This article is an on-site version of The Lex Newsletter. Sign up here to get the complete newsletter sent straight to your inbox every Wednesday and Friday

Dear reader,

Bosses are a lot harder to weigh up than balance sheets or boxers. How do you go about it? Lex’s analysis of this week’s business news provided plenty of insights. Join us to discuss this, or anything else you fancy, at the FTWeekend Festival tomorrow in Hampstead, North London. Full details here.

Credibility takes months or years to establish. As a boss, you can forfeit it in minutes. I saw the new chief executive of a large financial institution do this once. He was hosting a private dinner for hard-nosed City editors and commentary writers.

“Prudential is focused on Asia and L&G is a social investor. What’s your one-sentence mission statement?” I asked, expecting a slick response.

The man coughed. He took a drink of water. He launched into a stumbling explanation of how the disparate parts of his empire might be persuaded to work together better. He talked for five minutes. I was left none the wiser.

Suddenly, all the journalists were paying close attention. It reminded me of watching lions in Africa. When a lone wildebeest limps into view, their heads go up and they raise their ears. They are thinking “that’s the vulnerable one”.

Investors were not impressed by the new chief executive either, though personal factors were cited when he departed after a brief incumbency.

His exit was the best outcome for him and for the company. This has prospered since. Management failure, if allowed to persist, can turn into business failure, as illustrated by the collapse of Credit Suisse earlier this year.

UBS is metabolising the smaller Swiss bank as efficiently as any lion with a dead antelope. Lex’s initial take back in March was that the acquisition at 6 per cent of book value was great value, assuming toxic assets and client losses were manageable.

Second-quarter results this week provided early evidence that the integration is going well. Bosses Colm Kelleher and Sergio Ermotti, therefore, win managerial credibility points for calculated risk-taking.

Successive managements at Credit Suisse failed to spot trouble brewing within the bank, or contributed to it. This led to what Lex has dubbed “chaotic drift”. That involves chief executives bouncing reactively from one crisis to the next. The problem was also apparent at GAM, the Swiss fund manager that was once part of UBS.

GAM’s funds under management have slumped since its embroilment in scandals involving metals magnate Sanjeev Gupta and financier Lex Greensill.

NewGAMe, a consortium led by a French tycoon, has blocked a takeover of GAM by Liontrust of the UK. The board accordingly stood down this week. The uncertainty is destabilising for the group’s remaining clients.

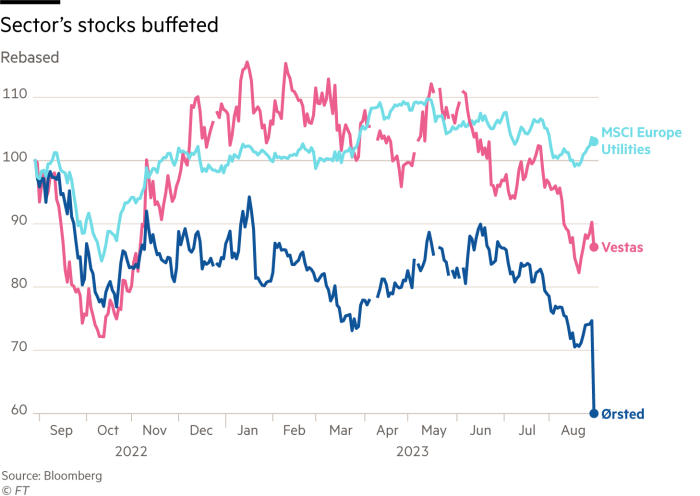

Lex had to admit this week that Ørsted has been suffering a foresight deficit of its own, albeit a less serious one than those apparent at Credit Suisse or GAM. The Danish wind power group took a $2.3bn impairment on US projects. Investors have suffered previous nasty surprises on everything from wind speeds to power price hedging.

We had been bulls on Ørsted. But the share price has crumbled.

It is time for chief executive Mads Nipper to deliver on promises with greater precision.

We got extra wear out of our hair shirt when Superdry shares were suspended, pending late results. Co-founder Julian Dunkerton returned as chief executive in 2019. Lex had fondly imagined he would revive the fortunes of the fashion retailer. We were wrong.

Dunkerton appears to have lost touch with the fickle tastes of consumers. It is very rare for any fashion boss to intuit what customers want for more than a few years, though George Davies managed to do so for decades at Next and elsewhere.

Oliver Haill, writing for Proactive Investors, describes Superdry as selling “faux Japanese fashion to middle-aged dads and undercover police officers”. Ouch.

When the auditor finally finished its box-ticking, Superdry announced an annual statutory loss of £148mn.

It has already generated a lot of waffle about “inspiring” people with its products and “leading” in sustainability.

That read like boilerplate to us. So did the promise of Anil Wadhwani, newish boss of Prudential, to “do things differently” by focusing on Asia and on paying dividends. Our impression was that the UK-listed insurer had been focusing on Asia and on paying dividends for at least the past decade.

More usefully, Wadhwani set a target of 15 to 20 per cent compound annual growth in new business profit for 2022-27. This would be easier to hit without the vigorous competition of AIA Group. Pru bosses could — and should — have bought AIA in 2010, but were blocked by timid UK fund managers.

Admittedly, big takeovers have the drawback that they can go bigly wrong, as Donald Trump might put it. The Nondescript Nine, Lex’s handpicked group of low-profile, high-return UK companies, generally favour bolt-on transactions. These are safer.

Managers of businesses in our mini index tend to be steady, focused and not very interested in getting press coverage. For me, the exemplar of this approach was the excellent Richard Cousins, who tragically died in a plane crash a few years ago.

Compass, the caterer Cousins ran, is one of the Nondescript Nine. This is a subset of the XFT Index first compiled by Lex in 2017 to track the performance of companies making only the faintest blips on the media’s radar screen.

The Nondescript Nine have produced returns 40 per cent in excess of the FTSE 350 index over the past five years.

Cousins was formidably focused. You could say the same of Erik Engstrom, chief executive of Relx since 2009. The academic publisher is another NN constituent and has provided a case study on how to take an analogue business online.

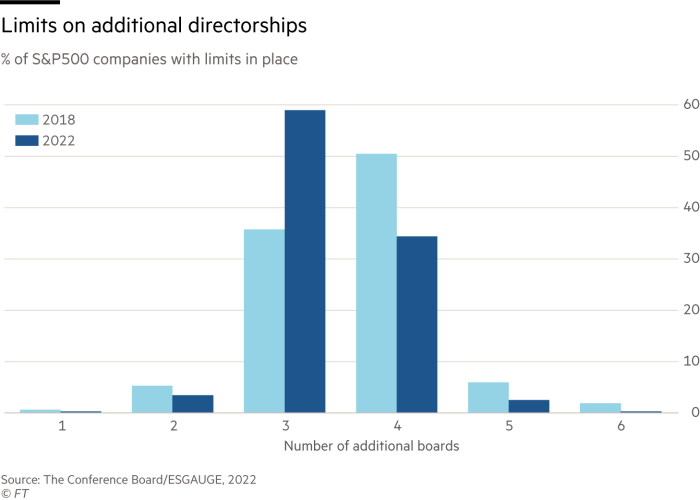

Investors should worry about lack of focus when bosses dip out of analyst calls, become frequent conference speakers or start building portfolio careers.

“Overboarding” among non-executive directors is only seen as a problem by the likes of BlackRock and Vanguard when they have four or more board seats. Lex thinks that is too many, given that the grandees are likely to devote time to start-ups, charities and other commitments.

Something old, something new

At what point does new technology become old technology? When investors stop feeling excited about it, perhaps? Artificial intelligence has given businesses the chance to apply a fresh lick of paint to products that were becoming passé.

Four Chinese businesses launched chatbots this week. They included search business Baidu and SenseTime, which specialises in facial recognition.

Their products lag behind those available in the west. The US-China tech battle pits an open society with free markets against an authoritarian country where the state makes heavy-handed interventions in business.

You would need a heart of stone not to laugh at the misery of Chinese censors. They must hate the idea of rogue AIs generating anti-government opinion. But unless they allow chatbots to develop through public interaction, Chinese AI will fall ever further behind.

Beijing is on safer ground in permitting electric vehicle maker Xpeng to buy the EV development arm of Didi, an old-school ride-hailing group. This will give Didi a small stake in a partner better placed than itself to provide robotaxis.

Smartphones are also old money these days, triggering claims the market is saturated and set to decline. Apple disproved the doomsters once before. My guess is that AI will feature in attempts by the US device group to do so again.

Lex colleague Elaine Moore highlighted a current lack of compelling use cases and revenue models for AI in a Lex newsletter of her own this week. The technology still has exciting potential.

Things I enjoyed this week

Laura Noonan and Owen Walker wrote an engaging FT Magazine piece on UBS chair Colm Kelleher.

Dan McCrum and John Reed delved into curious dealings in the shares of India’s Adani Group in conjunction with the Organized Crime and Corruption Reporting Project, a network of investigative journalists.

I also read The Garden Jungle, a book by the writer and biologist Dave Goulson. I’m looking forward to interviewing him on ways gardeners can help endangered bumblebees at the FTWeekend Festival tomorrow.

Enjoy your weekend, whatever gets you buzzing,

Jonathan Guthrie

Head of Lex

If you would like to receive regular Lex updates, do add us to your FT Digest, and you will get an instant email alert every time we publish. You can also see every Lex column via the webpage

Recommended newsletters for you

Cryptofinance — Scott Chipolina filters out the noise of the global cryptocurrency industry. Sign up here

Unhedged — Robert Armstrong dissects the most important market trends and discusses how Wall Street’s best minds respond to them. Sign up here