Receive free Property sector updates

We’ll send you a myFT Daily Digest email rounding up the latest Property sector news every morning.

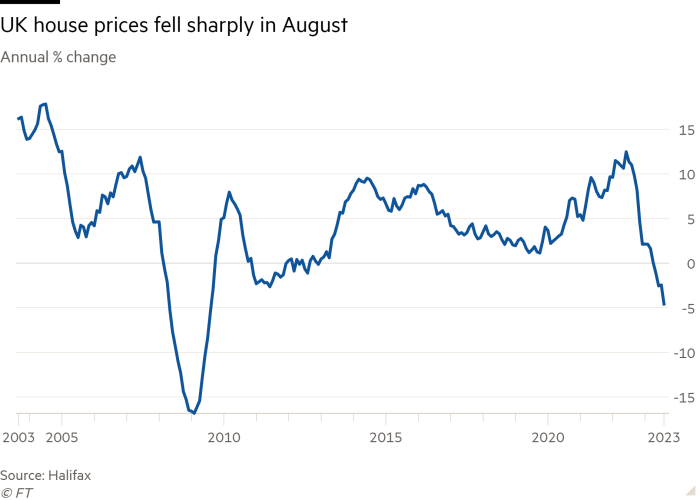

UK house prices fell for the fifth consecutive month and at the fastest annual pace since 2009 as higher mortgage rates hit prospective buyers, according to mortgage provider Halifax.

Property prices fell 4.6 per cent in August compared with the same month last year, when prices reached a record peak, and is the largest contraction since 2009, according to data released on Thursday.

Prices declined 1.9 per cent between July and August, following consecutive monthly drops since April, Halifax said.

The typical UK home now costs £279,569, down by about £14,000 over the past year.

The drop was larger than the monthly fall of 0.3 per cent and an annual contraction of 3.45 per cent forecast by economists polled by Reuters.

Kim Kinnaird, director at Halifax Mortgages, said house prices “have proven more resilient than expected so far this year, despite higher interest rates weighing on buyer demand”.

“However, there is always a lag effect where rate increases are concerned, and we may now be seeing a greater impact from higher mortgage costs flowing through to house prices,” she added.

Earlier in the month, the mortgage provider Nationwide reported UK house prices falling at an annual pace of 5.3 per cent in August, the sharpest fall since 2009.