This article is an on-site version of our Energy Source newsletter. Sign up here to get the newsletter sent straight to your inbox every Tuesday and Thursday

Hello and welcome back to Energy Source, coming to you from Houston today.

The news in US energy this week: there is a shouting match over Arctic drilling and Saudi oil supply cuts are raising hackles in the White House.

It could be a headline snapshot from 2022 or 2021 . . . or 1982 . . . or a dozen other years in the Groundhog Day that is the news cycle of the American energy sector.

I tackle the drilling saga in our main note today. For more on US-Saudi oil drama, keep an eye out for an analysis piece from me and David Sheppard later this week.

In Data Drill, Amanda has new data on where oil companies are parking their cash.

Thanks for reading — Myles

PS How can the energy industry find the right balance between sustainability, security and affordability? Please join us for discussions with leaders from across the sector October 31-November 2 for our Energy Transition Summit in London and online. See the full agenda and register here.

Much ado about Arctic drilling

Drilling in the pristine Alaskan Arctic is an emotive subject.

The Biden administration’s approval of ConocoPhillips’ Willow project in the National Petroleum Reserve in March drew accusations of betrayal from activists.

The sale of leases to exploit the Arctic National Wildlife Refuge during the Trump administration was widely criticised (though the date of the ultimate sale — January 6 2021 — meant it missed out on a front-page news slot).

Controversy over Arctic oil and gas exploitation is back in the spotlight this week, after the Biden administration yesterday announced a plan to restrict drilling in both the NPR and ANWR.

The Department of the Interior said it would cancel the ANWR leases awarded in 2021 on the grounds that a review had found them to be “seriously flawed and based on a number of fundamental legal deficiencies” ranging from an insufficient environmental analysis to improperly quantifying associated emissions.

In the NPR, the agency said it would limit development on 13mn acres of land and ban it outright on another 10mn acres. (The White House signalled it would make such a movie when it greenlit Conoco’s Willow project in a sort of good news-bad news sandwich for environmentalists.)

Announcing the moves yesterday, interior secretary Deb Haaland praised her boss for “delivering on the most ambitious climate and conservation agenda in history”.

So what to make of it?

Environmental groups will be pleased. Exhibit A: “This is a big f-ing deal,” said Ben Jealous, executive director of the Sierra Club.

The oil industry — and its Republican allies in Congress — will bemoan another attack on the sector by a hostile administration. Exhibit B: “President Biden’s war on American energy continues,” said Wyoming senator John Barrasso.

But at the end of the day, it seems to be more style than substance. Because ultimately — whatever the restrictions — no one really wants to drill in the Arctic.

All of the ANWR leases are held by the Alaska Industrial Development and Export Authority after a scant display of corporate interest during the lease sale (there were three bidders).

And Willow notwithstanding (a project that has been decades in the making), no major company has shown any interest in ploughing funds into Arctic drilling since Shell got out of dodge in 2015 after pouring billions of dollars into a dead-end exploration campaign.

BP followed suit in 2019, offloading its final Arctic assets.

Whatever the region’s untapped hydrocarbon riches, exploration in the Arctic is too expensive, too controversial and too much of a headache for serious companies to take seriously these days. (Myles McCormick)

Data Drill

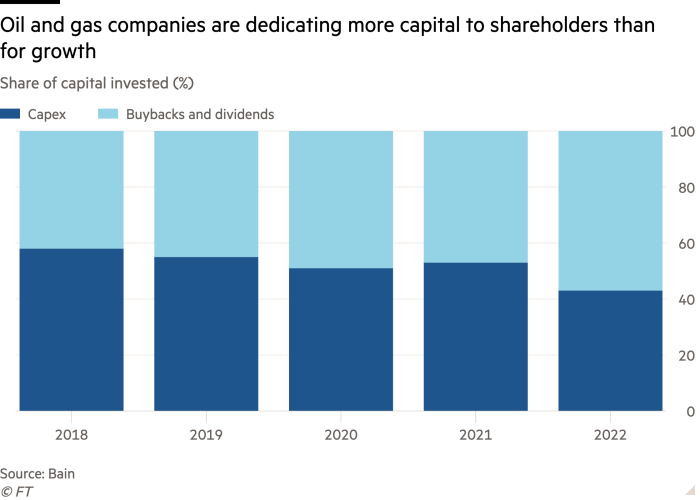

Energy executives are failing to invest more in decarbonisation despite funnelling large amounts of capital to shareholders, says a new report from consultancy Bain.

Oil and gas companies directed 56 per cent of capital to dividends and buybacks last year, up from 41 per cent in 2018, according to Bain. Mining companies saw a similar increase.

Meanwhile, plans to invest in low-carbon businesses remain flat despite the urgent need to scale up investment to reach the world’s net zero goals. Bain’s annual survey found energy executives plan to invest 25 per cent of capital in their low-carbon businesses this year, on par with last year.

Annual global investment in clean energy currently hovers around $1.7tn, but needs to surpass $4tn by 2030 to reach net zero by mid-century, according to the International Energy Agency.

A shortage of returns is the biggest reason behind the weak enthusiasm for low-carbon investment, according to Bain. More than three-quarters of executives cited low returns as the top barrier to investing in clean energy in the consultancy’s survey.

“It’s not about the availability of capital. There are plenty of people who would like to invest in the energy transition,” said Joe Scalise, global head of energy and natural resources at Bain. “The question is, who’s going to pay for it?”

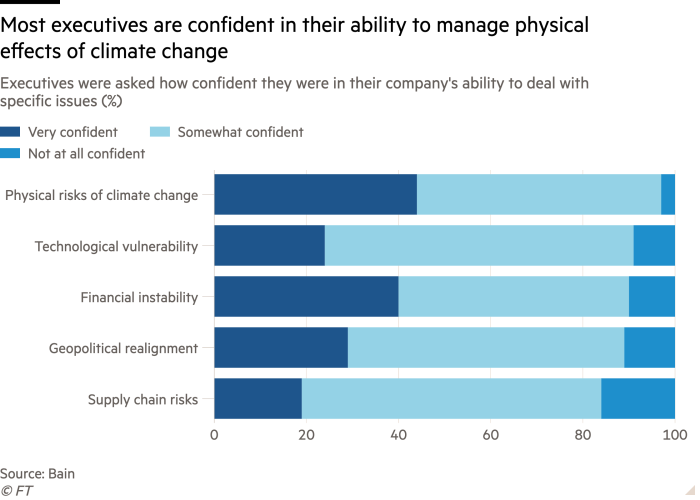

Despite the under-investment, executives are confident in their ability to manage the effects of climate change. The majority of energy executives in Bain’s survey said they were “somewhat confident” or “very confident” in their ability to take on the related physical, financial and supply chain risks.

The survey finding comes after a summer of extreme weather around the globe and goes against alarming forecasts showing supplies must rapidly scale up to meet transition needs. The world’s supply of critical minerals, for example, will have to grow at breakneck speed, with Bain estimating that supplies of nickel and cobalt must double by the end of the decade and lithium must increase seven-fold to reach net zero.

“These high numbers could reflect an overconfidence that’s not entirely justified by the limited investments most firms are making in resilience,” wrote the authors of the report. (Amanda Chu)

Power Points

-

Belgian energy minister says it’s “absolutely necessary” that the EU curbs Russian gas supply after news that the bloc will import record Russian LNG volumes this year.

-

A global copper shortfall has pushed mining giant Barrick to Pakistan’s western border, a tricky market that has deterred investors with repeated political and economic crises.

-

Opinion: a winter of discontent looms at the petrol station, warns the FT’s energy editor David Sheppard.

Energy Source is written and edited by the FT’s global energy team. Reach us at [email protected] and follow us on X, formerly Twitter, at @FTEnergy. Catch up on past editions of the newsletter here.

Recommended newsletters for you

Moral Money — Our unmissable newsletter on socially responsible business, sustainable finance and more. Sign up here

The Climate Graphic: Explained — Understanding the most important climate data of the week. Sign up here