Receive free Markets updates

We’ll send you a myFT Daily Digest email rounding up the latest Markets news every morning.

Global stocks fell on Thursday, as fresh data pointing to continued resilience in the US labour market added to investor jitters over inflation while Apple helped drag technology stocks lower.

Wall Street’s benchmark S&P 500 fell 0.4 per cent and the technology-focused Nasdaq Composite declined 1.2 per cent, extending losses from the previous trading session. Tech giant Apple fell 3.3 per cent after reports that China was broadening a ban on the use of iPhones.

In Europe the region-wide Stoxx Europe 600 ended the day 0.1 per cent lower, marking its seventh successive day of losses. Germany’s Dax also declined 0.1 per cent.

Weighing on markets was data from the US Department of Labor showing that initial unemployment claims decreased to 216,000 in the week ending September 2, their lowest level since February this year and below analysts’ expectations.

The data added to numerous recent signs that the US economy remains resilient despite the federal funds rate having climbed to a 22-year high, adding pressure on policymakers to keep policy tight for longer. A day earlier, a separate survey revealed that the US service sector unexpectedly expanded in August.

“Higher for longer is not what investors want to hear, but this message hampered global markets this week as economic data made for uncomfortable reading,” said Lewis Grant, senior portfolio manager for global equities at Federated Hermes.

“Even if the Fed is done with its rate hikes, it may need to hold its key interest rate for longer than previously expected if the economy continues to be this strong,” said Karl Steiner, chief quantitative strategist at SEB Research.

The dollar, which tends to rise when investors expect higher US rates, added 0.1 per cent against a basket of six currencies on Thursday, remaining near its highest level since March.

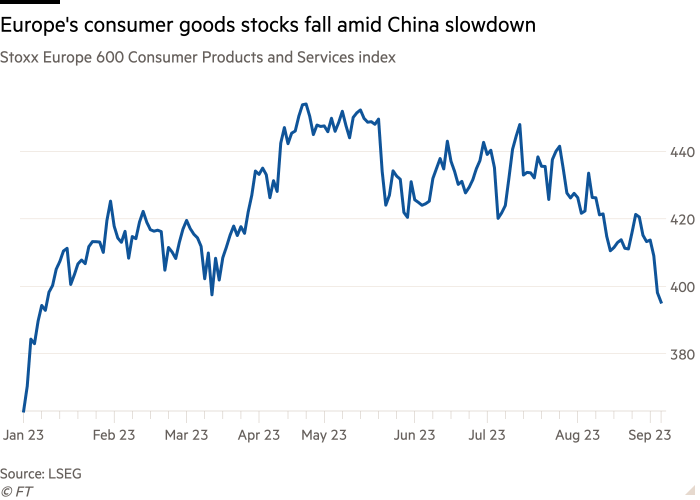

In Europe, the Stoxx Consumer Products and Services index fell almost 3 per cent and hit its lowest level since the start of this year, as investors worried that an economic slowdown in China could lower demand for the region’s exports.

Such concerns were corroborated by fresh data from Beijing on Thursday, which showed Chinese exports falling 8.8 per cent year on year in August, while imports declined 7.3 per cent in a sign that demand was slowing domestically and abroad. China’s CSI 300 fell 1.4 per cent and Hong Kong’s Hang Seng lost 1.3 per cent.

Oil prices edged lower, as worries about slowing demand in China — the world’s top importer of the fossil fuel — overshadowed an earlier announcement of supply cuts by Saudi Arabia and Russia.

Brent crude, the international marker, fell 0.5 per cent to trade at $90.15 a barrel, although it remains near its highest level this year, while the US equivalent West Texas Intermediate also dropped 0.5 per cent to $87.15 a barrel.