Receive free Global Economy updates

We’ll send you a myFT Daily Digest email rounding up the latest Global Economy news every morning.

This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Good morning. Arm plans to price its initial public offering at between $47 and $51 a share, according to an updated filing yesterday, raising up to $4.9bn for its current owner SoftBank and valuing the UK-based chip designer at up to $52bn.

Cornerstone investors, including Apple, Google, Nvidia, Samsung, Intel and TSMC, have indicated they plan to purchase up to $735mn worth of Arm shares at the IPO price, the company said.

Tuesday’s filing also disclosed that Apple and Arm have signed a new “long-term agreement” that ensures the iPhone maker will be able to develop processors based on Arm’s designs “beyond 2040”. Apple is one of Arm’s largest and longest-standing customers after it helped found the company as part of a joint venture in 1990.

SoftBank paid $32bn to acquire Arm in 2016 but its latest target is below the $64bn valuation implied less than a month ago. Read the full story on the float — expected to be one of this year’s biggest.

Here’s what else I’m watching today:

-

Australia GDP: Second-quarter growth figures are set to be released today.

-

New Qantas CEO: Vanessa Hudson becomes chief executive, succeeding Alan Joyce as the airline attempts to rebuild following a series of scandals.

-

Rustem Umerov: The former businessman’s appointment as Ukraine’s new defence minister is set to be ratified by parliament.

-

Trump arraignment: Former US president Donald Trump will be arraigned in Georgia on charges of violation of the racketeer influence and corrupt organisations law, solicitation of violation of oath by a public officer and other charges.

Join FT correspondents and UBS’s expert economist Tao Wang for an exclusive subscriber event to assess the implications of China’s economic slowdown. Register for free here and submit your questions ahead of the webinar here.

Five more top stories

1. Chinese property developer Country Garden has avoided default on two dollar bonds, ending a month-long saga that had become the focal point of global investors’ concerns about China’s struggling property sector. Local media reported that the company made the late coupon payments totalling $22.5mn on two $500mn international bonds within their grace period.

2. Exclusive: Some of the world’s biggest tech companies will have to overhaul how they do business and generate billions of euros in revenues to comply with new EU laws. Amazon’s marketplace, Apple’s AppStore, Meta’s WhatsApp, Facebook and Instagram and Google’s Search and YouTube are among the extensive list of services that will have to meet obligations aimed at enabling greater competition for the sector.

3. The world’s most powerful financial watchdog has warned of “further challenges and shocks” in the months ahead, as high interest rates undermine economic recoveries and threaten key sectors including real estate. Read the warning from Klaas Knot, chair of the Basel-based Financial Stability Board, ahead of the G20 leaders summit in New Delhi this week.

4. A surge in electricity costs in Pakistan has triggered nationwide protests. The outpouring of popular anger threatens to derail the crisis-hit country’s $3bn IMF programme. Pakistan narrowly avoided default in June after securing a loan from the fund that came with strict conditions to enact economic reforms, including cutting energy subsidies and imposing taxes to reduce heavy losses in the power sector.

5. The head of the EU foreign service has demanded that Iran release Johan Floderus, a European diplomat, “illegally detained” for more than 500 days, confirming the Swedish man’s identity a day after his incarceration was disclosed. While many western countries have accused Tehran of detaining private citizens, imprisoning a western diplomat is rare. Here’s what we know about the case.

News in-depth

Sequoia Capital has had the most tumultuous 12 months in its 51-year history. It has spun off its highly profitable Chinese arm, slashed the size of a crypto investment fund and lost key partners. Venture capital correspondent George Hammond’s 20-plus interviews with Sequoia’s limited partners, current and former investors at Sequoia as well as rival groups, and start-up founders reveal a period of “profound change”.

We’re also reading . . .

-

Demand dilemma: The biggest economic issue in the world right now is a lack of demand in China — and other countries will have few options if China tries to rely on demand from the rest of the world, writes Robin Harding.

-

Space race: New rules are needed as costs fall and space exploration goes beyond the preserve of superpowers, writes Stephen Bush.

-

Big government: Amid signs of “the return of fiscal activism”, paying for more interventionist government will require a rethink of fiscal policy.

Chart of the day

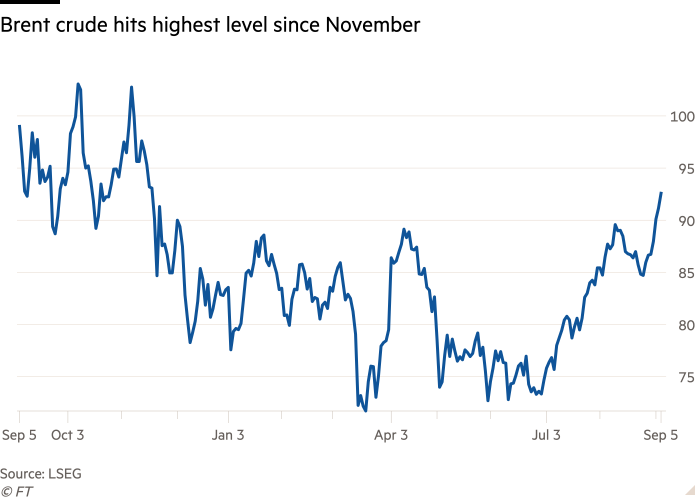

Oil prices rose above $90 a barrel for the first time in 2023 yesterday as Saudi Arabia and Russia said they would extend their voluntary production and export cuts until the end of the year. Saudi Arabia, which leads the expanded Opec+ cartel with Russia, has cut an additional 1mn barrels a day from the global market since July, in what had been originally billed as a temporary measure.

Take a break from the news

Descend into the murky depths with Under the Waves. Chris Allnutt reviews the new underwater exploration game that sees an offshore maintenance worker confront personal trauma and corporate malpractice.

Additional contributions from Gordon Smith and Tee Zhuo

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to [email protected]

Recommended newsletters for you

Working It — Everything you need to get ahead at work, in your inbox every Wednesday. Sign up here

One Must-Read — The one piece of journalism you should read today. Sign up here