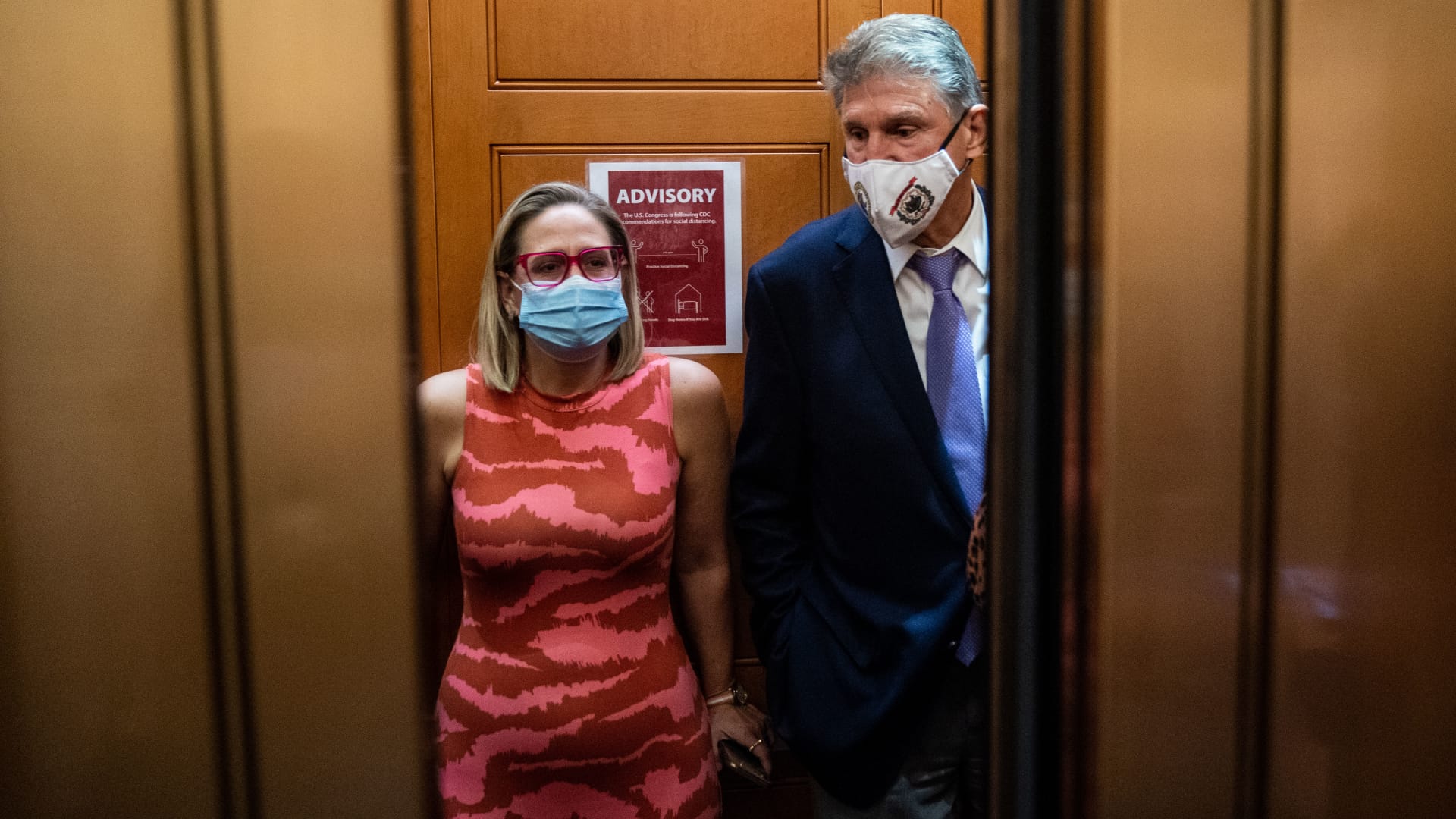

Sen. Kyrsten Sinema, D-Ariz., and Sen. Joe Manchin, D-W.V., on Capitol Hill on Sept. 30, 2021.

Jabin Botsford | The Washington Post | Getty Images

Senate Democrats passed a historic package of climate, healthcare and tax provisions on Sunday.

But one proposed tweak to the tax code — a modification of so-called carried interest rules — didn’t survive due to objections from Sen. Kyrsten Sinema, D-Ariz., whose support was essential to pass the Inflation Reduction Act in an evenly divided Senate. The bill now heads to the House, which is expected to pass it this week.

Many Democrats and opponents refer to the lower tax rate on carried interest as a loophole that allows wealthy private equity, hedge fund and other investment managers to pay a lower tax rate than some of their employees and other American workers.

“It’s a real rich benefit for the wealthiest of Americans,” said Steve Rosenthal, a senior fellow at the Urban-Brookings Tax Policy Center. “Why should a private-equity manager be able to structure his or her compensation with low-taxed gains? That seems wrong.”

Here’s what carried interest is, and why many Democrats want to change how it’s taxed.

Carried interest compensates investment executives

Carried interest is a form of compensation paid to investment executives like private equity, hedge fund and venture capital managers.

The managers receive a share of the fund’s profits — typically 20% of the total — which is divided among them proportionally. The profit is called carried interest, and is also known as “carry” or “profits interest.”

Here’s where the tax controversy lies: That money is considered a return on investment. As such, managers pay a top 20% federal tax rate on those profits, rather than regular federal tax rates of up to 37% that apply to compensation paid as a wage or salary.

That preferential 20% tax rate is the same as “long-term capital gains,” which applies to investments like stocks, bonds, mutual funds and real estate held for more than a year.

Bulk of fund managers’ compensation is carried interest

Carried interest accounts for the “vast majority” of compensation paid to managing partners of private equity funds, according to Jonathan Goldstein, who leads the Americas private equity practice at Heidrick & Struggles, an executive search firm.

For example, carried interest accounts for at least 84% of managing partners’ total compensation, on average, according to a Heidrick & Struggles 2021 survey. The share varies, depending on a firm’s assets under management, though skews well over 90% among partners at larger firms.

More from Personal Finance:

How the Inflation Reduction Act preserves expanded health subsidies

These 30 companies will help employees pay off their student loans

Reconciliation bill includes nearly $80 billion for IRS funding

In dollar terms, managing partners’ carried interest ranged from $10 million to $102 million, on average, according to the survey, again depending on overall assets under management.

Additionally, while capital gains for wealthy investors are generally subject to an additional 3.8% Medicare surtax, not all carried interest is subject to this “net investment income tax,” according to tax experts. When it is factored in, managers that are subject to the tax would owe a 23.8% total top tax rate at the federal level, when added to the 20% top rate for capital gains.

Some say it’s a ‘stain’; others, a ‘successful policy’

Wealthy investors, including Warren Buffett and Bill Ackman, have lambasted the tax treatment of carried interest.

“The carried interest loophole is a stain on the tax code,” Ackman, the chief executive of Pershing Square, wrote July 28 on Twitter.

However, other tax experts and proponents of the current tax structure think a lower rate on carried interest is appropriate, benefiting investors and the economy. Raising taxes on fund profits would be a disincentive for managers to take risk and would reduce investment capital, they said.

“Carried interest is appropriately taxed as a capital gain and a successful policy that incentivizes investment in the U.S. economy,” according to Noah Theran, the executive vice president and managing director of the Managed Funds Association, a trade group.

Higher tax rates could also have “spillover effects” by reducing the rate of return for investors like pension funds and other institutions, said Jennifer Acuna, a partner at KPMG and former tax counsel for the Senate Finance Committee.

“The policies have been going back and forth for many years, on what is the right policy to tax carried interest,” Acuna said. “I don’t think it’s a slam dunk.”

Proposal would have curtailed carried interest

A deal brokered by Senate Majority Leader Chuck Schumer, D-NY, and Sen. Joe Manchin, D-W. Va., initially proposed curtailing the tax break for carried interest. However, the proposal was removed from the final legislation that passed the Senate.

Most significantly, the proposal would have required fund managers to hold portfolio assets for five years — an increase from three years — in order to receive the preferential 20% tax rate.

Managers with a holding period of less than five years would incur “short-term” capital gains tax rates on carried interest — a 37% top rate, the same that applies to wage and salary income for the highest-income taxpayers.

Another proposed tweak would have effectively lengthened that holding period beyond five years, according to Rosenthal.

That’s because the initial proposal would have started counting the five-year clock only after a private-equity fund made “substantially all” of its investments — a term that isn’t specifically defined but which tax experts would generally consider as 70% to 80% of a fund’s investment capital being committed, Rosenthal said.

In practice, that would likely have extended the effective holding period to roughly seven to nine years, a policy that “had some bite,” he added.

Democrats estimated that the proposed changes to the carried interest rules would have raised $14 billion over 10 years.