From the US to the UK and Japan, governments are launching initiatives to help public and private sector scientists work in tandem — in some cases for the first time — on the tantalising goal of fusing atoms to produce safe, zero-emissions power.

Countries have taken different approaches to supporting the nascent sector but there is growing hope that public-private collaboration can overcome the immense technical and funding barriers to turning recent scientific achievements into a global clean energy source.

“There’s been a paradigm shift,” said Richard Pearson, a co-founder of Japan’s Kyoto Fusioneering, set up in 2019.

For decades fusion research was driven by large, public sector programmes working methodically towards scientific goals, but over the past 20 years commercial companies have moved in to shake things up.

The progress made by some of those businesses has forced governments to take notice and seek to support private enterprise, Pearson added. “That’s why things are very different in 2023 than even in 2018.”

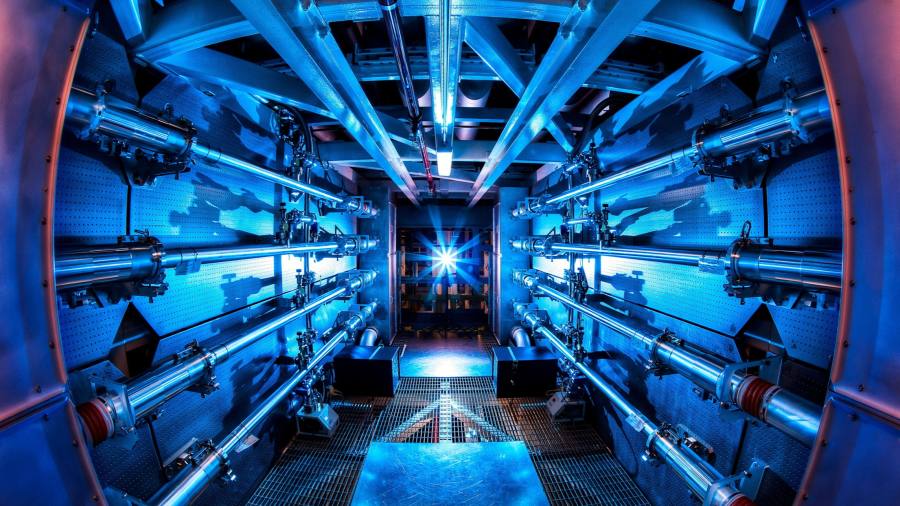

The increased government attention follows two years of unprecedented private investment in fusion companies and two breakthroughs by US scientists at a federal laboratory in the past eight months.

Total private investment into fusion has now surpassed $6bn, with most of the funding coming since 2021, according to the Fusion Industry Association (FIA), which represents the global industry.

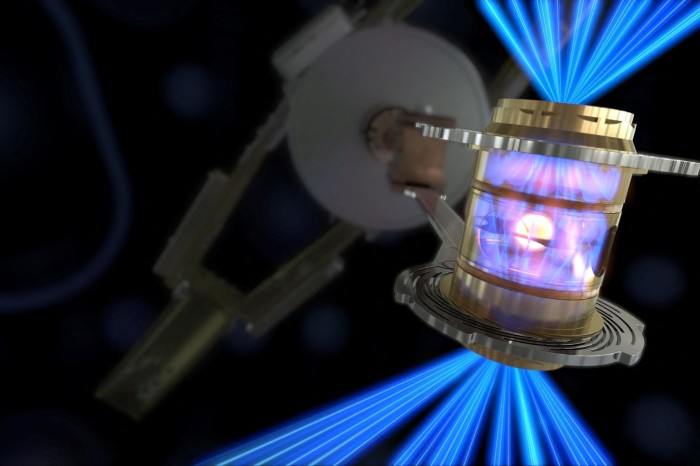

Fusion energy, which is created when two hydrogen isotopes are fused to produce helium and neutrons, is still a long way from proving it can generate commercially viable power.

In the breakthrough experiments in December and July, US government scientists produced only slightly more energy than was in the laser used to trigger the reactions. Physicists estimate that commercial fusion will require reactions that generate between 30 and 100 times the energy going in.

But the achievement of the long-sought goal of net energy gain has elevated fusion power from science fiction to something with genuine potential.

Fusion reactions create no long-lived radioactive waste, the hydrogen isotopes used can be sourced in large quantities and a small cup of the fuel has the potential to power a house for hundreds of years.

Enthused by this promise, the US government launched a “milestone” cost-sharing programme in May that selected eight companies, including Massachusetts-based Commonwealth Fusion Systems, to receive a combined $50mn of initial public funding to support the development of commercial fusion power. Under current plans, the programme can allocate up to $415mn before the end of 2027.

The UK, Canada, France, Germany, Italy, Sweden, Israel, Australia, New Zealand, Japan and China are among the countries with at least one fusion start-up. But the private fusion industry has grown fastest in the US. Of the 43 fusion companies worldwide, 25 are headquartered in the US, according to the FIA, with 80 per cent of private investment raised by the sector going to US-based groups.

Fusion companies have proliferated in the US due to a relative lack of public-sector research opportunities and a fundraising environment that makes it comparatively easier for scientists to raise private investment for ambitious goals, said Andrew Holland, executive director of the FIA. Many of the companies have set aggressive timelines to deliver fusion power to the grid in the 2030s.

“I don’t think it’s necessarily true that there’s more ideas for fusion commercialisation in the United States, it’s just that there’s easier access to capital,” he added.

The UK has been at the forefront of fusion science since the Joint European Torus, which remains the world’s most powerful fusion machine, began operations at Culham in Oxfordshire in 1984.

The ageing device is due to be turned off next year, but three fusion companies, including UK-based groups Tokamak Energy and First Light Fusion, have plans to build prototype devices at Culham to benefit from collaborating with the facility’s publicly-funded scientists.

“We want to make use of our heritage and expertise in the UK to be at the centre of a growing fusion industry,” said Tim Bestwick, chief development officer at the UK Atomic Energy Authority (UKAEA), which runs the Culham site.

The UKAEA is both advancing plans for a new national fusion demonstration plant to be built by 2040 and supporting the development of a wider fusion industry through an initial £42.1mn in funding for private companies.

Japan is taking a different approach, said Pearson at Kyoto Fusioneering. The country published its first national fusion strategy in April and intends to use its existing manufacturing capabilities to play a prominent role in developing the supply chains needed for a global fusion industry.

“Japan is outward looking when it comes to fusion and it is positioning itself to support those global players,” Pearson added.

In contrast, the EU is lagging behind its peers in supporting commercial initiatives. Instead, the bloc has focused its efforts on the flagship Iter project, becoming the biggest funder of the multilateral fusion experiment, which is under construction in France at a cost of more than $23bn.

“The EU has been very slow in getting going on the private sector side,” said Melanie Windridge, chief executive of advisory group Fusion Energy Insights. “How the research and the expertise from the national laboratories is transferred into the private sector and into the commercial realm is very important.”

The “sleeping giant” of the fusion industry is Germany, according to the FIA’s Holland.

Publicly funded German scientists have been quietly working on an experimental fusion machine, known as a stellarator, since the 1990s. But until this year the government had shown little open support for the nascent private sector.

Germany’s ministry of education and research published its first fusion paper in May. On Tuesday it announced plans to provide an additional €370mn in funding to the fusion industry by 2028, bringing total state funding for the sector to €1bn over the next five years.

“The idea that you could have a large centralised source of zero carbon power that’s not nuclear fission is attractive to them,” said Holland. “Nowhere in the world has felt the energy security fallout of Russia’s invasion of Ukraine more than Germany.”

Despite the promising signs of increased public-private collaboration, there is still a huge gap between the funding available — either from government or investors — and what would be required to achieve fusion energy at scale.

Each fusion company is likely to need between $300mn and $1bn to build a prototype machine and even more to develop demonstration plants, said the UKAEA’s Bestwick.

“There remains an unanswered question about how the whole global fusion community is going to get the investment into fusion that’s needed to make the rate of technical progress we all aspire to.”