prospects — was a further sign of British economic resilience after better than expected data on private sector activity a day before.

The data bolstered markets bets that the Bank of England will hold its benchmark rate at its current high of 5.25 per cent for longer than previously thought. Consumer confidence is closely watched because it provides a near real-time indicator of shoppers’ mood and spending behaviour.

“Markets had pulled forward interest rate cuts to levels that, I think, were quite simply unrealistic,” said Peter Schaffrik, chief European macro strategist at RBC Capital Markets. “Now we have data that slightly contradicts that, so the markets are taking some of it back.”

Investors now expect the BoE to deliver its first rate cut by September next year. At the beginning of the week, they were betting it would come by June.

The pound rose 0.6 per cent against the dollar to trade at $1.26, the strongest level since September 4.

Benchmark 10-year gilt yields, which move inversely to prices, rose 0.05 percentage points to 4.31 per cent on Friday, having climbed 0.1 percentage points in the previous day’s trading session.

Schaffrik said another factor driving the sell-off in gilts was a warning by Huw Pill, the BoE’s economist, in an interview published by the Financial Times on Friday that price pressures remained “stubbornly high”.

“The previous communication that he, specifically, has delivered has been a bit more supportive of rate cuts,” Schaffrik added. “He’s now toeing the party line.”

A fall in household spending contributed to the stagnation of the UK economy in the three months to September, but the improvement in consumer confidence in November suggests spending could rise in the busiest shopping season of the year.

The metric has been volatile in recent months, boosted by falling inflation and strong wage growth but dragged down by high borrowing costs and rising fuel prices.

Joe Staton, client strategy director at GfK, said the improvement in consumer confidence “will be good news for retailers looking to benefit from Black Friday and Christmas”.

Purchasing managers surveys, a measure of private sector activity, were also better than expected for November, with growth returning after three months of contraction. The data, released on Thursday, also indicated persistent price pressures.

Tomasz Wieladek, chief European economist at T Rowe Price, said the improved business and consumer sentiment suggested it was “plausible the Bank of England was too pessimistic” in forecasting a prolonged period of UK economic stagnation.

“Therefore, there is a risk markets have too many cuts priced in, especially when wage inflation remains at these elevated levels,” he added.

Richard McGuire, head of rates strategy at Rabobank, said: “The market has been on a knife-edge for some time: it doesn’t take much in terms of a firmer datapoint or flow to see the market undertake a violent swing.”